Articles

See All

Reading Between the Lines On A Stock’s Financials

I’m fairly certain Glass House is the cheapest producer of cannabis in North America. Maybe on the planet. Because of what isn’t being said.

Of course, Glass House themselves say that they are the lowest cost producer.

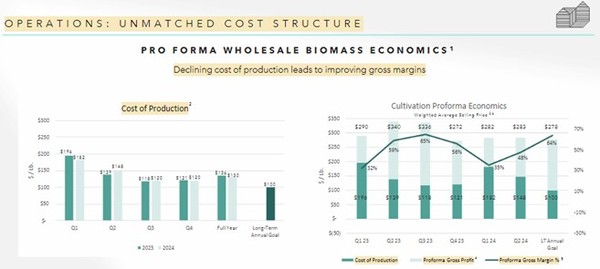

Source: Glass House Analyst Day

But you can’t take a company, especially an investor deck, at face value. They are always giving a rose-colored view.

What really makes me believe that Glass House is lowest cost is that they are the only one’s talking about cost.

I don’t mean the only one’s talking about being lowest cost. More than that. Glass House is the only company talking about cost AT ALL.

Of course, every company must disclose production costs in their financial statements. That is what cost of goods sold (COGS) is.

But with cannabis companies, COGS can vary wildly. It reflects the cost of the final product, which can be very different for extract vs. flower vs. a gummy or a cookie. COGS doesn’t tell you what it costs a company to grow the plant.

It turns out that grow information is non-existent.

No one reports their grow costs.

Well, no one except Glass House.

Glass House is not just an outlier, they are off the charts. Glass House tells you quarter by quarter what their production costs are.

Source: Glass House Brands Q2 Presentation

Glass House also tells you how much they sell a pound for at the wholesale level. The flower, the trim, all of it. It provides a complete picture of the unit economics.

Source: Glass House Brands Q2 Presentation

Why don’t other companies do the same? While I can’t say for sure, I would hazard a guess. It wouldn’t paint them in the best light.

THE BENEFITS OF THE WILD WEST

It makes sense that Glass House is the low-cost producer of cannabis. For a few reasons.

Glass House has built its greenhouses in the prime growing location in North America. Southern California, just north of Los Angeles.

This is the same area where we get the majority of our strawberries, our blueberries, and our grapes. If you need to grow something well, this is where you do it.

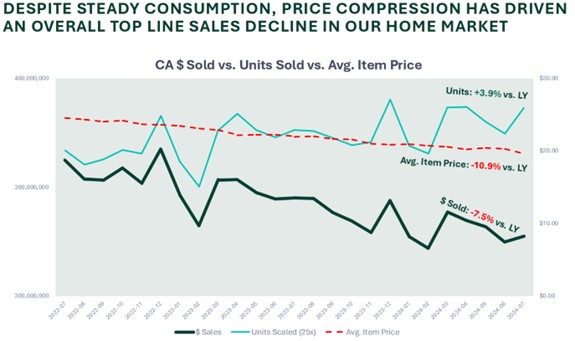

California is also the toughest cannabis market to sell into.

California was one of the first markets to legalize cannabis. The state flooded the market with licensees. Because its so easy to grow cannabis in the state, the illegal market continues to thrive.

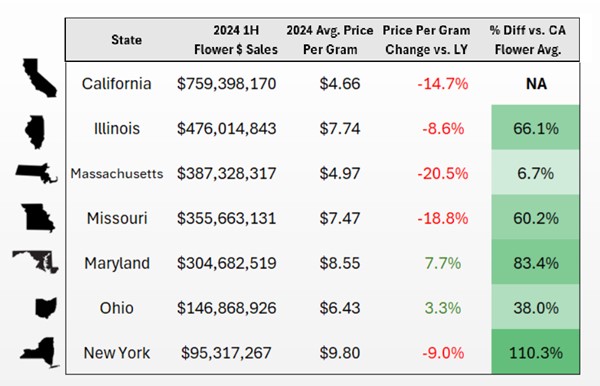

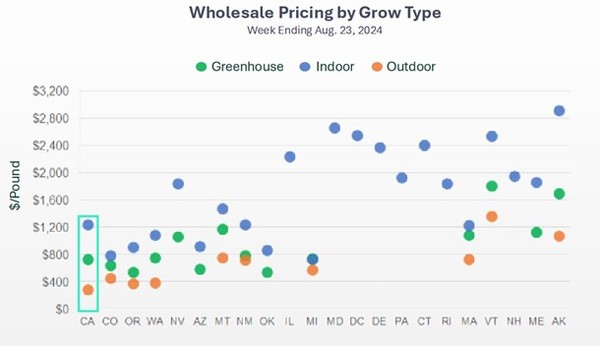

Prices of legal cannabis are some of the lowest in the United States.

