Articles

See All

THIS GOLD PRODUCER IS SET TO HAVE A HUGE CASH FLOW JUMP NEXT QUARTER

The stocks that go up the most are the ones with the biggest jump in cash flow.

It doesn’t matter what the business is, that law should apply.

And the stock I’m revealing to you today is set for a huge jump in cash flow—within weeks.

Back in late 2021, it was oil stocks that gave investors life-changing capital gains as commodity prices bounced back, post-COVID—but oil stocks took another two quarters to start roaring back.

At the time, energy had been one of the worst performing sectors for years; the last half of the 2010s.

Valuations were 2-2.5x EV (Enterprise Value). Even as commodity prices rebounded and oil & gas producers paid down debt to almost nothing, the stocks did not move for months.

Then in early 2021, huge wealth was created—especially among the juniors and intermediates that were priced to bankruptcy levels. That was despite the fact that their cash flows had been increasing for months as commodity prices normalized.

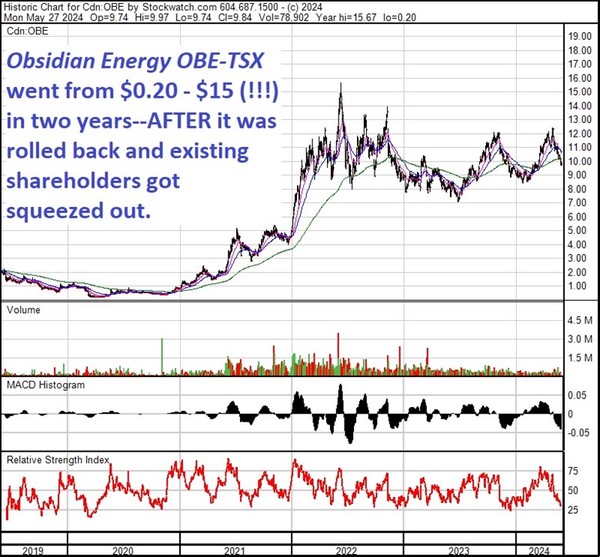

Several stocks—including Obsidian Energy OBE-TSX—went up 7,500% – 75x – from bottom to top in two years (20 cents to $15!!). But like many oil & gas producers, the stock had been rolled back; a reverse-split (7:1) which made a big run like that much easier.

The next set of stocks that are ready to do that–junior gold & copper producers.

Gold prices ran from $1600 – $2000 in 2000-2001, and most gold stocks did nothing. Gold has now just run from $2000 – $2400, and only a couple producers outside the seniors have moved up.

The producer that I’m fixated on—which has TWO operating mines—has three immediate catalysts:

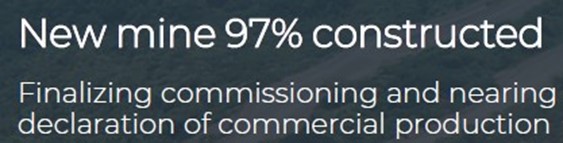

- Their gold/silver mine—which is 97% built and producing gold NOW—will announce commercial production—a HUGE increase in throughput (tons per day) that will produce more gold

- Their copper/zinc mine has already improved recoveries

- This second mine is now starting to increase production by 30-50% per day

To me, what’s key is this: This producer is completely unhedged, can therefore take advantage of the rapid recent increase in gold and copper prices.

This set up reminds me a lot of Obsidian Energy, the 75-bagger I wrote about earlier in this story:

- The stock was recently rolled back 8:1.

- The gold price has run, but junior gold stocks have not

- A new board of directors is now at the helm, two of which have spent the majority of their career working with the Lundin group of companies.

This board now hits WAY above its weight for this small but fast growing producer.

More importantly, revenue is about to have a huge jump. The reasons are simple, and all in the public domain:

- The gold price is up $400/oz in 2024, or 20%–this unhedged producer benefits HUGE from this:

As their two mines grow into full production, revenue, operating cash flow and net cash flow are rising—20% over the last quarter—and are already positive—CAD$4.04 M in positive operating cash flow and $7.3 M in net income.

