Articles

See All

THE REAL SPARE CAPACITY

The talk of the town in the oil market is spare capacity. OPEC+ spare capacity.

When OPEC+ met in September they surprised the market by deciding to continue to increase production. OPEC+ plans another boost of 137,000 barrels a day in October. This is on top of the unwind of 2.2 million barrels from April to September.

It is OPEC’s way of saying we are going to unwind it all! A second layer of OPEC+ cuts, equal to a further 1.65 mmbbl/d, looks ready to come to market over the next number of months.

IF you take it at face value, the oil market is in DEEP trouble. We are talking about an oversupply of at least a couple million barrels a day.

When oil tanked to the $40s (and eventually the $20s) in the fall of 2014, that was because of less than a million barrels of oversupply.

Yet the oil market is responding to all this… in stride – to say the least!

Source: Stockcharts.com

Why the complacency? Part of the reason is a growing disbelief that these additions are real barrels.

A number of oil forecasters have begun to point out that the OPEC+ production adds so far aren’t quite what they seem. “Between April and August, the OPEC+ producers delivered only 75% of the production increases” according to a Reuters analysis of OPEC+ data.

Another reason to look at the bright side is that every barrel added is a barrel of reduced spare capacity. Eric Nuttal, for one, has been saying that with the new unwind, OPEC+ will be essentially without spare capacity by the middle of next year.

That would put the oil market without an anchor for the first time in a long time.

But here’s the thing. I think the situation is MUCH WORSE than that.

That is because it’s not just OPEC+ spare capacity that is disappearing. While the mainstream media focuses on the Saudi’s and Russia, the oil analysts I listen to are far more worried about a different type of capacity. The capacity of the oil market to grow barrels to meet future demand.

THE REAL ENGINE OF GROWTH

OPEC+ gets the headlines, but for more than a decade, the real driver of growth in the oil market has been elsewhere.

It has been all about US shale.

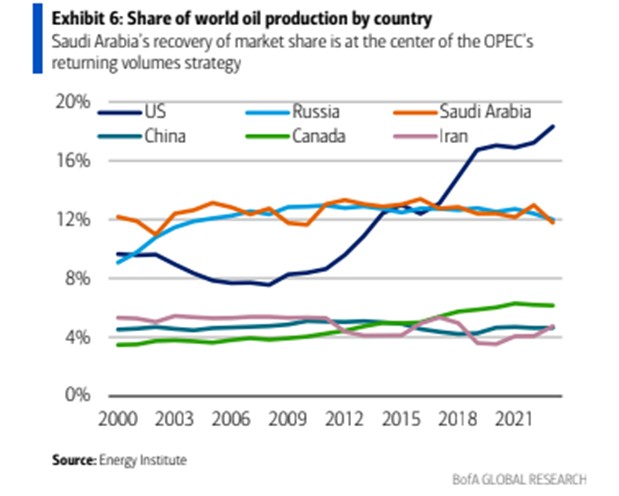

Source: Bank of America

Saudi, Russia, Iran, even Canada – they have been able to only modestly increase oil production (if at all!) over the last 25 years. Only one source of supply has kept oil barrels growing – the United States oil shale.

Today the US pumps almost as much oil as Russia and Saudi Arabia combined. According to Bank of America, “total US petroleum and liquids supply hit 20 million barrels per day in 2024, almost twice that of Saudi and Russia.”

