Articles

See All

One Of The Most Profitable Small Caps Ever

This is simply the most profitable company I see in the cannabis space. And as I dug deeper, I discovered WHY that was.

The main reason is CEO Jeff Swainson. He knows how to run a business. I’ll go out on a limb and generalize—most management teams in the cannabis space are not professional and it’s a lifestyle business.

The other generalization would be…most teams at least got their start in the good days of right after Canadian legalization, and money was easy. Everybody overbuilt everything, bloating cost structures and everybody got to live off easy money; big equity raises.

Jeff’s company was (comparatively) born into abject poverty. He has had to be so sharp, so disciplined, to keep his company afloat while it was private (immediately post-COVID), that now it’s second nature to him.

And speaking with him at length, you realize there is no ego here. He is a competent humble man from Alberta who is now one of the most sought after industry consolidators in the country.

What I mean by that is…struggling cannabis companies want Jeff to buy them…even for ZERO…because they know the only money they’re going to get is from the 3 year earn-out clause in the deal they strike with Jeff. They trust Jeff to improve their business enough to actually make some money for them. They weren’t willing to make hard, and sometimes obvious decisions. Jeff can do that. No dull knives in his toolbox.

Running a cannabis business is hard. The heavy excise taxes—on revenue–are pretty much thuggery on the part of the government. If companies don’t keep up on them, the gov’t WILL come after you.

QUICK FACTS

Trading Symbols: HASH

Share Price Today: $0.48

Shares Outstanding: 106.4 million*

Market Capitalization: $51 million

Net Debt: -$9.8 million*

Enterprise Value: $41.2 million

*includes 35.1M in-the-money warrants at 20c and 40c.

POSITIVES

– Consolidating Cannabis space

– Already profitable

– Just finished a capital raise

– Stock trading at a very cheap valuation

NEGATIVES

– Excise taxes from the federal government hinder margins

– Large cash-rich companies are squeezing the smaller ones

– Margins have been high due to small but profitable B2B business

– Investors are gun-shy on cannabis after losing boatloads of money

SUMMARY

If there is a tried-and-true strategy in the Canadian market, it’s the roll up.

And could there be a better sector for rolling up than cannabis? After the capital frenzy of 2017-2019 we are now in a capital desert. The space is littered with companies just barely hanging on.

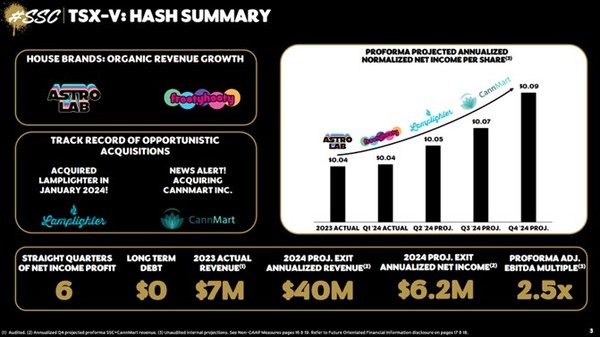

Simply Solventless Concentrates (HASH – TSXv) is taking advantage of this. They are rolling up cash strapped brands to turn them around with their profitable model.

HASH is targeting and executing on accretive deals where they put down minimal cash upfront and pick up assets for cents on the dollar.

They have been doing this since they went public 8 months ago. HASH has already completed two acquisitions that have grown annual revenue nearly 7x the 2023 level.

Through those acquisitions, HASH added two established brands to their own house labels.

Source: HASH Investor Presentation

Their two-house brands, Astro Lab and frootyhooty, are solventless concentrates.

Solventless concentrates are produced without the use of chemical solvents. Instead, heat, ice and pressure are applied to extract a concentrate.

Astrolabs is pure solventless concentrate. They call it ultra-premium products at fair pricing. It is cheaper than some black-market products. HASH is trying to give consumers in the black market an opportunity in the legal channel.Frootyhooty is amplified solventless. It is a blend of live rosin and distillate and turpines – more flavourful and a higher price point.

The new acquisitions open up hash to solvent based concentrates. This is a much bigger market.

Lamplighter is an ultra-high potency brand. Its vapes are over 90% THC. Lamplight infused prerolls are over 50% THC.

The CannMart acquisition added two hydrocarbon concentrate brands – Zest and Roilty. These are cannabis extracts produced using hydrocarbon solvents like butane or propane to extract cannabinoids and terpenes.

Zest Cannabis is a high potency brand, with hydrocarbon vape cartridges and disposable vapes. Roilty was CannMart’s primary brand. It is the #1 concentrate brand in SASK, MAN, #2 in AB, #8 in ONT.

By adding the new brands and being VERY disciplined in cost management, HASH should be able to leverage their footprint and be even more profitable. They were already profitable before these acquisitions.

I talked with the management of HASH, including CEO Jeff Swainson, last month. My takeaway was that these guys aren’t going over their skis growing for the sake of growing.

