Articles

See All

MY OH MY, HOW DID THIS NASDAQ COMPANY FALTER SO FAST???

(AND WHY DIDN’T I FOLLOW MY TRADING RULES?)

Myomo (MYO – NASDAQ) was one of our big winners in 2023 and 2024–going from 80 cents to $7–WOOHOO!

They have the rights to a myo-electric arm brace from MIT that kind of reads your mind and allows people to regain finer motor skills.

But then, on no news, the stock started to fall earlier this year–then jumped 30% in March when a GREAT Q4 24 was announced–which included a big upgrade on their 2025 guidance and some initial positive news on their new big market, Orthotics and Prosthetics (O&P).

(Myomo estimates 500,000 people annually in the US have a stroke or injury that could lead them to using their product–and those patients will come via O&P practitioners.)

But right after that big day in March–when the stock jumped from $4.50 to $6–the relentless slide continued, and investors didn’t get the REAL story until Investor Day on June 16–that the O&P market was not increasing; in fact take up of their MYOPRO arm brace had been anemic. And insurance re-imbursement continued to be a struggle.

That took the stock from $2.80 to $2.25 that Investors Day and that’s where I sold. I give the MYOMO team credit for being willing to hold an investor day just to clear the air with all the bad news that had been happening. Delaying that 6 weeks until Q2 came out would have been irresponsible at best.

Q2 confirmed a bad quarter, largely a function of the Facebook leads being poor quality which lead to lower conversion. Now, when I say bad quarter, the quarterly revenue number was close to all time highs but for sure they lowered guidance and were honest about the sudden challenges facing the business.

I committed a great trading sin here–I didn’t sell on the 20% drop after a BIG run. That cost me a lot of money, as the stock kept dropping with no news.

In a quick email exchange, it’s clear to me mgmt did the right thing with that quick turn from the very bullish March press release.

The lead conversion from ads was down and the O&P market was not seeing the uptake they had hoped for–and the stock had gone up from $1 – $7 in the 15 months prior.

Again, the business has not collapsed but any growth expectations required a sudden and large reset. It also became clear that the window of injury for which MYOPRO works is much smaller than I anticipated.

That was the very first Investor Day I have ever known to be scheduled to clear the air of all bad news as fast as possible.

So going into the Q2 results, Myomo was set up to disappoint. Sadly, that turned out to be correct.

Source: Myomo Press Release

They didn’t confirm or update 2025 guidance and were careful about providing any near-term projections (they did say $100M of revenue in 2028).

It just seemed like the day was designed to lead-in to a “it’s-going-to-be-a-long-road-ahead” kind of story. Which is exactly what we got with Q2.

