Articles

See All

INDUSTRY ROLL-UPS CAN BE BIG WINNERS SEE BOYD (BYD) & CONSTELLATION (CSU) IS DENTALCORP NEXT?

One quirk about Canadian stocks is that some of its biggest winners are roll-ups. Constellation Software (CSU – TSX), Boyd Group (BYD – TSX) are the two most successful and well known; each are up THOUSANDS of percent over the years. Canada is ripe for growth by acquisition.

I am always on the look out for the next one. Which led me to Dentalcorp (DNTL – TSX). It’s got scale, it generates cash, grows cash flow over 10% per year and trades at 9% FCF yield—it all sounds good, if not great, right? So why is the stock down by 70% in the last 3 years since going public?

Dentalcorp is a dental services organization (DSO). They manage dental offices. Dentalcorp is a roll-up play on the Canadian dental landscape.

Dentalcorp has been ANYTHING BUT a big winner. Just the opposite. The stock is down over 50% from its IPO almost 3 years ago.

Source: Stockcharts.com

It’s a simple business. They acquire dental practices from dentists. They retain those dentists and their staff to run the practice. Dentalcorp provides the back office and corporate, making the practice more profitable. The practices are profitable enough to rinse and repeat.

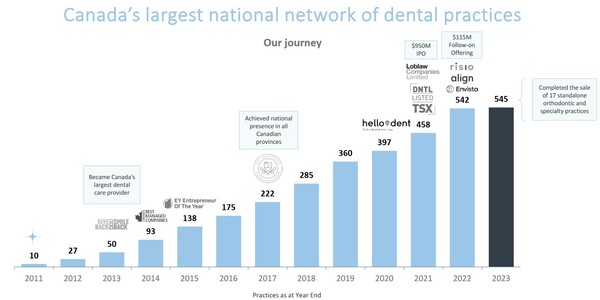

Dentalcorp is the largest player in the Canadian dental space. They operate 545 locations, have 1,850 dentists and see 2.1M patients.

Source: Dentalcorp Investor Presentation

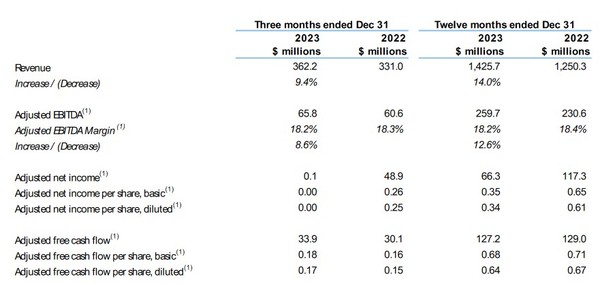

Dentistry is not a lucrative business, but it is a) consistent with b) decent margins. As a result, Dentalcorp generates a lot of cash–$125M of it in 2023.

Source: Dentalcorp MD&A

The stock has been hit hard and trades at only 9x free-cash-flow.

Yet their outlook for 2024 is pretty darn good:

- 9.5%-10.5% revenue growth

- Same practice growth of 4%

- FCF growth of 15% to 20%

Does this look like a business that should trade at 9x FCF?

There are two big reasons for the discount.

- The new federal dental care program

- High interest rates.

High interest rates are self-explanatory. Dentalcorp takes on debt with their acquisitions. Higher rates make new acquisitions less attractive and their existing business less profitable.

The new federal dental program, called the Canadian Dental Care Plan (CDCP) is another story. I’ve spent some time on this, and quite honestly, it is a bit of a mess. I’m not sure that anyone has fully wrapped their head around it yet.

That uncertainty has driven Dentalcorp’s stock price down. Which could mean opportunity. But also, risk. To understand that risk, first we need to understand the CDCP.

THE CDCP – WHAT IS IT?

The CDCP is a new Federal Government program intended to deliver dental care to Canadians that don’t have access today.

The program came out of the NDP/Liberal Federal Government coalition. In return for supporting the Liberals, the NDP demanded universal dental care for Canadians (Canada already has universal healthcare).

The CDCP covers most of the basic dentistry costs for uninsured Canadians with low income. It is a tiered system:

- Families with net income of $70,000 or less are fully covered.

- Families earning between $70,000 and $79,999 are 60% covered.

- Families earning between $80,000 to $89,999 are 40% covered.

The CDCP covers basic services:

- Teeth cleaning, polishing, sealants and fluoride

- Diagnostic services, such as X-rays and examinations

- Crowns, fillings and dentures

- Complete and partial dentures

- Root canals, deep scaling and extractions

The big issues with the CDCP are:

- How it overlaps with private insurance and provincial dental programs.

