Articles

See All

STEALTHGAS (GASS – NASDAQ)A SNEAKY PLAY ON LPG?

On Tuesday morning Stealthgas (GASS – NASDAQ) reported another HUGE quarter. Adjusted EPS came in at 31c per share – a big beat over average analyst estimates of only 15c per share.

In the last nine months, Stealthgas has tabled adjusted earnings of $1.04 per share. With the stock trading at a little over $6 that puts it well into the “value” basket with a P/E of under 5x.

Is this a no-brainer buy? Nothing is ever that easy. In fact, even though the stock looks really cheap and the outlook could not be better, I’m not sure I am ready to take the plunge in Stealthgas. If I decide to do it, it will be with a very short leash.

Here’s why.

LAND LOCKED BY DROUGHT

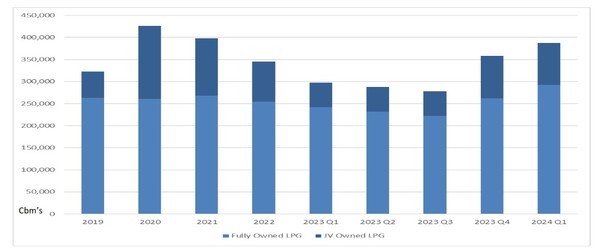

Stealthgas owns the largest fleet of small LPG—Liquid Propan and butane—carriers in world. These are vessels ranging from 3,000 to 8,000 form cubic meter (CBM) in size. Stealthgas owns 27 LPG vessels with another 6 vessels controlled via JV’s.

Source: Stealthgas Q2 Investor Presentation

LPG is liquified propane and butane.

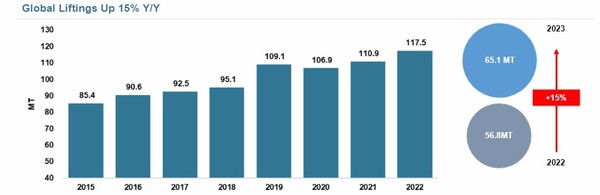

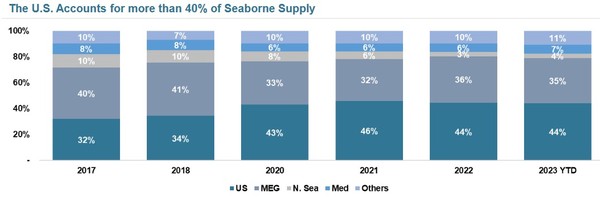

The seaborne LPG market has grown at a 4.7% clip since 2017.

Source: Dorian LPG Investor Presentation

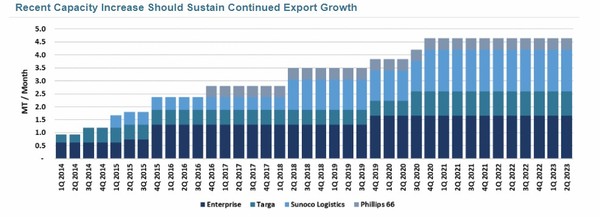

On the supply side, most of that growth has come from the US. Since 2014 export capacity in the US has grown from under 1 MT/month to over 4 MT/moth.

Source: Dorian LPG Presentation

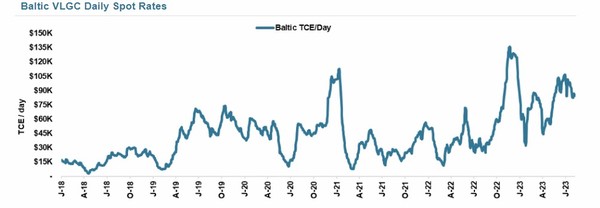

But it’s been a bumpy ride for shippers. Over the past 10-years rates for VLGCs have been subdued.

Source: Dorian LPG Presentation

A lot of that was because of the trade dispute between the US and China. China sanctioned shipments of LPG from the US from August 2018 to March 2020.

Today though, China is growing imports of LPGs A LOT. China has building propane dehydrogenation plant (PDH) capacity at a fast clip. So far, Chinese imports of LPGs have increased 22% year-over-year.

