Articles

See All

Is Wesdome Gold a Better Buy Now at $7 Than It Was at $4?

Wesdome (WDO-TSX) has been one of the best performing gold stocks this year – and with good reason. It has:

- A safe mining district with a mining friendly government – Ontario Canada

- Ability to grow production organically and cost-effectively

- A resource without any big question marks about continuity and grade

There are surprisingly few companies that meet all three.

Now, despite The Big Run this year, investors may be looking at a better risk/reward today than it was in early May at $4 (now $6.75), as the second resource estimate on their Kiena deposit has confirmed what the Market had suspected – that size and grade would be much better than what management was willing to say publicly.

That resource estimate came out Sept 25, as the gold price started to swoon – and only now is the chart looking to perk up again.

They are a small-cap producer that has great potential to become a mid-cap producer in the next couple years – if they don’t get acquired first.

Wesdome can grow without a big capital spend – that’s important to me. Gold companies presenting slides showing great growth profiles are a dime a dozen. But when you dig into the numbers there are usually $100’s of million of capital expenditures required to get there.

Not so with Wesdome. They can nearly triple production while spending somewhere in the neighborhood of $50 million.

How’s that?

Much of the infrastructure is already built.

Wesdome owns an old mine in Quebec called Kiena. It’s been on care and maintenance for 5 years. A couple of years ago Wesdome announced they hit a new vein at Kiena. That vein has expanded into a resource. The most recent estimate says it is big enough for a mine.

Because Kiena used to be a mine, they don’t have to build a new mill. They just have to bring everything back on-line and add a shaft down to the new zone.

Mills cost a lot. As much as $100 million. That is money already spent, money saved.

There aren’t a lot of gold companies that can grow this much for this little.

I think the stock will be in the double digits as this gold bull progresses. It has to be seen as an attractive takeover target for growth deprived mid-tier producers.

QUICK FACTS

Trading Symbols: WDO

Share Price Today: $6.50

Shares Outstanding: 137 million

Market Capitalization: $890 million

Net CASH: -$27 million

Enterprise Value: $863 million

2019 cash flow Estimate: $80 million

P/CF 11x

POSITIVES

– Producing Eagle River mine generating consistent cash flow

– Exploration at Kiena has uncovered deep high-grade mineralization

– Restart of Kiena requires minimal upfront capital

– Eagle River has exploration upside of its own

– Operating assets in mining friendly jurisdiction

NEGATIVES

– Trades at a premium to other junior gold miners

– Until Kiena restarts they are a single mine company

– Modest insider ownership (outside of options)

BACKGROUND

Wesdome is a junior gold producer that operates a mine in Ontario and has a project called Kiena with a lot of growth potential in Quebec.

The operating mine is called the Eagle River complex. Eagle River is in Northern Ontario, located about 50 km west of Wawa Ontario off the eastern edge of Lake Superior.

Eagle River Complex

The Eagle River complex consists of an open pit deposit called Mishi and an underground deposit called Eagle River. Most of the gold production comes from the underground mine.

The Eagle River underground has been operating since 1995. Over that time it has produced a little over 1 million ounces of gold during that time. It’s a high grade mine, with historic grade of 9.1 g/t.

Like most underground mines, reserves are modest. The company drills ahead of its underground workings, adding reserves as they move deeper. This is common for an underground mine, where the eventual mined resource can be multiples of known reserves.

Source: Company September 2019 Investor Presentation

In addition to the proven and probable ounces there are another 190,000 ounces of indicated and inferred resource.

At the beginning of the year Wesdome guided 69,000 to 76,000 ounces from Eagle River for 2019. But they blew those estimates out of the water with a stellar third quarter where they produced 28,910 ounces, bringing year-to-date production to 70,356 ounces. The company raised full year guidance to 88,000 to 93,000 ounces.

Because underground mines often have modest mine life it is important that the company report exploration results that show new veins and continuity of grade on existing veins as they move deeper in the mine.

Wesdome has been doing just that at Eagle River.