HASH came public during the cannabis depression. They don’t know anything but bad times and that’s a good thing. They have learned how to scrape and save to survive.

When HASH goes into a deal, they make sure it adds to the bottom line and works out favorably to shareholders. HASH has been able to structure their deals in non-dilutive and, quite frankly, clever ways. They are picking up revenue and profits and using the cash flow from the acquisition to pay for it.

Essentially the HASH strategy is this: There are good cannabis brands out there. Many (most?) these brands are in dire straights but not because there is anything wrong with the brand itself. They are being choked off by lack of capital.

A brand needs capital to buy product, build inventory, and create a reliable distribution channel. If you can’t maintain that back channel of product and marketing, the brand will die no matter how strong the product is.

Today the cannabis market is a desert of capital. That has left a lot of brands dying, even when the product should be much more.

HASH is executing by buying distressed brands on the cheap, injecting much-needed capital and turning them around.

Their competitive advantage is simple: their credibility. It gives them access to capital when few have it.

HASH is in a FAR BETTER financial position than 90% of their peers. They have money, they can raise capital (in fact they just did), and as long as they show they can pick through the rubble and find bankrupt or near-bankrupt assets for cents on the dollar, that snowball is only going to grow.

To top it off, the stock is cheap. HASH is trading at 8.2x 2024 earnings (not EBITDA but EARNINGS) based on their own guidance.

THE ACQUISITIONS SO FAR

HASH came public via is a reverse merger between Dash Capital Corp and their predecessor, Simply Solventless Concentrates. To bring HASH public Dash acquired all the shares. The merger was completed in January.

Simply Solvent shareholders received shares of Dash at an effective price of 19.5c.

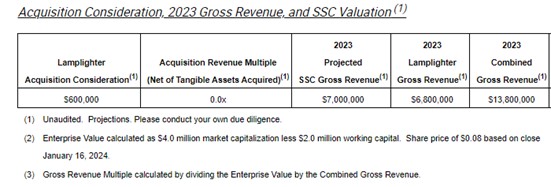

HASH didn’t waste any time to make their first acquisition, the Lamplighter cannabis brand, which they also bought in January.

HASH paid $600k for the brand. Lamplighter revenue was nearly $7M in 2023, which makes the acquisition look very cheap – about 0.1x P/S. HASH said in the press release they expect Lamplighter to have similar revenue in 2024.

Source: HASH News Release

Lamplighter products are available in Ontario, BC, and Alberta. These are “ready to consume” products: ultra high potency vape cartridges and infused pre-rolls.

HASH also acquired Lamplighter’s inventory as part of the deal – net of that inventory the rest of business was free. The acquisition opens up the BC market to the other HASH brands.

The Lamplighter acquisition was followed up by a second acquisition in June. HASH acquired CannMart and their two brands from Lifeist Wellness (LFST – TSXv): Roilty and Zest Cannabis.

Both brands are leaders in the hydrocarbon extracts market. Hydrocarbon extracts are concentrates produced using hydrocarbon solvents like butane and propane. The solvents are used to extract the THC, CBD, and terpenes, creating a high-potency product. HASH did not have a hydrocarbon extract product before the acquisition. They were truly, simply solvent-less. No solvents.

Much like Lamplighter, CannMart is in retail space where other HASH brands are not, which opens the door for cross sell.

The acquisition is structured uniquely and is an example of what makes HASH successful. HASH is paying CannMart’s operating expenses and a royalty that applies against the acquisition price of $2.5M. They also pay a “bonus” earn-out of 20% of revenue above $3M per quarter for the first year.

This “bonus” caps some of the very near-term upside, but it got the deal done without dilution and with lower risk to HASH.

I thought it was very interesting to see the Lifeist Wellness CEO justify the acquisition to their shareholders by saying: “success stories in the cannabis space have been few and far between, but HASH is clearly one of them. HASH have proven themselves capable of succeeding in an extremely challenging sector, returning profitable quarters repeatedly while growing their market”.

The CannMart brands have struggled over the last few months. They did as much as much as $2M per month last year. But Lifeist has had capital issues and that led to a shortage of product. Revenue had dropped to just a little over $1M per month in the months leading up to the acquisition.

HASH believes they can turn the brands around by making working capital available. Swainson said that the primary problem was that the brands hadn’t been able to supply inventory because Lifeist didn’t have the capital. HASH expects to use much of the recent capital raise to build inventory and turn that around.

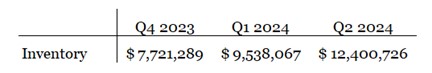

You can already see HASH execute this inventory strategy across the business, as HASH has built inventory significantly the last two quarters:

Source: HASH Financial Statements

To help fund the acquisition HASH did the other thing it can do that other cannabis companies are struggling to do – raise capital. HASH sold 15.4M shares at 25c with 40c half-warrants. The warrants have an acceleration clause if the shares trade above 40c for 10 trading days – something that looks very possible with the current price action.