- What the fees will be.

There are programs throughout Canada, mostly at the provincial level, that cover parts of dental care for seniors, kids, and low-income families. It doesn’t look like the Liberals put much thought into how these programs would work with the CDCP.

There will be situations where a procedure is partially charged to the Federal plan, partially to the Provincial plan, just because the one plan covers this part and the other covers another.

A similar issue exists with private insurance.

The government says there is no overlap with private insurance. If you have private insurance, it should be no bueno for the CDCP.

In practice, that seems unlikely to play out.

The CDCP provides full dental coverage. Most private insurance is a co-pay. If you are privately insured for 75-85%% and the CDCP can give you 100% (and you qualify for it), are you going to keep your private insurance?

The final issue is just the growing pains. No one really seems to know how the CDCP works. The dentists aren’t sure how it works, the patients aren’t sure how it works. I’ve seen explanations completely at odds with each other from different experts.

How does this impact Dentalcorp?

Well, it is to be a headache of administration, paperwork, and more complicated billing for customers using the CDCP. But how many of Dentalcorp’s customers will use the CDCP?

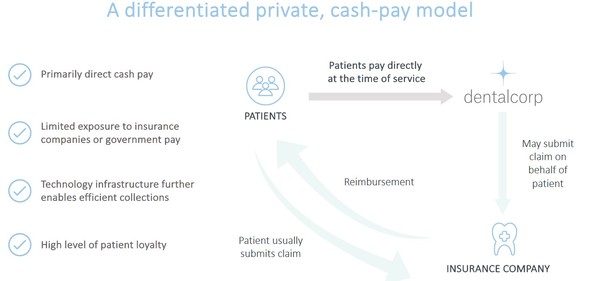

Right now, Dentalcorp mostly deals with cash pay customers.

Source: Dentalcorp Investor Presentation

Which should mean Dentalcorp won’t be as impacted by the new Federal program.

But the situation is more complicated.

The CDCP is going to bring in more patients. Dentists have the right to refuse treatment to patients. If a dentist determines that your insurance, including the CDCP, isn’t going to pay enough for the procedure (that could be private insurance or government insurance), they can just say no.

But it is the dentist that decides this. Not the DSO. Dentalcorp can’t make a blanket statement across all their clinics that they won’t accept patients from a particular insurance provider.

And the dentist doesn’t always have the same interests as the DSO.

DSO dentists often get paid on a percentage of fees received. Just for simplicity, let’s say that split is 50/50. If the CDCP is paying 70c on the dollar for a procedure, the dentist gets 35c of that. That may still be worth the dentist’s while.

But for Dentalcorp, getting 35c instead of 50c could mean that the procedure is being done at a loss.

How many CDCP patients Dentalcorp sees is going to be determined by their dentists.

If the fee schedule of the CDCP turns out to be low, meaning the government isn’t paying the going rate for procedures, and if enough dentists accept patients under the CDCP, that is where things could get dicey for Dentalcorp.

Which brings up the next question: what are the CDCP fees? The short answer is, we’re not quite sure. If you go to where the 2024 fee guide should be, there aren’t any numbers yet.

There was a limited 2023 guide published and the numbers there look to be about 10-20% less on average to provincial guides (like from the Alberta Dental Association).

The fees are probably lower this year as well? But how much, we will have to wait and see.

COULD DENTALCORP COME OUT ON TOP?

I’ve thrown out a lot of FUD so far and it’s on purpose. I’m trying to illustrate all the uncertainty around the CDCP that is being priced into the stock.

But does any of this actually matter to Dentalcorp?

The CDCP is going to impact 9M Canadians that have income less than $90K per family and don’t have any form of insurance.

These aren’t typical of Dentalcorp clients today. But that is the point of the program – to bring in Canadians that didn’t have access to dentists before.

That means these are NEW patients, which could actually mean growth for the business.

We don’t know that they will be unprofitable patients. We don’t even know the fees. They may just be less profitable, and against a partially fixed cost base, be accretive to the business as a whole.

You can see where I’m going. Turn this story on its head and the CDCP could be a BIG TAILWIND for DSOs.

Bad could be good. DSO’s are all about managing risk and scale. Handling HR, payroll, inventory for 100s of clinics, not just one. Efficiency of scale come into play.

Dentalcorp has a lower cost structure and single-clinic shops. It will be easier for them to manage the difficult environment than for a mom-and-pop dentist.

