Articles

See All

The Cheapest AI Stock on the Board?

ASE Technology Holdings (ASX-NASD)

As you read this story, you will learn more about the GUTS, the physical manufacture, of AI components than you ever needed to know.

And it leads to the cheapest AI stock that I see–ASE Technology Holdings. I think it’s fair to call ASE Semiconductor the little brother of Taiwan Semiconductor, TSM-NYSE.

See if you agree with me:

AI is, without question, the BIGGEST trend of our times.

Anyone that doubts me has never used Claude Code, never learned a new subject from ChatGPT, never had Google Gemini run analysis on a large dataset.

This is about way more then just answering simple questions. These models are becoming very good. And more importantly, they are always getting better.

The BIGGEST thing that people are missing with AI is that it has nothing to do with where things are today. Today is already yesterday’s news.

What matters is the trajectory.

Models today are leaps and bounds better than they were even 6 months ago. Those models are way better then they were a year ago. Two years ago AI was rendering humans with six fingers are arbitrary number of arms.

Today I can literally code Python programs that create financial models and I have never learned a line of code.

You can’t make this stuff up!

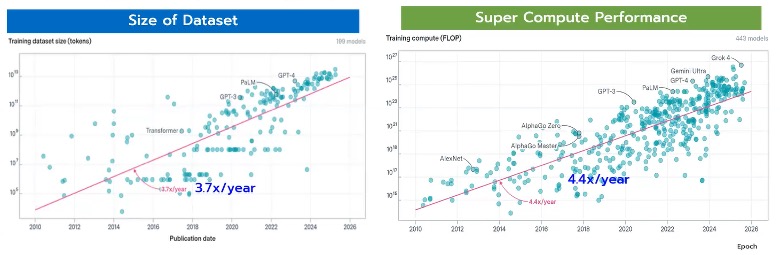

The dataset size to train models is doubling every 6 months with tens of trillions of words in its training vocabulary. The performance of compute to train these models needs to improve by 4.4x every year to support this growth.

It is the clear trend of our lifetime. Yet there is one thing that always holds me back from taking big positions in AI stocks.

Valuation!

AI stocks are expensive and the technology changes so fast, its hard to know which one’s win.

This is all leading into ASE Semiconductor (ASX – NASDAQ).

ASE Semiconductor is right in the middle of this AI infrastructure build out. In fact, they sit in the middle of the most important supply chain on earth right now – semiconductor packaging and testing.

That business means ASE can win no matter which chip or model eventually wins out. They are going to help manufacture whatever the market needs.

While the market obsesses over the dominant names, TSMC (TSM – NYSE) and NVIDIA (NVDA – NASDAQ), ASE is quietly absorbing an increasing share of the advanced packaging work that used to live exclusively inside TSMC’s walls.

TSMC is full to capacity and ASE is becoming their release valve.

With TSMC unable to meet capacity, more and higher margin business is being offloaded to ASE. ASE could end up doing most of the work across the supply chain.

ASE’s leading-edge packaging business is expected to double in 2026. Its margins are expanding. And the company just told us — on its Q4 2025 earnings call last week — that demand far exceeds the capacity they can build.

Yet ASE trades at a reasonable multiple. The stock trades at just 12x forward EBITDA.

This is a valuation that would be reasonable for just about any stock. But for a company in the middle of the AI buildout, it seems like a steal.

THE BUSINESS: TWO SEGMENTS, ONE THAT MATTERS

ASE operates two segments.

Let’s get the unexciting one out of the way first. That would be the Electronic Manufacturing Services (EMS) segment. This is the assembly of motherboards and PCBs.

EMS is roughly 40% of ASE’s total revenue. It is a low margin business with gross margins only around 9%. The business has seen flat to declining revenue for the last couple of years, though with AI buoying the industry, there are signs that the cyclical downturn on basic electronics demand is turning around.

Regardless of how quickly the cycle turns, it doesn’t really matter. The EMS business is not the story.

The story is the other segment, Assembly, Testing, and Materials (ATM). The ATM segment packages and tests the chips that power AI, HPC, mobile, automotive, and everything else.

