Articles

See All

THE SECRET FORMULA FOR JUNIOR SOLAR STOCKS

My solar portfolio broke even this year—with Westbridge Renewables (WEB-TSXv/WEGEF-OTC) the big winner, more than a double—but the rest of them were down enough to make the sector a flat trade for the year.

CEO Stefan Romano and his team just announced (Dec 14, 23) they took in CAD$47.5 million on the sale of their Alberta solar project to a Greek utility names Mytilineos (MYTHY-NYSE) that they announced several weeks ago.

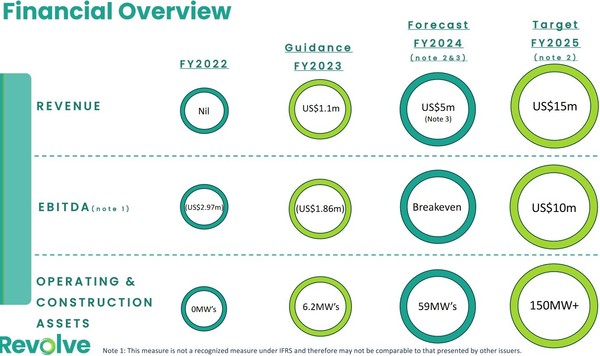

This year I learned a lot about junior solar stocks—what to look for both in their projects and in how they manage their balance sheet as they grow. The projects themselves are worth a lot of money to industry, but they don’t throw off a lot of cash flow—great asset value, but meagre cash flow. So this sector takes patience.

A recent chat with Steve Dalton, CEO of Revolve Renewable Power (REVV-TSXv; REVVF-OTC) crystallized what investors should be looking for in junior solar stocks—what I call The Secret Formula to capital gains in this sector.

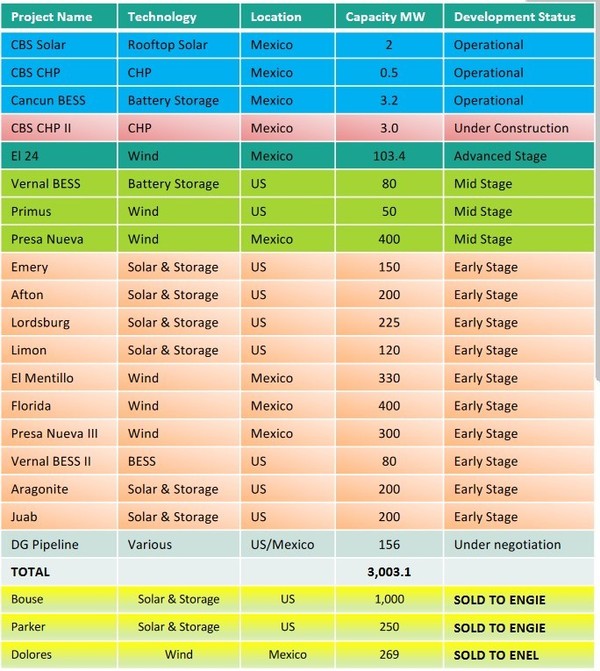

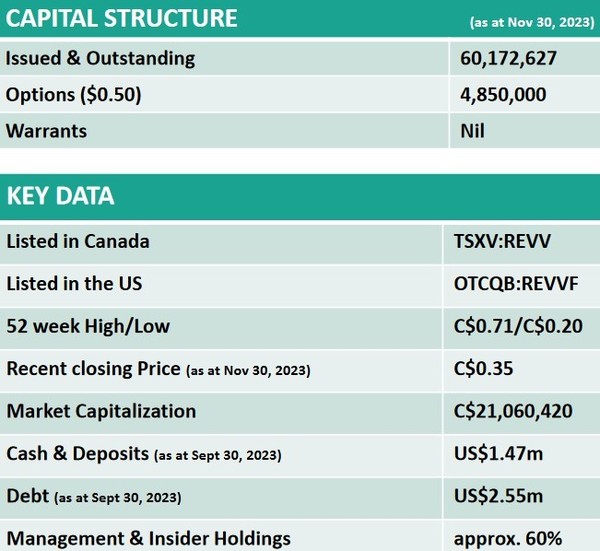

Revolve is a lot like Westbridge, as they have an incoming US$50-$60 million from a European utility—in their case Engie (ENGIY-NYSE), from France.

Revolve’s two projects, named Parker and Bourse, are both located in Arizona, and the value of both sales combined is more than US$50 million—and REVVs market cap is only CAD$20 million. WEB’s market cap is $100 million—though it now has $45 million cash.

REVV’s stock has lagged, which I think is for three reasons:

- They needed money for both M&A (see the Wind River deal they just did in Canada

- They have some debt, though it’s small, but the Street hates debt in these small companies

- Their milestone payments from Engie—again, they total between US$50 – $62 million—are staged out much longer than Westbridge’s deal with Mytilineos; WEB got a big CAD$47.5 million payment NOW, but REVV’s earlier stage Parker and Bourse have those payments stretching into 2027, depending on when they actually start to operate/produce power.

