Articles

See All

iSun (ISUN – NASDAQ) A VICTIM OF CIRCUMSTANCE?

Solar stocks took off like a rocket the day the Fed turned dovish on interest rate policy—for the first time in a year.

Solar projects use A LOT of debt, and the sector largely trades inverse to interest rates for that reason.

I had been following ISUN-NASD–a solar installer with $100 million revenue, and break-even EBITDA—trading at just 20 cents! iSun got a big pop too on the Fed news–the stock rallied nearly 30% on the day!

And…they had (what seemed like) good news as well—an $8 million loan with Decathlon Capital Partners.

But then the stock price stopped moving up—despite a huge new tailwind, near break-even financials and a new loan that helped Why was the market so excited about this loan? Because it replaced another loan that has been an overhang on the stock.

AT THE MERCY OF LOAN SHARKS

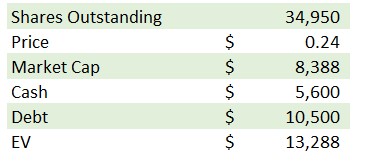

iSun has a lot of debt for a business this size. At the end of Q3 they had $11 million of debt against $5.6 million of cash. The market cap of the company is $ 8 million.

Most of that debt ($8 million of it) was in a convertible owed to Anson Investment Master Fund. This convertible came with an EBITDA covenant that iSun breached in Q2. While the Anson waived the covenant, the market looked at it as a black cloud since iSun’s fate was essentially in Anson’s hands.

The new loan—from a company called Decathlon—changes that. No more convertible overhang. No more cloud.

The Decathlon loan is not a cheap loan. There will be monthly payments of $165,000 in 2024 and $225,000 in 2025-2027. Not all of that is interest, but a lot of it is. The loan comes with a variable interest rate that is defined as:

The loaned amount will bear interest at a rate necessary to generate “Minimum Interest” as that term is defined in the Loan Agreement, which is between 0.25 times the advanced amount and 0.65 the advanced amount depending on the number of months elapsed following the effective date of the Loan Agreement.

While this is an odd way to describe interest, if I am reading it correctly, iSun is paying between 25% and 65% interest for this debt! Yikes!

Of course, the bottomline, usury or not, is whether iSun can make a go of it even with this high-interest loan.

A LONG-TIME PLAYER IN

THE SOLAR EPC BUSINESS

iSun is a solar EPC. They do everything from project origination, design, development, engineering, procurement, construction, storage, monitoring and maintenance for EV infrastructure, residential, commercial, industrial and utility customers.

iSun isn’t a new company. Up until 2021 they were called Peck Electric. Peck is over 50 years old. It was owned by the Peck family. Jeffrey Peck still runs iSun today.

Until Peck went public (via a SPAC in 2020) they were focused on installing solar to the Vermont market. They had installed over 1/3 of all the solar in Vermont.

Source: Peck Electric SPAC Roadshow Presentation

Being an EPC is a low-margin business. Peck Electric was no exception. They were a marginally profitable company. Peck did $4.4 million of revenue in 2018 and $3.9 million in 2019, generating net income of $125k and $220k in those years.

The idea behind the SPAC was to grow Peck by acquisition. Solar installation was a growing opportunity and there a lot of mom and pop EPCs that were ripe for acquisition. Peck would roll them all up, expanding to adjacent states.

After the IPO Peck began to acquire businesses. They acquired Sunworks in 2020, a C&I solar EPC on the West Coast. They acquired iSun (and took their name), a provider of solar powered EV charging, in January 2021. They acquired SunCommon, a residential solar provider in Vermont and New York, in August 2021 for $40 million.

These acquisitions have not panned out. They weren’t accretive to iSun’s bottom line because operating costs ballooned along with revenue.