B2B SALES BRING THE MARGIN

HASH benefits from one thing most of the competition doesn’t have – a very profitable B2B business.

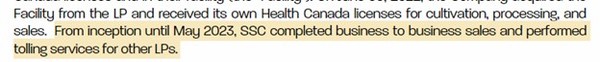

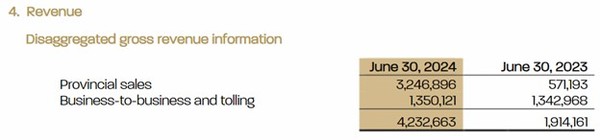

HASH’s B2B sales appear to be very high margin. According to their quarterly disclosures, prior to May 2023 HASH only sold B2B:

Source: HASH MD&A

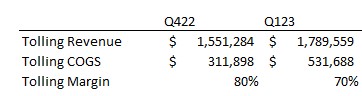

Looking at the HASH financial statements for the 2 quarters prior to May 2023 (when all sales were B2B), the company had gross margins from their B2B business of 70%-80%:

Source: HASH Financial Statements

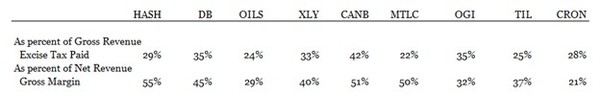

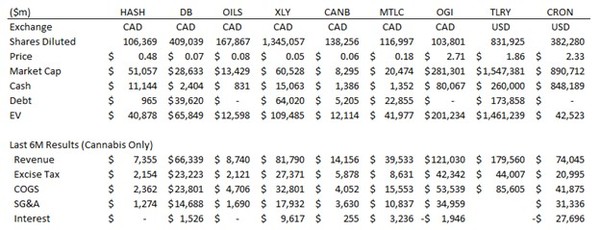

These B2B margins help explain why HASH has the best gross margins in the public cannabis landscape (the table below shows revenue net of excise tax).

Source: Company Financials

In Q2 2024, HASH had B2B revenue of $1.35M. It remains a significant (though smaller) part of the business (note that their total revenue doesn’t equal the components) and a bigger part of margins.

Source: HASH Q2 MD&A

While its tricky to look at what HASH margins would be without the B2B business, my best estimate is that they are in the 40-45% range (using revenue net of excise tax).

There could be room for margins to improve further. HASH buys their oil from 3rd party producers. Swainson said in a recent interview that they can reduce the cost of their oil purchases by 50% once they begin to produce it in-house – something they plan to do soon.

HASH also has by far the lowest SG&A of the group I looked at and they have no debt overhang.

Source: Company Financials

HASH isn’t hamstrung with big greenhouses and excess capacity like the cannabis majors. They are careful to sell branded product only after ensuring they are profitable. And they operate the business on a shoestring.

WHAT IS HASH WORTH?

HASH is targeting about $20M of annual revenue from CannMart. Together with Lamplighter, HASH now “projects to more than double current annualized gross revenue to $40.0 million” and they expect net income of $6.2 million.

Source: HASH Investor Presentation

HASH expects to hold the #2 concentrates market share position in Alberta, #1 in Saskatchewan and Manitoba, and #6 in Ontario, and by 2024 year end.

The thing is – they are likely not done yet.

Swainson believes that to get to the next level, which would be $100M+ of revenue, HASH is going to have to look at cultivation assets. I fully expect that future acquisitions will look upstream at the dried flower market.

But only if the price is right.

HASH has 106.4M shares fully diluted, including in the money warrants.

The stock is at 48c, which gives it a market cap is $51M.

If HASH can achieve the target of $40M of revenue and $6.2M of net income, which they believe they can with the two acquisitions they have already made, its pretty plain that the stock is fairly cheap – about 8.2x earnings.

There is also the matter of the excise tax. Cannabis producers in Canada pay A LOT of tax back to the government. The excise tax can amount to as much as 40%+ of revenue.

There has been a lot of talk about reforming the excise tax. Even though some expected it, there was nothing in this year’s Federal budget on it. But Swainson believes changes will be coming.

A significant reduction to the excise tax could be a boon to HASH – especially to the businesses it is acquiring that are suffering in part because of the high taxes they are saddled with.

But even without excise tax reform, HASH remains profitable. While we only have a few quarters of financials to go on, what I can see so far is on point. In Q2, HASH did $4.2M of revenue and $950k of EBITDA. That is a 23% EBITDA margin. This is before any contribution from CannMart.

Of course, a good chunk of those margins come from the B2B side. It will be important to see how margins evolve over the next couple quarters, as the B2B business is going to become less important to the overall picture and the margins of the acquisitions become more important.

So long as this plays out favorably, HASH is in a good place. They have credibility and access to capital. They are profitable today. They have shown they are prudent in acquiring businesses at a cheap price.

It should be the ideal mix to execute on more deals and consolidate a space that desperately needs consolidation.

If they can do that, there is no reason the stock won’t go higher.

Editors note: To get the updates on this fast profitable company Subscribe HERE for a 66% discount