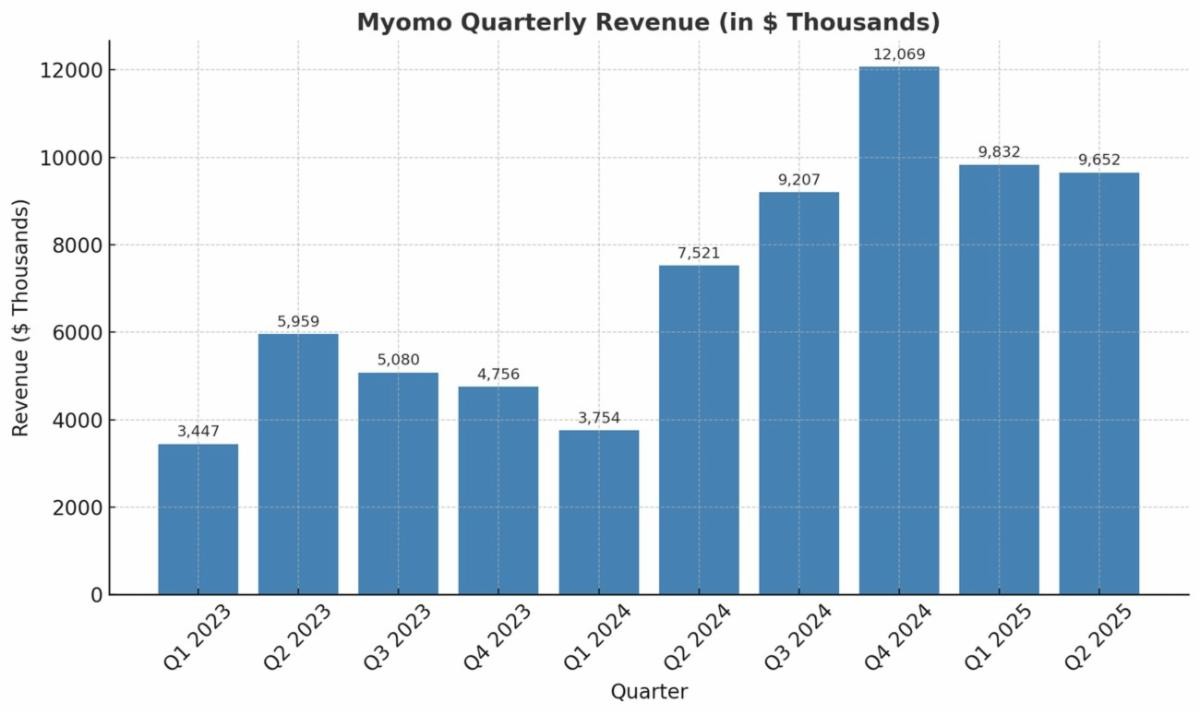

Myomo delivered another quarter of sub-$10M revenue. That makes two in a row after they had a very good $12M in Q4.

Source: Myomo Quarterly Results

But what was responsible for really killing the stock was….that Myomo reduced guidance from a range of $50M-$53M to $40M-$42M.

How did this happen? Well, while there are a whole bunch of nuances, the bottom line is that Myomo isn’t generating a strong pipeline of candidates and converting them to customers at a profitable rate.

It starts with advertising. Advertising is the engine of Myomo sales. One analyst on the call put it bluntly – they aren’t benefiting much from word of mouth.

Myomo began to have advertising issues in Q1, when Meta (META – NASDAQ) changed their algorithms to limit the access of health-related info.

That led to less effective ad spend and a drop in leads in Q1. Myomo warned that this would trickle down to the pipeline and into customers in Q2.

So in a way, it isn’t surprising that revenue was weak in Q2. But at the time Myomo released Q1, they also said they had the situation under control. They had shifted advertising dollars, ramped up other ad spend areas, and added to the total overall advertising spend. Everything was back on track.

Except it wasn’t. While lead generation did recover – in fact management said they “hit a record level in June with 4x as many leads generated as in January earlier this year”, the leads they generated turned out to be lower quality.