ATM revenue grew 24% year-over-year in Q4 2025.

Even though ATM was just 60% of revenue, it was over 90% of the company’s total operating profit. It’s the driver of the stock price.Within ATM, ASE breaks out what they call “LEAP” revenue, which stands for Leading Edge Advanced Packaging.

LEAP is the packaging of devices like AI GPUs and accelerators, custom ASICs (cloud, networking, AI inference/training), and HPC (high-performance computing) CPUs and networking silicon.

This is the business that accelerates with AI, manufacturing complicated devices that have a lot more going on then the CPU that runs your computer at home.

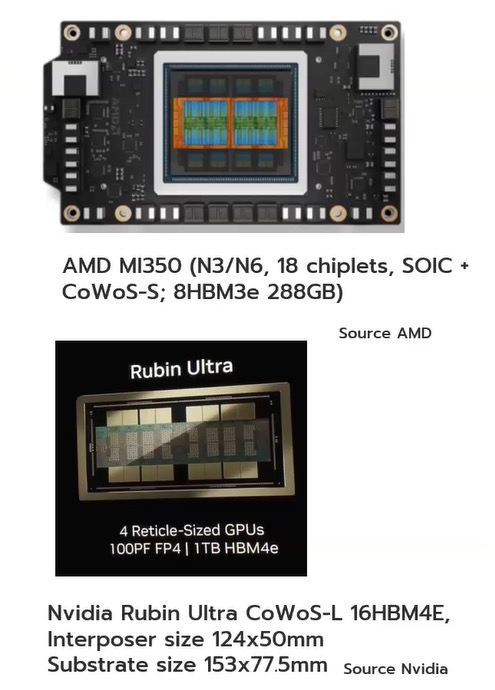

The snapshots below of the current generation of AMD and Nvidia GPUs. These are the sort of devices that ASE is responsible for building. The Nvidia design has 4 GPUS, 16 memory devices and power regulators all on a single substrate to make “one” chip. The AMD device has 18 chiplets, 8 memory chips, and power regulators.

These devices are large, 150 mm+, which means that only a few devices can fit on each semiconductor wafer.

That combination, having multiple chiplets, memory devices and power converters packaged together on a single large device is a recipe for device failure.

The math of semiconductor wafer manufacturing is that failure is a function of area. If one device takes up more area of the wafer, there is a greater chance that it is going to fail. These big devices have a >> chance of failure. ASE’s ability to package and test this sort of device without running into excessive failures is what gives them an edge.

They have the expertise to package and test these devices. These tricks and skills, which they collectively refer to as their VIPack can bring down failures and insure consistency.

There are only a few companies in the world that can do this.

With the growth of AI, the skills that ASE offers have led to significant growth. ASE’s LEAP revenue reached $1.6 billion in 2025, up from just $600 million in 2024. It now accounts for 13% of ATM revenue.

Even better, management guided for an even better 2026. LEAP revenues are expected to at least double again to $3.2 billion this year.

That’s a guide for 100% growth in their highest-margin business line.

TAKING BUSINESS FROM TSMC — WITHOUT COMPETING

Part of that LEAP revenue is coming from TSMC, a company that may have been seen as competition to ASE not that long ago.

