Articles

See All

OVID THERAPEUTICS JUMPS ON NEW RESEARCH (from The Street Not The Lab)

On July 17, we profiled OVID Therapeutics at 40 cents–

Source: Stockcharts.com

I’m seeing my watchlist blow up with multiple biotech stocks showing 10%+ moves in a single day.

On July 17, we profiled OVID Therapeutics at 40 cents—then on Wednesday August 13, Ovid ended the day up more than 40%, after the stock moved on an initiation report from Lucid Capital Markets.

The Lucid report put a price target of $5.50 on the stock—a 10-bagger if it works! This caught the market’s attention and caused the big move.

OVID is targeting a drug to combat epilepsy, and while the long term outcome is still muddy, the short term set up suggests the stock could do well, as upcoming—but preliminary—data milestones have a very good chance of being successful.

The report didn’t tackle anything with respect to OV329 that we didn’t already touch on in our July 17 report—https://bit.ly/ovid-epilepsy—so really, the stock ramped as the audience for the stock became larger.

It went through the same investment case we did, though it didn’t emphasize the longer-term challenges as much (I’ll touch on those at the end).

One thing I thought was interesting was that the report led its summary with Ovid’s epilepsy drug candidates, OV350, OV4071, and OVXXX (not yet named by the company).

These drug candidates are a different pathway, a different way of attacking epilepsy, than traditional medicines.

My focus has been OV329 because that is going to be the first drug to read-out results –- coming very soon — in September.

I still think the stock is going to sink or swim in the short-term based on those results. Nevertheless, it will be worth diving into these other drug candidates, which all use an entirely different pathway of action.

Back to the immediate catalyst: OV329. OV329 seems well set up to produce positive Phase 1 results. In fact, I would be surprised if the drug doesn’t meet expectations with healthy volunteers. Investors could be forgiven if they think this next, first milestone for OVID is a bit of a lay-up, and that could be why the stock ran (being as there was nothing new in the LUCID report).

We wrote that OV329 was designed to improve on vigabatrin, a known and approved epilepsy drug. It is shown to be more potent in mouse and rat models.

In the chart below, Ovid steps through the biomarkers that they plan to report on for the healthy volunteers in the Phase 1 study.

Source: Ovid Therapeutics

Vigabatrin increased Transcranial Magnetic Stimulation (TMS) parameters, showed evidence of increased brain wave frequency via EEG and, of course, increased GABA concentration.

If OV329 doesn’t do the same, it would be, to put it bluntly, a colossal screw up.

On the safety side of things, I really don’t expect there to be any issues during the short Phase 1 trial.

The trial consists of a single ascending dose (SAD) and multiple ascending dose (MAD) components. The company continues to be “coy”, IMHO, about the details of the MAD side – we don’t know for sure how many doses the patients are being given (though it appears to be 7 days of dosing as per one medical website I found) and we don’t know the dose concentration.

I don’t know why Ovid hasn’t disclosed those details in their presentation and filings, but I suspect the dosages are low enough to guarantee safety concerns won’t be an issue.

Remember that the big safety concern with vigabatrin was blindness, and this often wouldn’t show up in patients for months or even years (though there were at least some cases of it showing up in a matter of weeks).

Even if OV329 has a similar side effect (something we have no evidence of yet) it would just be horribly bad luck for it to show up in such a short-lived trial.

I think this trial is set up to succeed, and maybe some of the move we are seeing in the stock are investors reflecting that.

The only problem, and it is not really a “stock” problem, more of a “company” problem, is that the trial isn’t really going to tell us anything about whether the drug will eventually be approved or not.

There are two big hurdles that OV329 has to overcome.

- It must work in patients that have failed with at least 2 other epilepsy drugs (drug-resistant epilepsy)

- They need to prove to the FDA that it won’t cause blindness.

Both of these are big hurdles.

I note that Ovid pulled two mentions of using OV329 with Developmental Epileptic Encephalopathy (DEEs) from their August Investor Presentation, which is different than the hard-to-treat population I spoke to earlier.

That tells me that this isn’t an immediate target anymore. Which means they will be relying on showing efficacy with the drug-resistant population – a target that is known to be very difficult to treat.

As for the issue with blindness, I just don’t know. The report by Lucid points to the rat data that showed the drug flushed out of the eye quickly and that after 45 days it did not affect the structure or function of the retina (whereas vigabatrin did). Which is for certain a positive.

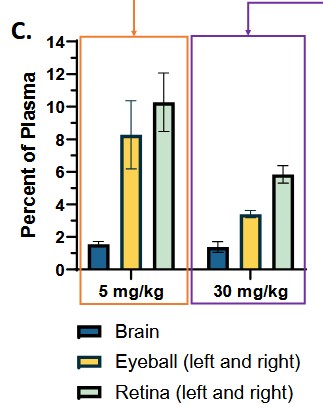

My concern is that the same rat study also showed what seems to be preferential movement of the drug to the eyeball and retina 30 minutes after administration.

Source: https://investors.ovidrx.com/resources/Scientific-Presentations/

We also know from the studies that you will have to dose the drug daily. And we know that the drug is significantly more potent than vigabatrin.

It’s just a muddy picture to me. I don’t know how this all plays out, and I especially don’t know what the FDA might decide they need to insure that there isn’t a more long-term effect.

But honestly, I’m not sure any of that matters to the stock. It’s like I said, it’s a problem for the company. But for investors buying this stock, what matters more is what is right in front of them, which are the P1 results that seem set up to be good.

After the P1 results are out (high probability of success), these questions/concerns become a bit more important. That next set of data could be a long way away. But the stock is telling us that investors aren’t really paying much attention to that–for now.

Perhaps by the time investors have to worry about long-term safety, the KCC2 program will be more important than OV329 any way.

EDITORS NOTE: I have a 35 cent junior gold explorer that I am very excited about. Like junior biotech, it’s high risk for sure, but initial exploration has found gold over a wide area. And it’s very shallow, which means that this will be a very low cost exploration program to determine if a multi-million ounce deposit is present. This is exactly the type of speculative play that can have a big run if they keep hitting what they have so far.

My report will be going out soon. To get the name and symbol when it’s time, and Unlock 3 Months of Premium service for Just $99 SUBSCRIBE HERE