Source: Glass House Investor Day Presentation

The best growing conditions and the worst market conditions. Its Darwinism that breeds the low-cost producer.

Glass House has a goal of producing cannabis biomass at $100 per ton. Last quarter they were under $140 per ton. They’ve seen their cost per ton come down each year.

Source: Glass House Brands Investor Day Presentation

Low production costs have allowed Glass House to operate profitability even as the selling price of California cannabis is mired in a slump due to overproduction – averaging just over $280 per ton in Q2.

Source: Glass House Brands Investor Day Presentation

That’s half of the story. The other half is quality. California is dog-eat-dog and to survive, you can’t just be the cheapest, you must be the best.

Glass House is not just the lowest cost producer of cannabis. They produce some of the highest-quality cannabis.

This was the first year where the California State fair awarded cannabis producers, and Glass House came away a big winner.

They won the Golden Bear for best greenhouse flower, a gold medal for highest in total terpenes, two gold medals for specific terpenes and a silver metal for their CBG. These awards were given out based on both subjective (ie. Cannabis experts blind taste-testing the product) and empirical lab tests on the product.

When cannabis gets legalized, Glass House is going to be in the catbird seat. The highest quality, lowest-cost product, ready to take share across the country.

But even if cannabis legalization remains stalled, there is another path to nationwide expansion.

HEMP/CANNABIS – TOM-A-TO/TOM-a-TO?

Hemp, cannabis – what’s the difference?

I’m still not sure I understand.

What I do know is that there is a BIG difference in terms of how the government looks at it.

While cannabis sales are governed by each state, has to be grown in the same state its sold in, and can’t be banked or bought by credit, NONE OF THIS applies to hemp.

Hemp sales are governed by the Farm Bill. Which means that hemp is an agricultural product.

The Farm Bill passed in 2018. It made the sale of hemp no different than cotton or tomatoes.

The technical definition of hemp (as far as the Federal Government is concerned) is a cannabis plant with less than 0.3% THC on a dry basis.

As long as you grow a cannabis plant below that threshold (and with a license), you are free to ship it to just about anywhere in the country (there are a few states that still have laws against it but the biggest targets of Glass House – Texas, Florida, New York – do not). You can accept credit cards; you can use USPS.

Glass House got a lot of attention when they talked about hemp on their Q2 earnings release. They said they were actively exploring the opportunity, “having meetings with large distributors of hemp-derived cannabis”. They are also considering direct to consumer products.

Glass House followed up these comments at their September analyst day. They expect to have a hemp license by mid-October. They were planning to start growing trial hemp at their new greenhouse. Doing all the things to dot ‘i’s and cross ‘t’s.

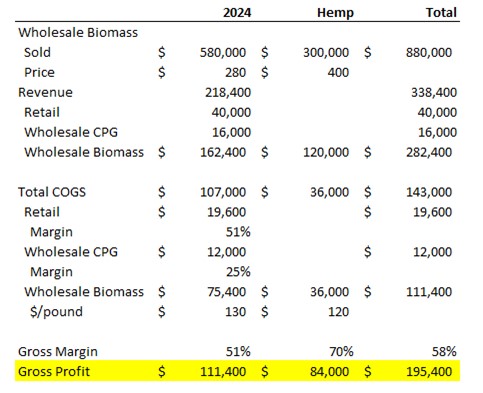

Glass House would likely dedicate a full greenhouse to hemp production. They hinted that their next greenhouse expansion, called Greenhouse 2, would target hemp. That would mean ~300k pounds of hemp per year.

Their growing expertise in cannabis applies to hemp. The greenhouse isn’t set up any different. A visitor wouldn’t be able to tell which plant was being grown where.

While the actual cost of producing a pound of hemp is no different than cannabis less regulatory issues make the overall cost less – the $100 per pound cost drops to $90 with hemp.

On the wholesale bulk side, the price of bulk hemp flower ranges from $600 per ton to $1,200 per ton. Direct to consumer is even higher. This is SIGNIFICANTLY more than what Glass House is getting for their product in California today.

On a X Spaces in mid-August after their Q2 results, Glass House management suggested that while an apples-to-apples comparison is difficult, they would expect an average hemp selling price (a blend of A-grade flower, B-grade flower and trim) of double their wholesale cannabis biomass today.