THE SECRET FORMULA—

HOW TO BEST GROW A JUNIOR SOLAR DEVELOPER

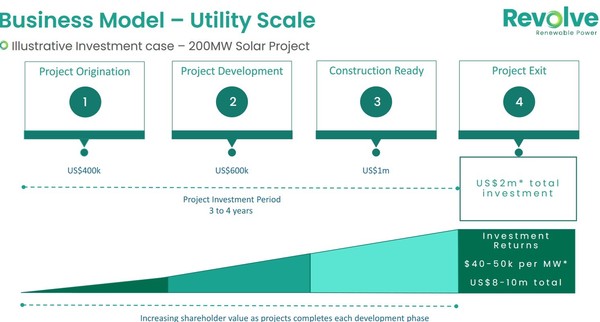

Revv CEO Steve Dalton outlined the secret formula for building a small solar developer—from scratch. Building is a lot slower than buying! But for longer term investors it can be lucrative.

There are TWO carrots here:

- long term cash flows—and solar projects are estimated to last 25-40 years–get valued much higher than large short-term cash flows. Solar revenues can get 20-30x cash flow, vs oil and gas at 4x cash flow. (But the payback is A LOT longer.)

- The solar industry has consistently shown in the last few years that they are willing to pay BIG, and pay EARLY for quality projects. I outlined the two examples already with REVV and Westbridge. So with just a lot of desk-work—brain power and no big capital outlay—these companies can get a huge influx of cash.

That sounds easy doesn’t it—build it and they will come. But only if you build it the right way! And of course, as a junior your cash balance to do all this is always low.

THE SECRET, says Dalton, is having a balance of LARGE projects you can sell to bring in some big cash, and some progressively bigger SMALL solar projects you can fund and build yourself up a recurring cash flow business.

“Where you see the differences in these types of deals is how far you bring the project along and how close it is to ‘ready-to-build’,” Dalton said in our interview.

“With us, we sold the projects early on where we had a certain amount of interconnection work done.” The term “interconnection” is when the utility approves your solar project hook into their grid and sell power.

“If I had the capital to hold onto my projects to get them all the way to ready to build ourselves, I would, but remember that now, Engie is actually spending their own money on one of the projects we sold them; we’re not spending any money on it.

“With that project (Parker) you could probably double the value of that project that we sold. That’s a trade off you take.”

“For us, it was better to get money off the table to do a deal with Engie to prove some value in the United States, rather than having to deploy lots more capital to bring it forward over a number of years and then hope the market’s the same.”

“So it’s a trade off and that’s just the nature of it.

“If you look at the project we did down in Mexico just before we went public–we got that US$16.1 million sale over really 18, probably 21 months. So a lot shorter timeframe.

“Why was that?

“We brought the project pretty much up to ready to build and we took pretty similar to what these guys have done. We took, I think it was around 80% of the value off the table within a nine month period.”

“I mean what we’re trying to build is I guess twofold. We don’t want to take all the risk on project development,” he said, pointing to Alberta’s six month moratorium on new solar approvals in the fall of 2023.

“We’re trying to build something where the downside is protected.

“Why? Because we’ve got some recurring revenue. We’ve now done the Wind River deal, that’s going to add a bunch more recurring revenue and that’s like 40 year revenue contracted. And then we’ve got our development pipeline and then we’ve got the Engie (ENGIY-NYSE) deal behind that.” (Where they sold Parker and Bourse assets for roughly US$50 million to the French utility Engie.)

“It’s going to deliver value over time. We get more recurring revenue, and we’re able to hold onto our development projects a bit longer and hold onto more of the value, potentially build some of the smaller ones, but certainly sell the larger ones at a better stage.

“And that’s what we’re trying to do, rather than just focus purely on development only because there is a lot of risk.

Dalton used one of his wind projects, called “Primus Project” to show the kind of balancing act that juniors have to think about:

“The Primus is 50 megawatt project, and a roughly $US65 million build. You could probably get 90% of the financing through project debt and tax equity down in the US.

“So that (is a large enough project that it) leaves you with still, a reasonable equity if we wanted to build, own and operate the project but that’s 12 months out.

“That’s certainly a project you could try to build or we could also do a 50-50 joint venture, leaving you with a smaller equity check and get that built out and then that starts delivering long term recurring revenue”.

“So it’s a balance of sell and build. The really big ones that are just going to be too big, like a 200 megawatts solar projects going to cost you US$250 million to build.

“Your equity for that will be up at US$25-$30 million—far too big for us at the moment. So you sell some of your projects off, recycle the capital, certainly build some of the smaller utility scale ones, and keep stepping up your revenue quarter on quarter.”

So that’s the FINANCIAL secret to small cap solar success. The operational secrets are things like picking a high-priced power market, and locating as close to a power line and power station as possible to keep your interconnection costs low.

There’s your update! I am long Revolve, and will be watching it grow in the coming years. Their recent financing is now complete AND we KNOW that they have US$50-$62 million coming in the door in non-dilutive capital from Engie in the next three years. They are getting NO reward for that in the stock now.

I don’t know when that will change—it realistically could be another couple quarters or more. But I believe in the long term story here.

Westbridge—with its CAD$45 million balance sheet and $1.25/share stock price—can grow much faster.

If you would like to see my original report – I bought the stock at 50 cents – click Here and write “Send me the report”, and we will email it to you right away.