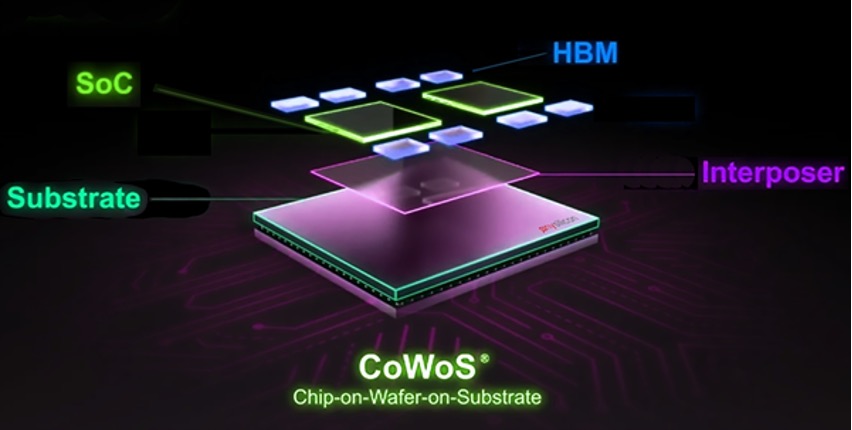

Today, ASE is absorbing work from TSMC but not through competition. A few years ago TSMC pioneered a chip design called CoWoS (Chip-on-Wafer-on-Substrate). It is an advanced 2.5D packaging technology that facilitates mounting of the GPUs, CPUs, and HBM memory and power converters all onto a single silicon surface.

For years, TSMC kept this work in-house. But TSMC has become capacity constrained. They simply cannot fabricate wafers and do all the advanced packaging for the insatiable AI demand.

Enter ASE. The company has been doing what it calls “OS” — outsourced substrate work. TSMC handles the wafer-level portion (the imprinting or stamping of the silicon) and ASE handles the substrate-level assembly and testing.

This is the bread and butter of LEAP growth so far.

Now ASE is expanding further into the TSMC bread box, to what they call “full process”. This entails handling the entire CoWoS process. ASE will do the entire packaging flow from start to finish, essentially all the same work TSMC does internally.

On last weeks earnings call, CEO of ASE Dr. Tien Wu was explicit: ASE has engagement with multiple customers for full process, and it “expect to triple… full process revenue this year to reach about 10% of the overall LEAP service revenue”.

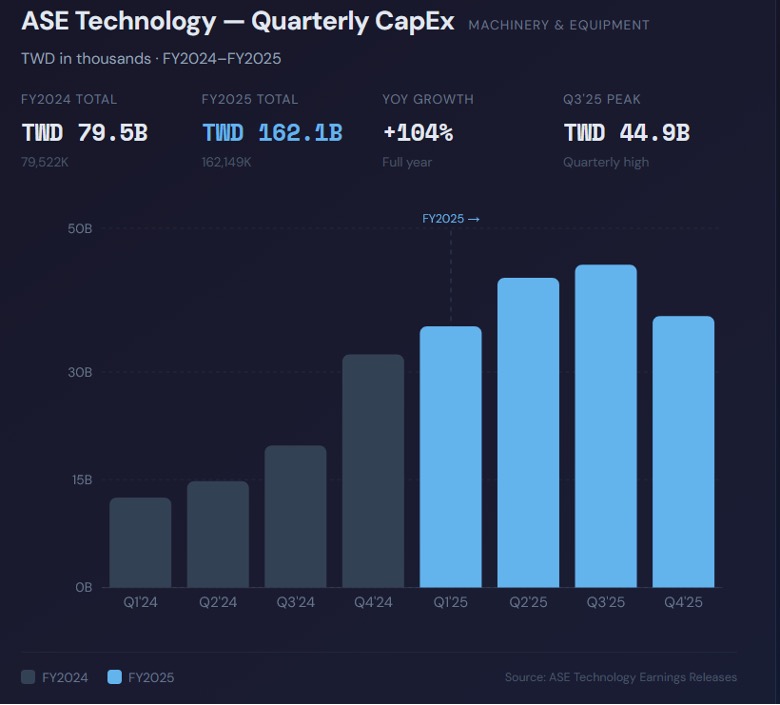

Full process revenue is expected to begin ramping in the second half of 2026. ASE has been ramping capital expenditures for the last number of quarters in anticipation of this.

What’s really important here is that ASE isn’t stealing TSMC’s business. Dr. Wu described it as “technology sharing”. TSMC’s foundry is partnering and end customers want a second source as TSMC is over capacity already.

ASE, as the largest outsourced semiconductor assembly and test shop, is a natural second sourc

What I’ve covered so far is the “assembly” part of the ATM segment. The second half of ATM is “test”.

While packaging is the headline grabber, ASE’s testing business is also growing. It grew 33% year-over-year in Q4.

Testing represents 19% of revenue. Management suggested on the Q4 call that the ratio should settle closer to 30%, which means there’s significant runway here as well.