That’s a great place to be –even before they hit full commercial production in the second half of 2024!

This is a GOLD and SILVER mine that is 97% built, and is forecast to payback its entire capital cost within two years—at US$1650/oz gold and US$21.60/oz silver.

Metal prices are now over 40% higher than that!

The feasibility study for this mine suggests its All-In-Sustaining-Cost (AISC) is only $885 AuEq per ounce—and gold is now trading at $2300/oz!

MOMENTUM KEEPS ROLLING

2ND MINE HITTING FULL PRODUCTION IN WEEKS

What I love about this company–their second mine (!!)—which has been producing for years–is about to jump production 30% to 2000 tons per day. It’s a copper/zinc/gold/silver mine that is also experiencing

- Higher metal prices

- Higher throughput per day

And…this mine has had a major new metallurgical discovery—they figure out how to recover 50% more copper per ton of ore than before. That’s THREE big improvements in the last 6 months, and it has made their second mine a huge cash cow.

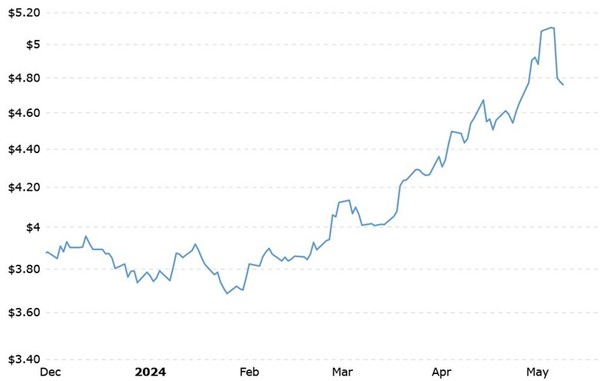

See the copper price is moving up – about 20% in the last few months:

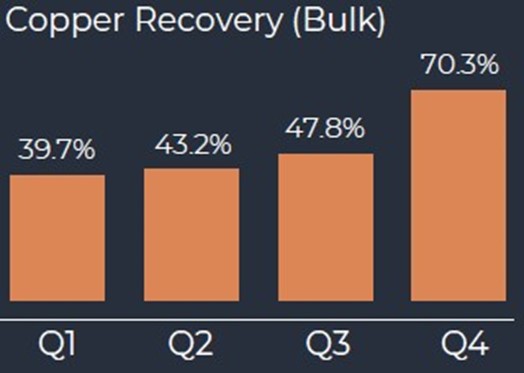

And now…the amount of copper they recover per ton of ore jumped from 45% to 75%!! See this chart below:

When you are able to produce 47% more copper per ton, you get to make a lot more money! AND…your cost per ton goes down. Revenue up, costs down. This is a (very) good thing.

This HUGE improvement happened because the new management team made a couple simple changes in how all the ore was put the through the mill.

They changed how they blend the different ores, and how finely they ground ore, and how much chemical they put in their process—and BINGO! These changes cost ZERO, and shareholders are already reaping a huge increase in revenue.

With these higher metal prices, and better copper recoveries, revenue will go higher.

And it gets better—just as this tweak will generate tens of millions in additional revenue, another small tweak—some new, larger equipment (scoop trucks) is halfway done, will deliver another big boost in revenue for shareholders..

These new scoop trucks will take production from 1390 tpd to 2000 tpd within a few weeks, and set up the mine to do 2400 topd by the end of 2025.

So..

- Metal prices have soared.

- Then came a major metallurgical win—management found a way to increase copper recoveries by 47%.

- Now a massive third step up in revenue will come from production moving up 50% to 2400 tpd.

I can’t wait to see the next couple quarterly financial statements!

This junior miner has, in my opinion, has a very bright future right in front of it—and I’ve just given you all the numbers to back that up. You don’t need to look down the road here, these improvements are happening NOW—and they’re all in the public domain.

It’s an unhedged producer with fast rising production, revenue and cash flow—you get the symbol tomorrow before market open on this emerging cash cow!