In other words, for the facilities converted to grow hemp, Glass House could see double the revenue from hemp that they see today from cannabis.

Even if I am conservative, I can see BIG upside. Using $400 per ton biomass (about 40% above their Q2 average selling price) for the 300,000 tons coming from their Greenhouse #2 expansion shows that gross profit would increase by more than 75% over 2024 guidance.

Source: Financials, Our own estimates

While hemp will require additional SG&A, much of that gross profit will still fall to the bottom line. In the above scenario I’d expect adjusted EBITDA of well over $100M.

GETTING PAST THE POLITICS

Given that the upside is clear, maybe the biggest question mark is the Farm Bill itself.

The Farm Bill is up for renewal this year. It is supposed to be renewed by October. There is the usual politics on both sides.

There is an ongoing tug-a-war between the drug enforcement administration (DEA) and industry. The DEA would like to put restrictions on the Farm Bill around what THC products can be derived from hemp.

Recent court rulings have sided with industry (the court says what starts as hemp is hemp).

There is also a recent Supreme Court ruling that overturned what is called “the Chevron doctrine”. This ruling limits what standards the DEA can enforce – again something that works in favor of hemp producers.

No surprise that Glass House called the hemp regulatory market “dynamic” at their analyst day.

Meanwhile Glass House is doing the early work of getting hemp licenses and provisioning for their first trial plants in the new greenhouse. While on their investor day Glass House said, “we have not formally made a decision to go with hemp”, their actions suggest its more about doing everything BUT announcing the commitment, with the stumbling block being clarity from the Farm Bill.

ONE WAY OR ANOTHER THEY WILL GROW

This all could be a moot point if cannabis itself is made legal.

I showed that chart earlier of cannabis flower prices in California. Prices are much lower then the rest of the country. Much the same can be said for biomass.

Source: Glass House Investor Day Presentation

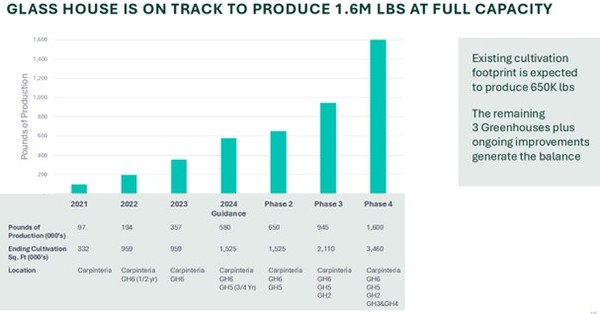

Growth will also come from volume, where Glass House has big plans. Glass House expects to retrofit their next expansion, Greenhouse 2, for $20M to $25M of capital. It will take 12 months. Greenhouse 2 will expand production from 550k lbs of biomass to something close to 850k lbs.

After Greenhouse 2, Glass House has two more greenhouse expansions waiting in the wings.

Source: Glass House Investor Day Presentation

All-in, Glass House is targeting long-term production of 1,600k lbs. Which is triple what they produce right now.

Source: Glass House Investor Day Presentation

With the stock at $9.30, Glass House has a market cap of $660M. They have some very high-cost preferred debt: $81M in three series that pay dividends at between 15% and 20% (10% to 15% is cash). Their total debt is $142M.

The high cost of their debt says more about the cannabis business then Glass House. And honestly, its why this opportunity exists.

Glass House looks like a premium name in a growth industry. It isn’t priced like one because A. regulatory uncertainty and B. not a lot of funds can own it.

Glass House (all cannabis stocks) are restricted from the big exchanges. They are limited to listing on the OTC markets, which are out of bounds for a lot of funds.

Banks also often refuse to custody cannabis assets from funds because they worry about violating the anti-money launder laws.

Yet even with all these headwinds, the stock has held up well. This is a clear down market for California cannabis. Margins are shrinking and many of the fringe players are going out of business. Most investors can’t even own the name.

Plenty of the reasons for the stock price to stink. Yet Glass House looks poised to break out to the upside if anything!

There is one reason for that. Its because investors realize this is a premium name in the sector, and that patience will eventually prevail.

Source: Stockcharts.com

The reason for that could be as simple as expectations of a thumbs up on hemp. It could also reflect growing optimism that cannabis will be made legal at the Federal level.

Look, I can’t tell you what good news is coming. I don’t know. What I know is that all the bad news is well known and largely in the stock.

That means it won’t take much good news to move the stock in a positive way. Or if there is some REALLY big news, the stock could go sky-high.