Articles

See All

THE BRILLIANT GOLD STRATEGY IN PLAIN SIGHT–THAT NEXGOLD IS EXECUTING

b) lowest operating cost,

c) environmentally permitted gold deposits in Canada

Environmental permits and low capex are the two keys to market success for junior gold stocks.

Speed is another key to success–and both Signal’s Goldboro deposit in Nova Scotia and Nexgold’s Goliath deposit in Ontario are so advanced, NexGold President Morgan Lekstrom says a realistic goal is to have one of them starting construction in 16 months.

Both deposits have recent feasibility studies showing they will produce 100,000 oz of gold per year for over a decade–with lots of exploration upside to realize through that time.

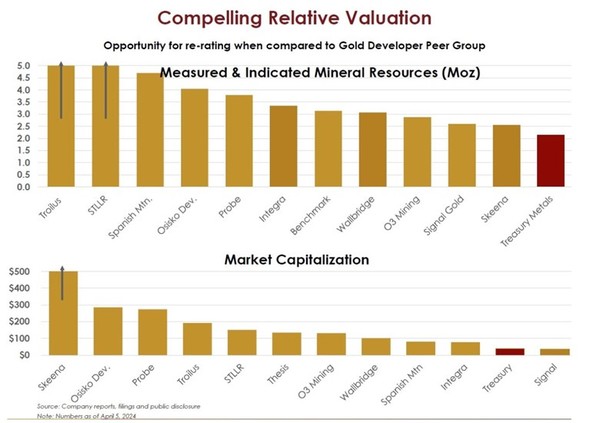

Nexgold now has 4.7 million ounces in the all important “Measured and Indicated” category, and another 1.3 million in inferred category–all in Canada.

Giustra and his lieutenant Morgan Lekstrom are executing a rapid-fire plan to grow the next mid-tier gold producer by targeting Signal Gold and the former Treasury Metals, which has Goliath. Both companies have great deposits, with high grade, infrastructure and permits. NexGold brings the financial power.

See this valuation chart from the article I wrote on Nexgold a few months ago:

The opportunity has been sitting in plain sight for a long time, but Giustra and Lekstrom are making it happen. Again, enviromental permitting is in place and both assets have low capex. Signal Gold’s feasibility was for CAD$271 million capex and Goliath’s feasibility study was $335 million.

“The idea of Nexgold is bite-sized chunks,” says Lekstrom. “Sub $400 million CapEx bite-sized—financeable—low dilution chunks for our shareholders. “You have the two most advanced projects, for permitting, in the M&I category in Canada. Once production financing is in place, it takes us to the 200,000 ounce a year production level—200,000 low cost ounces a year—de-risked.”

Lekstrom has a great relationship with Signal’s debtholder, Nebari, and along with Signal Gold CEO Kevin Bullock, was able to restructure a portion of the $25 million debt that Signal has to make this takeover work.

Assuming the $11 million financing that was announced with the deal gets filled, Nexgold will have $18 million gross cash and $12 million gross debt on the balance sheet. Nebari also gets a small 0.6% royalty on Goldboro that Nexgold can re-purchase at their option.

After issuing stock for Signal (who will own 29% of Nexgold now) there will be 108 million shares out on NexGold, before the $11 million financing. The “hard” equity is being raised at 70 cents with a half warrant at 95 cents for two years, and this will be free trading immediately upon closing. The tax-advantaged “flow-through” money and regular, “hard” equity, is being done at 80 cents with a half warrant at $1.05

Giustra is buying a BIG chunk of this financing–millions–and the rest of the NexGold management is also participating.

Bullock will become CEO of NexGold. Head offices for both the old Treasury Metals and Signal are in Toronto.

This strategy should work for investors. There isn’t years of drilling ahead of us–both these assets could get construction financing and the goal is to get shovels in the ground on one of them in 16 months. Speed. Low capex.

A feasibility study on the Goliath deposit that NexGold has from the Treasury Metals acquisition showed pro-forma production of 109,000 ounces per year with AISC—All-In-Sustaining-Costs—of US$1,072 per ounce, on a grade of 1.3 g/t Au. Capex was estimated at CAD$335 million.

The 2021 feasibility study for Signal’s Goldboro asset showed pro-forma 100,000 oz of annual production with an AISC of US$849/oz, when gold was US$1600/oz, on a grade of 2.26 g/t Au. Capex was estimated at CAD$271 million.

Nova Scotia is one of the most under-appreciated gold camps in the western hemisphere with over 8,000,000 ounces of known gold in 11 deposits in 150 km radius of Goldboro.

Goldboro—drilled down to 500m so far—remains wide open at depth. Its 2.8 million M&I ounces do NOT include any new ounces that could be added from the 1200 metre drill program just completed.

CONCLUSION—in six short months, as the gold price continues to rise, Giustra’s Nexgold has consolidated the two cheapest gold deals in Canada, based on comparables this past spring.

Giustra and Lekstrom see that scale matters—but it has to be smart. Low capex, top jurisdictions and big exploration upside is what can give investors big capital gains in a good gold market.

They are set up better than most to deliver that now.

NEXGOLD has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.