The biggest importers of LPGs are Asian countries: Japan, South Korea, China and India top the list.

The big exporters of LPGs are the Middle East countries (Saudi Arabia and Qatar) and the United States. US Gulf Coast exports of LPGs have increased significantly with shale production. Today the US Gulf exports nearly 2 MMbbld of LPGs and the US account for 40% of seaborne supply.

Source: Dorian LPG Investor Presentation

The fastest way to get LPG shipments from the Gulf Coast to Asia is through the Panama Canal. Almost all the LPGs go via this route.

But right now, there is a BIG problem. Panama is having a drought. The Panama Canal relies on a supply of freshwater for moving up and down the locks. According to RBN Energy, the canal’s primary reservoir for filling the locks has declined by half since the spring!

Low water levels are limiting the number of ships that can pass through the canal.

In normal times as many as 40 vessels pass through the locks every day. That dropped to just 32 vessels in July, and to 24 vessels last week. The Panama Canal Authority has said that if conditions don’t improve, they will reduce the number of ships through the canal to only 18 a day by February next year!

Adding to the LPG backlog is that LPG carriers (known as very large gas carriers) don’t get priority through the canal.

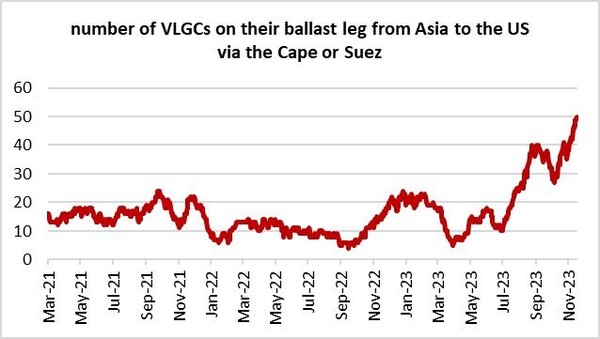

Without access through the Panama Canal, shippers are forced to make a much longer journey via the Middle East Suez Canal or around the southern tip of Africa. Again, deferring to RBN’s research, a 27 day trip via the Panama Canal increases to 41 days through the Suez Canal or 44 days around Africa.

This is leading to a big increase of ships in transit as they take longer to make deliveris and make their ballast leg back to the US for another shipment:

Source: Oeystein Kalleklev, CEO of Flex LNG

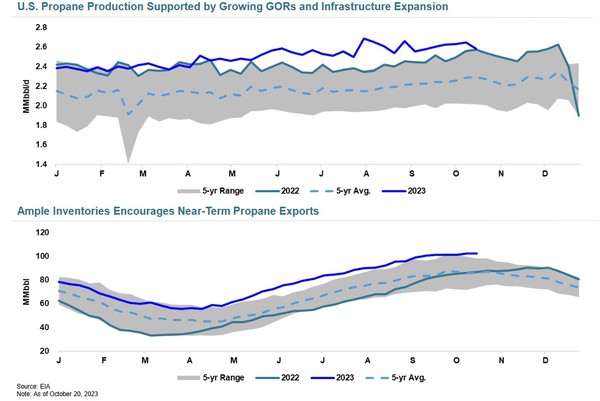

All this is happening at a time when the US is producing natural gas liquids (including butane and propane) at a record pace.

The propane market has struggled this year because inventories are high and demand in the US is soft. Propane stocks in the United States are at record levels.

In fact, the only thing holding up the propane market are exports, which have soared as China brings on new propane dehydrogenation (PDH) plants. Global seaborne LPG exports increased 3.1% YoY while US exports increased 13% YoY.

Source: Dorian LPG November Investor Presentation

If problems at the canal persist, we are moving toward a glut of LPGs on the water. Which should drive demand for LPG carriers sky high.

