Articles

See All

Why Gold And Gold Stocks Are Collapsing (HINT: levered ETFs)

The gold miners and gold itself endured a rough week last week. I have been a big believer that as interest rates go back to zero (which happened yesterday) or even negative (likely soon), the gold price should do well.

There are plenty of explanations of what contributed to last week’s fall. There was

- a) the reversal in long-bonds (see bottom of this article)

- b) the flight to sell what is liquid (still happening)

- c) just the overall panic that pervaded all asset classes.

But I think that something else contributed to the magnitude of what happened with the miners last week.

First, let’s look at the behavior.

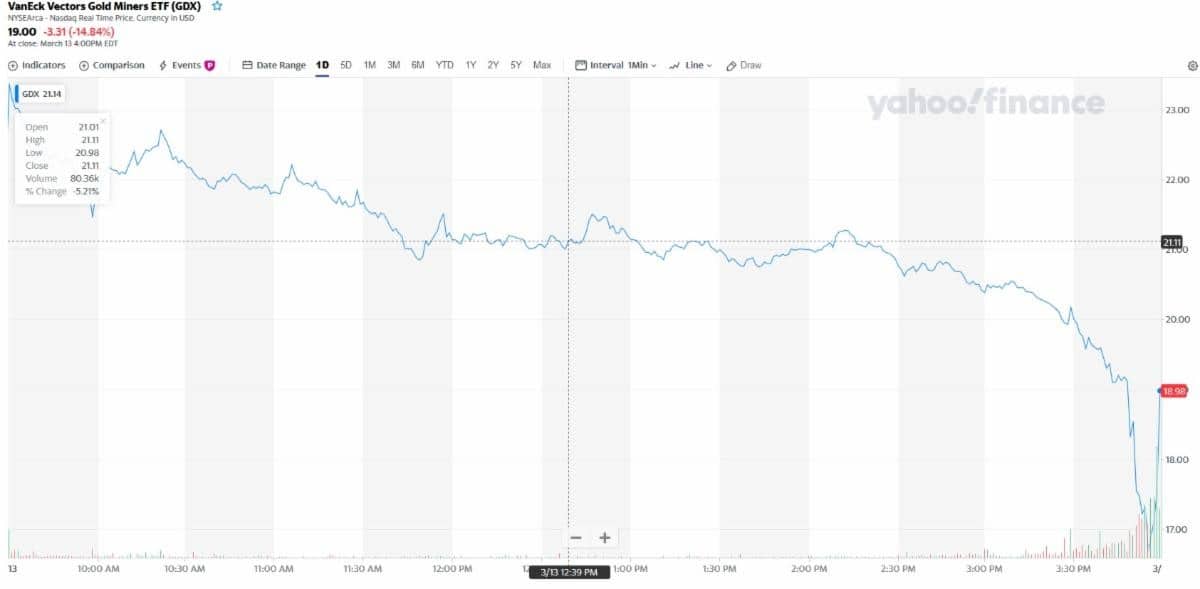

There was a crazy drop at the end of day Friday for both the VanEck Vectors Junior Gold Miners ETF (GDXJ – NYSE) and the VanEck Vectors Gold Miners ETF (GDX – NYSE).

Second, these indexes closed at larger and larger discounts to their net asset value as the week progressed.

On Thursday the GDXJ at a 13% discount to net asset value (NAV). On Friday it closed at an even greater 16% discount to NAV!

The GDX closed at a ~7-8% discount to NAV both Thursday and Friday.

This disconnect with the underlying stocks that make up these indexes led to even more bizarre intraday behavior.

On Friday morning the GDXJ was up over 10% early-on while top holdings like Kinross (KL – NYSE), Pan American Silver (PAAS – NYSE), Gold Fields (GFI – NYSE) and Yamana Gold (AUY – NYSE) were down between 2-8%.

It was bizarre. The ETFs were totally disconnected with the underlying securities that they were supposed to represent.

On Friday morning Fred Hickey of the High-Tech Strategist put forth the theory that the 3x levered ETFs (Direxion Daily Gold Miners Index Bull 3x Shares ETF (NUGT – NYSE) is 3x gold miners ETF and the Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF (JNUG – NYSE) is the 3x gold junior ETF), were to blame for the historic volatility.

These 3x ETFs are exactly what they sound like. These ETF should move 3x the level of the NYSE Arca Gold Miners Index and Junior Index on any given day. These are the same indexes that the GDX and GDXJ indexes are based off of.

To do that, the 3x ETFs have to lever up with swaps and future contracts.

Normally this works fine. The problem comes when the ETFs experience significant single day declines.

Both the NUGT and JNUG ETFs must rebalance at the end of each day. They promise 3x leverage but only within a given day. Each day they have to start over.

This becomes a problem if a single day decline is particularly large. For example, a 20% decline in one of these instruments can cause them to have to liquidate 50% of their holdings to get back to their 3x leverage ratio.

That kind of declines happened not once, not twice, but three times last week! NUGT was down 23%, 36% and 46% on the last three days of the week.

This drove a massive deleveraging of their holdings—which drove down both the underlying securities and even moreso, the GDX and GDXJ indexes of which these 3x ETFs own both securities and derivatives of. This led the extremely large discounts to net asset value that I already noted.

What makes it possible that this spillover was significant is–just how big these 3x ETFs are.

Going into last week (before the carnage) JNUG was worth $1.8b whereas the GDXJ (the 1x ETF that it tracks) was only $5.4 billion – that means that JNUG was the same order of magnitude of size as GDXJ.

NUGT isn’t quite as large comparatively – it comes in at $1.6 billion (a little over a week ago) while the GDX was $11.8 billion at the time.

Nevertheless it is easy to imagine a very large influence given that it still comparatively sized (roughly 1/7th the size) and especially considering that NUGT was essentially liquidated in the last week (it ended the week at a little over $300 million capitalization).

What occurs to me is that this was a situation ripe to be gamed. When you have a triple-leveraged version of an ETF that is sized at the same order of magnitude as the indexes they are designed to track… well, it is not hard to imagine the opportunity that could be had in a panic!

At the very least, buy-side funds clearly knew that as these 3x levered ETFs dropped in a market that already had no liquidity that it would not take much to push that drop into a route.

The good news for gold stockholders is that

A/ this has nothing to do with your individual holdings in miners

B/ these 3x funds are now so small that their influence on the GDX and GDXJ indexes should be greatly reduced.

The other theory that was making the rounds that made sense to me–and I think this came from Hedgeye – is that bonds are being sold down to get to cash, which is making yields jump – and gold often trades inverse to yield.

The Market appears to be quickly compensating for this out-of-the-norm market ripple (tidal wave?) of the ETF re-balance, with gold up 2% at time of writing late Sunday night.

But in this market, there appear to be no rules and no guarantees of historical relationship.

EDITORS NOTE: Panic selling this week may not mark a bottom in the Market yet, but it may mark a bottom in sentiment. I’ll show you how to profit from this tomorrow.