If those shops can’t cut it, Dentalcorp is there to acquire them.

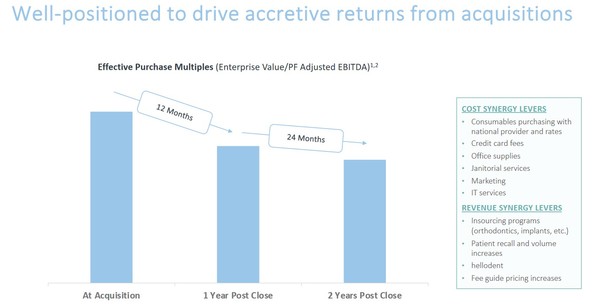

Dentalcorp takes cost out of the practices that it acquires. They estimate 10-15% practice-level EBITDA expansion in Year-1, followed by additional margin expansion in Year-2.

Source: Dentalcorp Q4 Investor Presentation

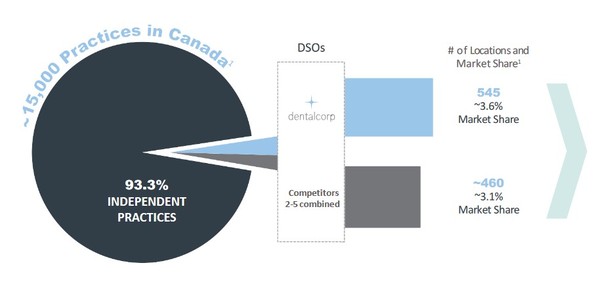

The Canadian dental landscape is REALLY fragmented. Dentalcorp is the biggest single player in Canada with 3.6% market share. The next 4 biggest competitors have only 3.1% market share combined.

Source: Dentalcorp Q4 Investor Presentation

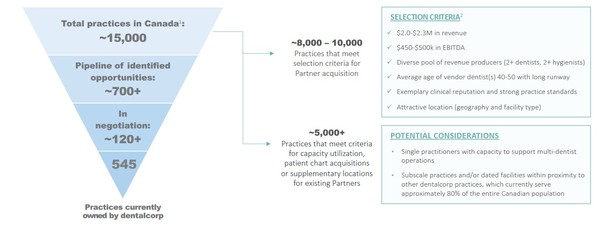

There are over 15,000 practices in Canada and 93% are independent.

If the new rules pressure these shops, Dentalcorp could find itself in a position to expand.

In their Q4 presentation, Dentalcorp highlighted a pipeline of 700 opportunities and 120 in negotiation.

Source: Dentalcorp Q4 Investor Presentation

THE RISK

If the dental business becomes unprofitable, Dentalcorp could quickly unwind in the way only roll-ups can.

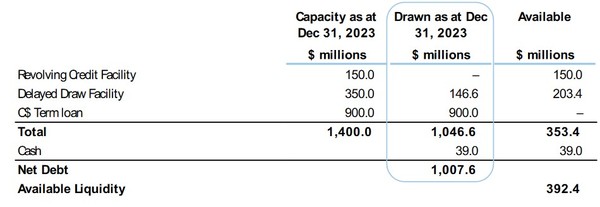

Dentalcorp takes on debt to fund their acquisitions. They have a lot of debt. They need a certain level of profitability to service that debt.

Source: Dentalcorp Q4 MD&A

Higher rates have been a headwind. The blended rate on Dentalcorp’s debt is 6.65%, which could be worse. But it makes acquisitions less accretive than a few years ago.

I would guess Dentalcorp’s acquisition slowdown is no coincidence.

Source: Dentalcorp Investor Presentation

The rate risk is manageable. The bigger risk?

That the Liberal government wins another minority with NDP support.

If that happens, we could see an expansion of the CDCP to all Canadians. The resulting fee structure of what would now be a government monopoly would almost certainly be unfavorable to Dentalcorp, maybe even existentially.

On the other hand, even the government can’t let a whole industry go bankrupt. Can they?

All these puts and takes leave me torn on the stock. Dentalcorp is a business with the potential to be a compounder for years to come.

- It operates in a fragmented industry.

- It generates a consistent top line and reliable margins.

- It is recession proof.

- It throws off enough cash to drive more acquisitions.

On the other hand, well, the CDCP.

The stock is down from $20 to $6 and change. You are paying under 10x FCF for the business. At this level, are the headwinds already in the stock?

I think they very well might be. But if you buy, you need to be ready for a rollercoaster ride. Because this new Federal dental program is not going to go smoothly.