THE TRICKLE-DOWN EFFECT

The immediate beneficiaries of this are the earnings of the biggest LPG carrier companies. Dorian LPG (LPG – NYSE), which owns 25 very-large-gas-carriers (VLGCs) that ship propane and butane along trans-atlantic routes, has seen its stock soar three-fold this year. Jefferies recently raised Dorian’s 2024 earnings estimate up from $3.68 to $8.67 – an increase of 135%!!

Source: Stockcharts.com

Stealthgas operates smaller LPG vessels. While Dorian LPG has a fleet of twenty-five 84,000 CBM ships, the biggest ship that Stealthgas has is only 40,000 CBM – and these are new builds that will be delivered in Q1 2024.

The rest of the Stealthgas fleet consists of smaller vessels, the largest of which are four 22,000 CBM vessels (these do run global routes). They own 23 vessels of less than 11,000 CBM.

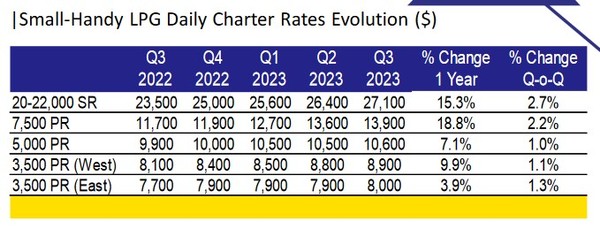

Nevertheless, Stealthgas still benefits from the rising tide. We’ve seen charter rates for smaller LPG carriers steadily move up for 4 quarters in a row:

Source: Stealthgas Q3 Investor Presentation

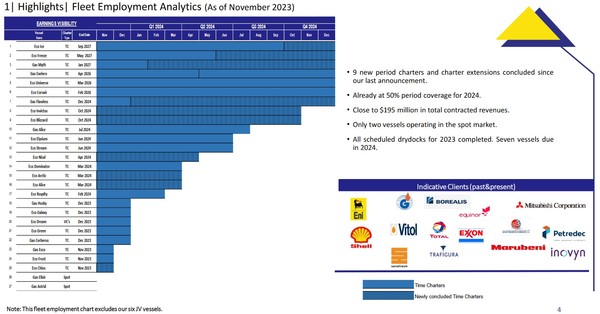

Stealthgas does not operate many of their vessels on the spot market. In Q3 they had only 2 ships on spot. Both were in JV’s with 50% ownership. The rest of the fleet is on charter.

A LACK OF DISCLOSURE

You would think that Stealthgas would still benefit – by signing lucrative charter terms. And they may be doing just that. Unfortunately, we can’t be sure.

Stealthgas signed on to 9 new charters in the third quarter. A few of these extended out as far as 2027.

Source: Stealthgas Q3 Investor Presentation

But we don’t know the terms of any of these charters. Stealthgas isn’t super upfront with giving specifics. Nowhere in their Q3 results do they tell us what their charter rates are.

Which brings us to the fly in the ointment…

FOOL ME ONCE?

Here is the BIG QUESTION with Stealthgas. Is management on our side?

In 2021, Stealthgas spun-off its clean tanker assets into a separate company called Imperial Petroleum (IMPP – NASDAQ). Here is what happened to Imperial’s stock after the spin-off.

Source: Stockcharts.com

Over this same period tanker stocks like Ardmore Shipping (ASC – NYSE) and Scorpio Tankers (STNG – NYSE) did very well. This isn’t a sector issue.

Instead, the problem with Imperial was dilution. Imperial’s management was relentless in diluting the stock while giving no regard to the impact on existing shareholders. Outstanding shares of Imperial increased 4,000% over the last 2 years!

The CEO who undertook this reckless dilution? Harry Vafias, the same one that is CEO of StealthGas. Vafias used the proceeds from share sales to grow the business and buy more vessels. Many of which were bought from other Harry Vafias-run companies.

Yikes!