Why does this matter? Testing is the highest-margin activity of the back-end assembly steps.

You can break up ASE’s test work into A: wafer probe testing and B: final test.

Wafer probe testing happens before the packaging stage. Probes are used to ensure the chip’s electrical pathways are in working order.

Final test is, well exactly as it sounds. It is a final test that is done once the die is in its finished packaging.

Wafer probing and final test for AI accelerators requires expensive, specialized equipment and engineering expertise. ASE is investing a good chunk of that incremental CapEx in testing equipment for both AI and non-AI chips.

ASE said on the call that they expect to have meaningful final test revenue for next-generation AI chips by the back half of 2026. Based on what they said the last couple of conference calls, I’d guess that ASE has secured or is securing final test business for upcoming GPU architectures. It could be Nvidia (NVDA – NASDAQ) and I have certainly seen that speculated on X, but I can’t be sure.

That spike in test equipment CAPEX — ASE spent $1.1 billion in 2025 alone — is a strong signal that the company has won this business. You don’t buy that kind of equipment on speculation.

NOT EXPENSIVE FOR AN AI PLAY

Full year 2025 EPS was 60C per US listed share (ASE trades in the US with American Depository shares (ADS), with each ADS equal to 2 Taiwanese shares).

Now, that doesn’t sound all that cheap. It works out to about 45x P/E.

But earnings have been growing and they should continue to grow in 2026. The building blocks are in place for another strong year. This will be led by LEAP revenue doubling from $1.6 billion to $3.2 billion. The rest of the ATM business is expected to grow at a similar pace to 2025, supported by more test revenue and growth of IoT, automotive, and the industrial recovery.

Gross margins are going to be a tailwind as LEAP revenue and the final test business both carry higher gross margins. They say they: “expect ATM gross margins to stay within our structural margin range throughout the year and to improve every quarter, while second half gross margin to reach the upper end of the range”. A favorable pricing environment — management used the word “friendly” on the call — across the entire ATM segment should boost the bottom line even more.

The EMS business, that boring motherboard assembly business that I haven’t really talked about, is expected to reverse its course of declining revenue and stabilize to modest growth. It won’t be a drag. ASE sees it extending it into “AI and AI adjacent applications such as server, optical and power solutions”.

In Q4 ASE did 22c EPS. Analyst estimates for 2026 are for 92c EPS, which could be quite conservative if they can beat their guidance numbers. When I ran my own back of the napkin math, I can see $1+ EPS with just a little bit of good luck.

In 2027 the consensus numbers rise to $1.24 EPS. That would put the stock at 20x forward P/E. Not bad in a world where a lot of the AI names trade at 50x PE’s or more.

If their AI business is as good as it seems to be, it’s easy to imagine the market pricing in a $1.50 EPS number for 2027 by mid-year. With accelerating growth, the market might be willing to give the stock a 25x multiple, putting the stock closer to $40 per share.

The big tell for 2026 is the CAPEX. The chart I showed earlier had CAPEX rising from under $15 billion per quarter in the first quarter of 2024 to almost $50 billion in Q3 2025.

The only reason for that massive jump in Capex is because ASE has opportunities in its pocket already. I get no sense that the management team would churn out that kind of Capex on spec.

In fact, on their Q3 call, management went to some pains answering questions about why they aren’t rushing to build a US manufacturing site, which the Trump administration has been pushing for from the larger TSMC.

But ASE management wouldn’t commit to any plans. The reason? They simply couldn’t guarantee a sufficient return on investment, and they weren’t going to spend the money without that.

That makes me believe that the big ramp in capital being committed last year came because of some guarantees of ROI, just not necessarily one’s that management can discuss.

We shall see. What we know is that AI demand is accelerating, the hyperscalers are spending way more than anyone expected, and that we are beginning to see chip shortages as a result.

That all plays right into ASE’s wheelhouse. This is a company investing through the cycle with conviction. As Dr. Wu put it: “This is our time to shine.”

DISCLOSURE–I’M LONG 1000 SHARES AT $19.75