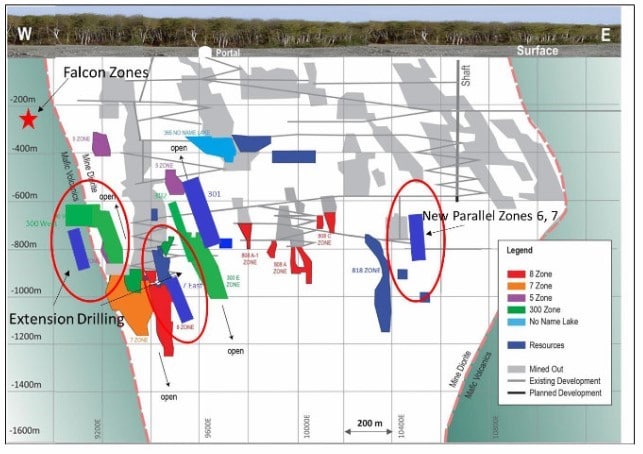

The company is producing from the 8 Zone, 7 Zone and 300 Zone (red, orange and green in the cross section below). Recent drilling has focused on developing and extending the 7 zone and 300 zone (circled below). New zones have been discovered to the east (parallel zone) and at shallow depths outside of the mine diorite (Falcon Zones).

Source: Company September 2019 Investor Presentation

So far drilling has been successful. First, it has confirmed the 7 zone is open and extended at depth.

Wesdome noted last December that they had extended the 7 Zone 100m (it was previously 200m deep). The extension has similar grades and strike length to the higher reserves.

Wesdome also discovered a new 7 Zone extension to the east. The intercepts continue to show high grade gold of 15 g/t to 40 g/t.

The 300 zone results have been just as good. In March, Wesdome said that they had confirmed continuity of the 300 zone over 140 meters and extended the zone a further 50 meters than previously thought. Like the 7 Zone, grades are 15 g/t to 40 g/t range.

The mining of the 300 zone this year has shown results that exceed grades of the resource estimate. On a recent call management said that grades of the 300 zone have been coming in at 21 g/t versus the 16 g/t they had modeled.

Another new zone was found to the east. Initial holes into the 6 and 7 parallel zones (I’ve zoomed in the larger cross section to show the area below) are showing similar grades and widths to the rest of the mine.

Source: March 9th Press Release

Finally, a new shallow zone, what they are calling the Falcon Zone, was discovered. It is highlighted as “Area of Recent Surface Drilling” below.

Source: June Press Release

The Falcon zone appears to be somewhat lower grade than the rest of the deposit but it is also quite shallow.

Between Mishi and the Eagle River underground, the complex mill is running at 500 tonnes per day. But the mill has capacity for 850 tonnes per day, so further positive exploration results leave room for more upside to production.

Mishi

The Mishi open pit is located a few kilometres north of Eagle River. It’s a lower grade (~2g/t). Mishi has contributed 200 t/d to 400 t/d of ore to the mill but this has declined recently.

As Wesdome has more success with its underground development, they have been replacing Mishi tonnage with more high-grade underground tonnage to the mill.

In 2019 Mishi is expected to only contribute 3,000-4,000 oz. Part of the longer-term plan has been to increase Mishi production, delivering up to 900 t/d but that seems to be on-hold because the underground exploration has been so successful.

Production at Eagle River and Mishi has bounced around 16,000 and 20,000 oz per quarter for the last couple of years.

Eagle River has taken on a larger percentage of the total as Wesdome finds more high-grade ore to fill the mill with.

Kiena

The reason that Wesdome has gone from a $2 stock to a $6 stock in the last 18 months is because of the Kiena project.

Up until the middle of 2016 Kiena was an after-thought. It was 3rd on Wesdome’s depth chart, listed after Eagle River and an open pit deposit near Thunder Bay called Moss Lake (they still own Moss Lake by the way though it probably won’t be developed any time soon).

Kiena is a past producing mine that has produced 1.75 million ounces before being put on care and maintenance in 2013 when it ran out of ore.

At the time the underground ore-shoots were thought to be mined out and while the mine still had a relatively new mill there wasn’t enough ore around to feed it.

That changed in August 2016 when Wesdome had a deep discovery at Kiena. Initial holes showed extremely high grades over decent widths.

Subsequent drilling has verified that there is a new zone (called the Deep A Zone) and it looks like it will contain enough ore to eventually re-start the mine.

Wesdome announced a preliminary resource for Kiena in December of last year. Thiis was followed up by a more robust resource release a few weeks ago. I have put the two estimates side by side to illustrate the progress.

Source: December 2018 and October 2019 Press Releases

Management described the December resource as “a work in progress”. In contrast, a few weeks ago when they announced the resource update, management talked about the “confidence” they had in the new resource, that they have proven to themselves that “this thing holds together”.