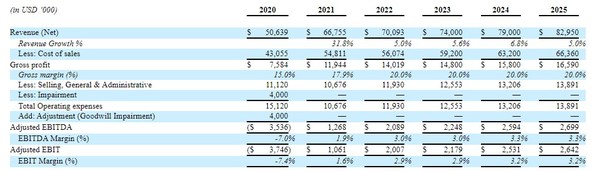

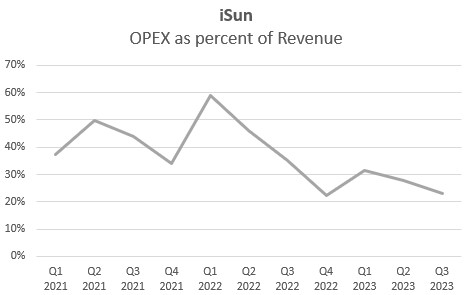

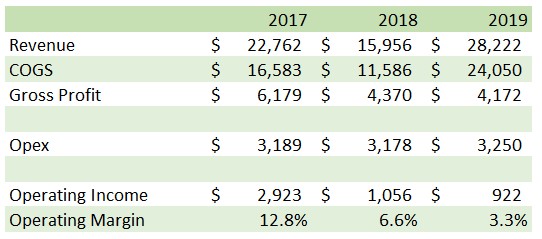

In 2018 and 2019, before the SPAC and all the acquisitions, Peck had OPEX that was 12% of revenue. In 2021 Peck’s OPEX was 37% of revenue!

This was at odds with the SPAC strategy. Take a look at the forecast below from Peck’s SPAC prospectus, in particular the SG&A line. Peck’s SG&A was supposed to flatline as revenue grew, thus increasing operating margins by a lot.

Source: Peck 2019 Prospectus Document

In 2021 it may have been okay to have ballooning OPEX costs because the solar installation market was booming, and you could paper over it with growth. But in 2022 the market slowed and in 2023 it slowed some more. iSun saw its stock price crater as investors focused on the bottom line.

Source: Stockcharts.com

WHAT IS THE POTENTIAL?

Residential solar installations are down a lot this year. That is why stocks like Enphase (ENPH – NASDAQ) and SolarEdge (SEDG – NASDAQ) have recently been disasters (to be fair, after incredible run ups)

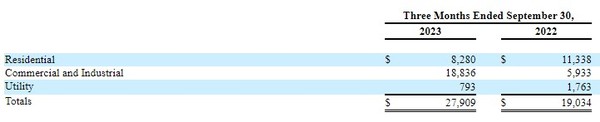

iSun’s residential solar is no exception – down 27% yoy.

Source: iSun Q3 10-Q

Residential solar has the highest margins. So far this year, residential gross margins are 29% while C&I margins are 18%.

So while iSun has been able to keep the lights on by driving more Commercial and Industrial business (revenue in this segment tripled this year) they need more growth because of lower margins.

Their overall backlog has stayed relatively constant over the last year.

This year iSun has also managed to rein in their operating costs. Their SG&A has been trending lower as a percent of revenue.

Source: iSun Quarterly Disclosures

Today iSun’s residential solar business operates in New York and Vermont. Their C&I business operates in New York, New Hampshire, Maine and Vermont.

They are a much bigger company than they were at the time of the SPAC.

Their revenue run rate is close to $100 million.

Yet iSun is a very small market cap stock. They trade at about 0.1x P/S.

Source: iSun Q3 10-Q

That is because they aren’t profitable.

I think the question here is how profitable iSun can be if they do turn it around?

Before iSun became a public company and costs ballooned, they were relatively good operators – they kept their operating cost down even as revenue fluctuated with industry conditions.

Source: Peck SPAC Prospectus Documents

This is an EPC business so gross margins are always tight and susceptible to poor bidding, unanticipated cost overruns and industry supply and demand.

Nevertheless, iSun still made money. Margins were as low as 3.3% and as high as 12.8%.

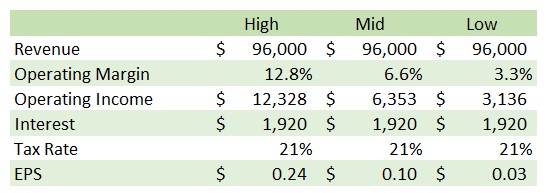

Let’s consider the 3 historic margins scenarios with today’s revenue run rate.

Source: My Own Estimates

What this tells us is that there is a lot of upside to the stock if iSun can get back to running the business like they have in the past.

The question is, how do they do that and how long will it take? It is probably going to be some combination of higher revenue (an industry rebound) and continued focus on cost cutting (getting SG&A even lower as a percentage of revenue).

The good news is that it seems to be going in that direction. iSun has weathered this dismal solar market pretty well. They haven’t diluted shareholders into oblivion. They haven’t taken on more debt. They’ve actually managed to grow their C&I segment a lot this year.

It is really easy to look at the solar business today and think: DISASTER. It has been this year. But solar is a cyclical business and just when things look worst is when the bottom is in.

This is a REALLY speculative idea and one that could easily go to zero if things go south for a few more quarters. But it also could be a big winner if the solar cycle turns. At 10c-20c EPS this could be $1+ stock. Which makes it worth keeping an eye on.