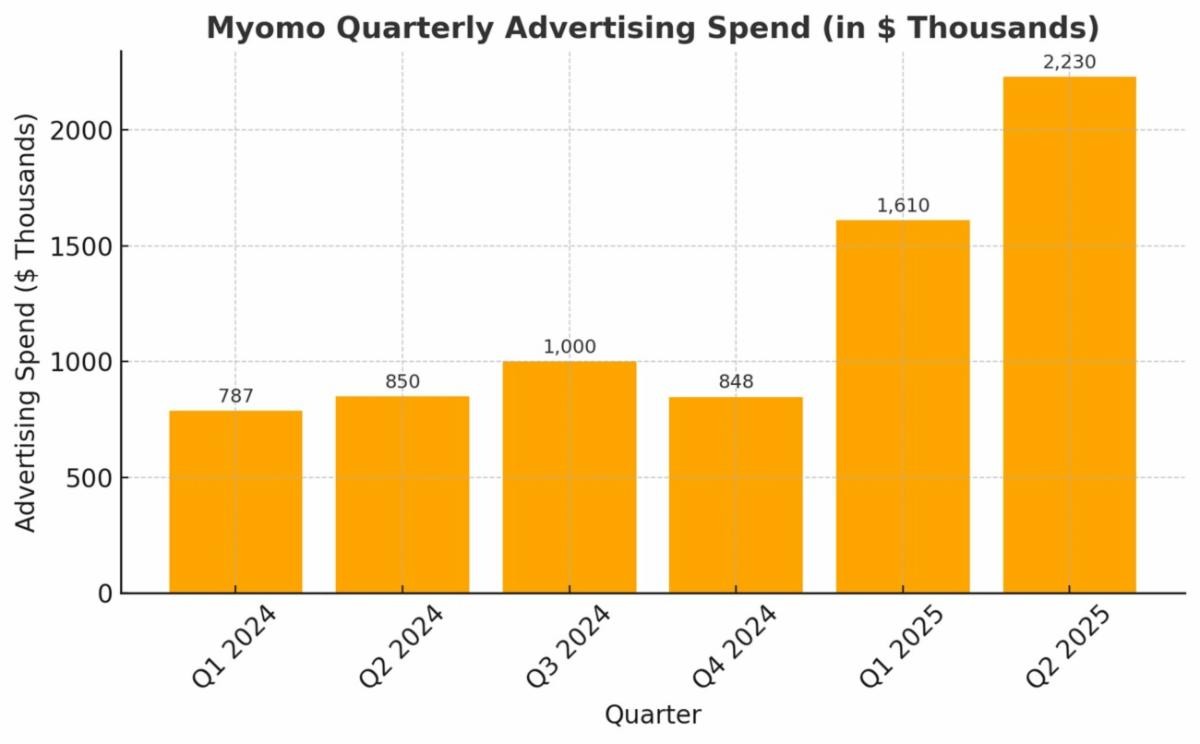

It wasn’t for lack of trying. Myomo spent a lot on advertising in Q2. They did $2.23M of advertising in Q2. Myomo only did $3.5M of advertising in all of 2024. It has ramped significantly in the last 2Q’s.

Source: Myomo Quarterly Results

If you are going to spend that much, investors want to see growth and because the leads they were generating were sub-par, that didn’t happen. MyoPro orders have basically been flat for 5 quarters running.

Source: Myomo Quarterly Results

Advertising efficiency, which is really the lifeblood of a business that can’t rely on word of mouth, has plummeted. Myomo’s cost per pipeline add essentially doubled, to $2,900 from $1,500.

And there isn’t an easy fix – they said “it will take a while” to get back to that $1,500 number.

A couple of other issues only made the problem worse.

First, Myomo ran into trouble converting pipeline adds to MyoPro orders for Medicare Advantage patients (which is 61% of the pipeline).

Only 15% of patients saw first-time authorization, meaning that they were cleared to order the device right from the get-go. The rest had to go through the appeal process. Myomo claims they are seeing success with appeals, but it is still a lengthy process and a drag on growth.

Second, Myomo saw more attrition within the pipeline – about 30%. This sounds like another consequence of just not having good leads. They said they are addressing this with stricter in-person evaluations to remove marginal candidates.

Finally, Myomo wasn’t saved by the new Orthotics and Prosthetics (O&P) providers. They only had 50 O&P leads in the quarter, which seems low.

The O&P segment is a bit of a shamble of its own. Myomo had to clarify on the call that they only had 100 certified prosthetist orthotists (CPOs) that have gone through training and are actively selling the device.

That is a lot less than we thought – the number they had been quoted before was 300. Apparently, that referred to CPO’s trained, and not all trained CPOs are marketing MyoPro’s. With all the other disappointments, this sort of misunderstanding likely didn’t sit well with analysts, who seemed genuinely surprised by the disclosure.

All in all, I just don’t know what to say. The good news is that Myomo is generating a lot of leads. Those leads should begin to cycle into pipeline and then orders.

But it takes time. Half of their pipeline adds come from leads generated within 30 days. The other half are 6-12 month contacts that have circled back.

That means that all these new leads should set Myomo up for better growth, but that might not happen until next year.

Myomo said their cash burn in H2 is expected to be what it was in Q2, which is about $5M. Which means they probably (?!?) have enough cash to wait for a turn.

But in the meantime, there isn’t really a compelling reason to buy the stock, unless you think it’s just gotten SO cheap that you can’t possibly resist. That level is going to be different for everyone. For myself, I’d like to see some signs of the turnaround first.