The new resource showed increased ounces and more than a doubling of grade at the core A zone deposit. It is becoming clearer that Kiena will reach Wesdome’s goal of being a 100,000+ ounce per year mine.

Building a Mine without the Capex

What I love about Kiena is that the infrastructure is already mostly in place. There is a mill on-site that is ready to go. Wesdome has said this mill would cost $80-$100 million to build from scratch.

To put that another way, the mill was basically a dead asset on Wesdome’s books until the discovery. Now that mill is worth 60-75c to the share price on its own.

Not having to build a mill means that Wesdome can bring Kiena on as a second producing mine at the relatively small capital cost – estimated by management to be $40-$50 million. Most of this cost is associated with building out a ramp to the deeper level, which is going to be about $20 million.

Wesdome has $30 million of cash on hand. Eagle River is generating free cash of $8-$9 million per quarter. They should easily be able to pay for Kiena without a capital raise. At the most they will need a small debt offering.

Kiena has a big mill – a capacity of 2,000 tonnes per day. The size of the mine will really be limited by how much gold they can find and how fast they can mine it.

While its still early to put numbers to Kiena, the expectation is that annual production will be in the neighbourhood of 90,000-130,000 ounces.

That would more than double current production.

While Wesdome looks expensive compared to peers in the rear-view mirror, it’s missing the potential of Kiena, especially considering the exploration upside (we don’t know yet just how big Kiena could get).

FINANCES / VALUATION

The stock has a market capitalization of $890 million. There is a little less than $30 million of cash on the balance sheet.

Analyst estimates for 2019 cash flow are about $80 million. That would put the stock at about 11.5x P/CF. These estimates will undoubtably go up after the big third quarter beat.

According to BMO Capital Market the universe of mid-tier gold producers trade at a little over 10x P/CF. Wesdome is still considered a junior but Kiena will boost it to mid-tier status.

So Wesdome is valued a little above average but most mid-tier producers do not have the organic growth opportunities that Wesdome has. In fact, I doubt there is another gold producer out there able to double production with such a small capital investment.

For instance, the BMO research team is estimating Kiena begins production in 2021 at ~65,000 oz and ramps to 130,000 oz by 2022. They think Wesdome eventually finds 1moz at Kiena, which will support that production level. Overall production levels for the company will be around 230,000 ounces per year.

If BMO is right, Wesdome will have nearly tripled production from 2018 levels for a mere $50 million capital expense.

As a 200,000 oz producer, Wesdome would generate cash flow of roughly $200 million at $1,250 gold. A 9x multiple (the average for the mid-tier producers) would give a $1.8 billion valuation on the stock. That works out to $13 per share. I do not need remind you that gold is much higher than $1,250 per ounce at the moment.

That’s the sort of upside we’ve got here.

If you want to talk even more blue-sky, it’s all exploration. Both Kiena and Eagle River are prospective for more gold. Another big find at either and the stock price goes even higher.

Stock Chart

Conclusion

Gold stocks are always a tough investment. You are fighting a number of headwinds.

- The price of gold

- Investor sentiment about gold stocks

- Chance of exploration failure

- Chance of production shortfall

Any of these four things can potentially derail a stock.

Yet Wesdome held up extremely well during a time when (1) and (2) were headwinds for the sector. That bodes well. Now we are entering a period where these headwinds will become tailwinds.

Anything could happen of course. Kiena might turn out to be smaller than expected. A mill or wall failure at Eagle River could cripple production for a time. Those are the risks.

But with the exploration success that they are having at Eagle River and Kiena, and the consistent production numbers coming out of the underground, the odds seem in my favour that the good times will continue.

The new resource at Kiena showing higher grade and more gold arguably removes One Big Risk from the stock, and from a risk-reward perspective is likely a safer bet for capital gains than it was in May at $4–assuming gold prices stay steady here at $1500/oz.

DISCLOSURE – Keith Schaefer is neither long nor short Wesdome. One of his research team is long Wesdome.

EDITORS NOTE: I just returned from a site visit in Nevada – for a junior that I think will be the world’s Next Big Deposit. Management has already built and sold one junior. And they are bringing their new play to market with an Enterprise Value of just $9 million. Get ready for this new IPO – sign up with The InvestingWhisperer today – click HERE.

Keith