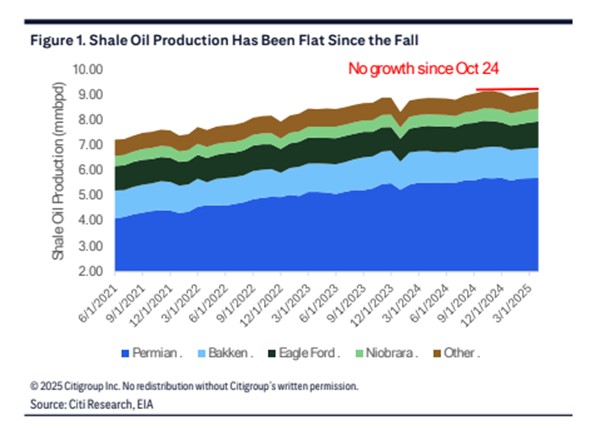

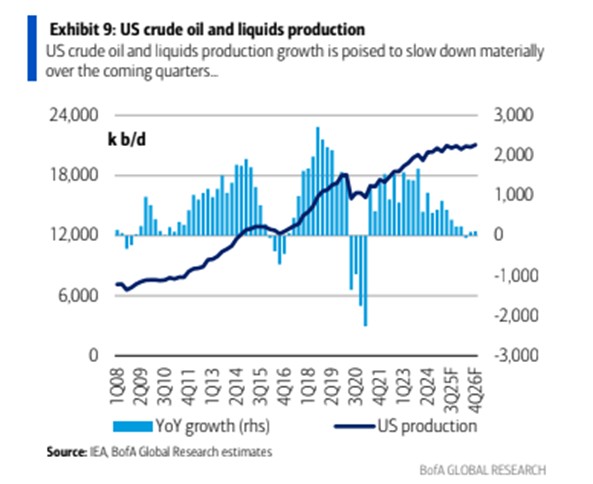

But this is starting to change. There has been no growth in US shale production since October 2024.

Source: Citi Research

What I glean from what the experts say is just what you’d expect: the best acreage in the major shale basins, called the Tier-1 acreage, is being drilled up fast.

Last March, Scott Sheffield, former CEO of Pioneer Natural Resources, put it bluntly: “One of the reasons Pioneer sold…we were running out of Tier 1 inventory. Everybody is running out of tier 1 inventory” (my emphasis).

Sheffield can speak frankly. He is a former CEO and the company he led has been bought out. He has no skin in the game (and no stock price to worry about!).

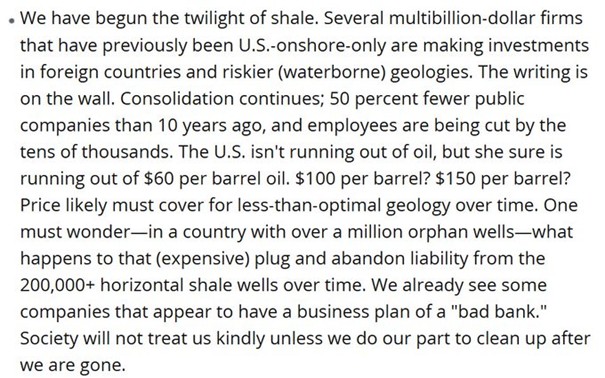

Earlier this week, the very excellent oil analyst Rory Johnston pulled this excerpt from the Dallas Fed Energy Survey. The quote below isn’t the Fed talking. It is an oil executive.

Source: https://x.com/Rory_Johnston/

That same Fed survey made the broader comment that “oil and gas activity in the key producing states of Texas, Louisiana and New Mexico declined slightly in the third quarter, as executives there expressed an increasingly negative outlook for the industry”.

Look. No publicly traded oil company is going to say they are running out of inventory. The only one’s that will are former execs or those that are speaking anonymously. But the numbers speak for themselves.

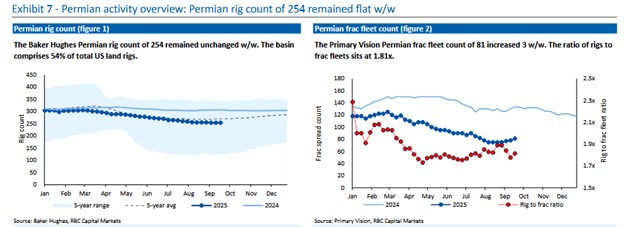

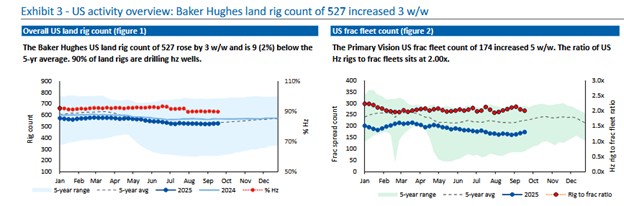

The US rig count has fallen 15% or by 73 rigs since late March.

Source: RBC Capital Markets

The total rig count and frac fleet count is flat as well.

Source: RBC Capital Markets

What we have here is a bad combination: less drilling of less productive acreage. But it is even worse than that! Because of the large decline rates of shale wells.

Nuttall has again been ahead of the curve. He says that the average shale company in the US is dealing with 40% YoY decline rates. The US needs to drill a lot more just to keep the hamster wheel running, never mind move it ahead!