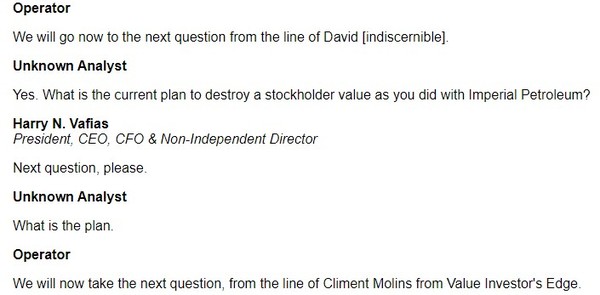

On the second quarter call we got a hint of the shareholder ire with this exchange:

Source: Alpha-Sense Transcripts

Usually this would be enough for a hard NO. What complicates things here is that StealthGas IS NOT following the same path.

Stealthgas is not diluting shareholders right now. In fact just the opposite: they are buying back shares.

Stealthgas has bought back $19 million worth of their shares since announcing a share buyback in May. They added to the buyback by authorizing an additional $10 million more.

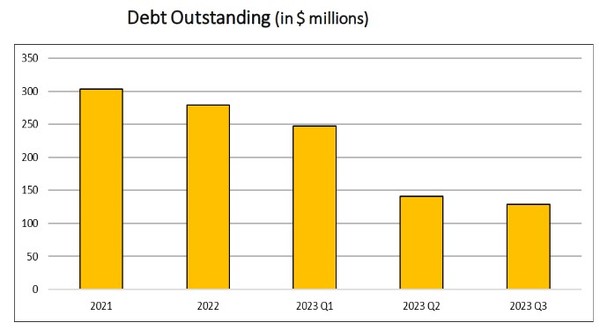

They have also been reducing debt. total liabilities have been reduced since the beginning of the year by $156 million, from $303.6 million, down to $147.5 million. As a result of the solid results being reported, shareholders’ equity has increased by $33 million to $550 million. Net debt has dropped significantly.

Source: Stealthgas Q3 Investor Presentation

Nor is there a sign that Stealthgas will grow at all costs. Stealthgas has been a seller of their older, smaller vessels. They have been replacing them with larger, new builds. They sold two vessels in July and announced another two sales that will close in Q1 2024. They are buying to large 40,000 cbm vessels that will be delivered in Q1 2024.

The two new-builds will add $70 million of debt when they are delivered.

Imperial Petroleum has even changed their course and is now buying back shares. Does that mean Vafias has found religion? Maybe, maybe not, but in the case of Stealthgas he has a stake at the same table as the rest of us. Vafias is the largest common shareholder through his investment company, Flawless Management (I am not making this up), which holds 7.1 million shares of the stock.

Shipping stocks should generally be traded, not owned. There is hardly a better example of this than Stealthgas. It’s as cyclical as the rest of the energy industry, and very prone to over-building their fleet.

Even though Stealthgas seems to be doing all the right things, I would suggest investors have to remain vigilant. Shipping companies are a graveyard for investors and the management of Stealthgas hasn’t been a model for preserving shareholder value in the past.

The situation with the Panama Canal could improve in an instant – a torrential rain over the country (remember the California drought and what happened there) and the issue could quickly reverse. Clarkson recently said that current VLGC rates of ~$138,000 were $100,000 more than they would be without the Panama drought.

On the other hand, if no rain falls this is only going to get worse. When asked what might happen with the canal if the drought carries on and whether we may see VLGCs restricted entirely, Dorian CEO John Hadjipateras replied “it is impossible for us to know”.

What I do know is that if rain does not fall rates will rise. Stealthgas should benefit. For the remainder of the year 2023, Stealthgas has about 85% of fleet days secured under period contracts, but for 2024 only about 50% of their volume is priced.

Stealthgas has 3 vessels coming off charter in November, another 4 in December and 4 more in the first quarter of 2024. There are also 2 JV vessels on the spot market and 2 more than come off charter in December.

This all means that the stock should move higher with rates.

But with the big, BIG caveat that this only happens if the management team continues to make shareholder friendly decisions. A sudden announcement of an ATM, a filing of an S-3, or a buying spree of new-build commitments and Stealthgas will go south and fast.

If that doesn’t happen and Vafias is content to win along with the rest of us, there could still be a lot of upside in the stock. But Stealthgas is not for the faint of heart. Or for anyone slow on the sell button.