It’s not going to happen. At least, not at <$60 oil. The growth in cheap US production is coming to an end.

Bank of America has production leveling off in 2026 with YoY growth going flat.

Source: Bank of America

A GLUT – BUT A SHORT LIVED ONE

Yet in the medium term, we still need more oil. Demand is looking… well, it’s okay. It is certainly a lot better than has been feared for a number of years.

From Bank of America, on demand growth:

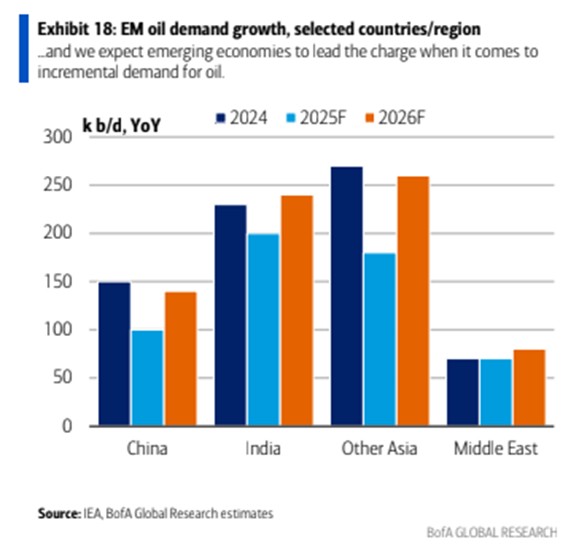

On the demand side we now expect growth of about 900k b/d this year and 1mn b/d next year on the back of our upwardly revised global GDP growth expectations of 3% for 2025 and 3.1% for 2026.

There is no doubt that oil demand growth isn’t what it was a few years ago. We aren’t going to see 2M+ bbl/d demand increases, maybe ever again. But oil demand is also a long way from a plateau and a very long way from going negative – especially if Trump does what he seems to be doing and making climate change irrelevant.

Virtually all this demand growth is going to come from Asia. India is actually going to account for more growth than China (the times are certainly a-changin!).

Source: Bank of America

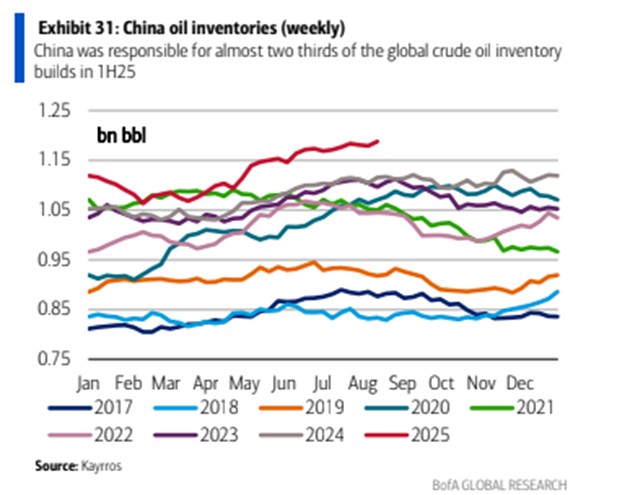

China growth has been even higher, as China is “mopping up” extra supply by increasing their inventories.

Source: Bank of America

Nevertheless, in the very short run (think the next six months), it will be a choppy market. Those OPEC+ production increases will weigh on the market.

We are going to have a surplus, even if it isn’t at the scale some are suggesting.

Bank of America thinks we will have a surplus for the rest of this year and beginning of next. They expect a 800,000 bopd surplus in the second half of 2025 and 990,000 bopd in the first half of 2026.

That sounds ugly, and if it comes to pass, it will have an impact. But given the skepticism about where those OPEC+ barrels are coming from, you can see why the market isn’t willing to price in these worries just yet.

Moreover, when we come out on the other side – in the spring when oil demand picks up seasonally – we could be looking at a surprisingly tight market.

That market may look materially different then we have seen it in years. Just imagine a market where not only OPEC+ but also US shale has no more barrels to add.

Unless, of course, prices go higher. We need prices high enough so that Tier 3 acreage becomes the new Tier 1. Which is almost certainly somewhere above $70+ WTI.

This is what I think the market is focused on. It is the big reason oil is sitting here at $65 in the face of all this bad news.

If that is indeed what’s coming, $65 might look pretty cheap by the spring.