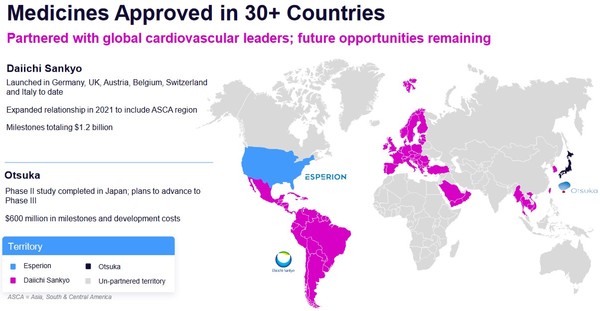

Articles

See All

GET THE SKINNY ON A FAST GROWING CHOLESTEROL DRUG ESPERION THERAPEUTICS (ESPR – NASDAQ) THIS BIOTECH STOCK COULD BE A BIG WINNER IN 2024!!

No two stocks are the same. But they can be VERY similar.

The story with Esperion Therapeutics (ESPR – NASDAQ) reminds me a lot of my big 2023 win, Myomo (MYO – NASDAQ). And with yesterday’s news, Esperion’s story just got A LOT BETTER.

The FDA recently gave Esperion’s cholesterol inhibitor a FLASHING GREEN LIGHT, after a couple years of saying it had no statistical benefit. That has helped the stock quadruple to $3.20 recently.

But then—just yesterday—they negotiated a US$125 million payment from partner Daiichi (a $100 BBBBBillion company), which gives them two years of cash—and analysts are saying Esperion’s revenue could triple or more in 2024 to well over $300 million.

That puts the stock at just 1x leading P/S right now!!! The Big Question is–will that revenue be enough to get them to positive cash flow?

They were burning $40 million a quarter last year, down to less than $25 million a quarter now–and if this forecasted revenue actually happens….

Esperion COULD BE a great stock for junior biotech investors in 2024.

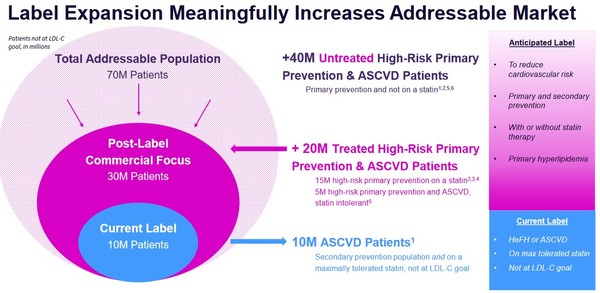

HERE’S THE STORYIf you boil down Myomo it really was all about TAM—Total Addressable Market. When Medicare gave the greenlight to insure Myomo’s arm brace, their TAM tripled virtually overnight. Esperion is experiencing the same thing via a change to their prescription labeling. When the FDA approves your drug, it tells you what you can put on the label.

If the FDA tells you that your drug is only for a specific patient population, that goes right on the label. If you can convince the FDA to expand the usage to a larger patient population, it can lead to a step-change in your TAM. Esperion has done just that. Their potential patient population has expanded from 10 million to 30 million virtually overnight – a tripling of their TAM. And with it, the stock price has exploded upwards.

HUNTING AN ELEPHANT

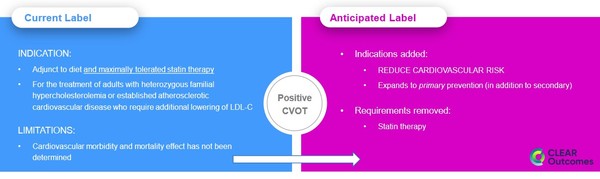

Esperion has two approved products targeting LDL-cholesterol (LDL-C) reduction.LDL-C is treated today with statins, the most common name being Lipitor. Statins have been around a long time. They are now generic medicines. Statins work, but for many they come with side effects. There are limits to the statin dose that can be consumed and some people are completely intolerant of statins. Therefore, there is still a need for therapies that can be combined with statins or that can replace them for folks that can’t tolerate the side effects.

The only existing non-statin options are called PCSK9 inhibitors. These drugs work well to reduce LDL-C but they require bi-weekly injections, are expensive, and come with side-effects of their own. Esperion’s drugs are not statins. They are a new class of medicine, called an ATP citrate lyase inhibitor. These drugs are based on the compound called bempedoic acid. NEXLETOL is bempedoic acid alone, while NEXLIZET is bempedioc acid combined with the generic drug ezetimibe.

Both are once a day, oral tablets.Cholesterol control is obviously a HUGE market. There are 70 million people in the US alone that are at high-risk of cardiac issues where that risk could be mitigated with lower cholesterol. The National Institute of Health estimates worldwide sale of statins at $19 billion and growing.

Source: Esperion Investor Presentation

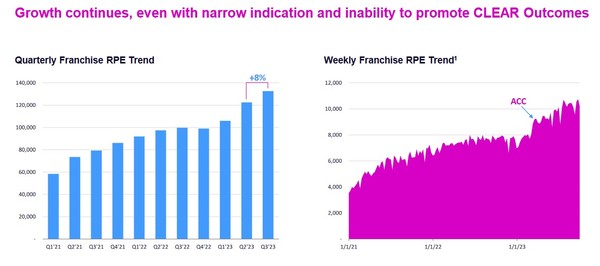

Esperion has had U.S. approval since early 2020. But uptake has been poor. Prescription trends stalled out last year before accelerating after recent study results.

Source: Esperion Investor Presentation

The stock price followed. Many analysts thought Esperion’s drug launch would be a success. The stock traded at well over $20 in 2021 in anticipation. Until very recently, it has been straight down.

Source: Stockcharts.com

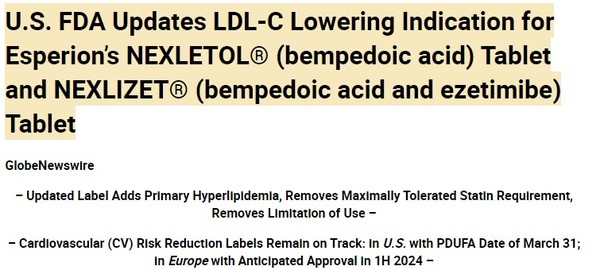

The problem has largely been labeling. Prescriptions of NEXLETOL and NEXLIZET were limited to patients that were already at the maximum dose of statins.

On top of that, the label warned that the drugs had no known link to improved cardiovascular morbidity.

Talk about a headwind! You couldn’t prescribe the drug to most patients and even those you could the FDA said it may not make a difference.

That labeling (add COVID on top of it, the drug launched at the height of the pandemic), and you had a disappointment in the making. Until now.

PROVING THAT IT WORKS

Esperion needed more data if they were going to A. Expand the addressable patient population and B. Prove that the drug worked.

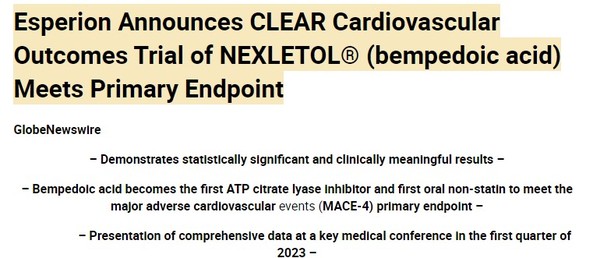

In anticipation, in 2019 Esperion enrolled 14,000 patients in what they have called their CLEAR (Cholesterol Lowering via BEmpedoic Acid, an ACL-inhibiting Regimen) outcomes pivotal trial. On December 7th, 2022, they announced the study met the primary endpoint.

Source: Esperion Press Release

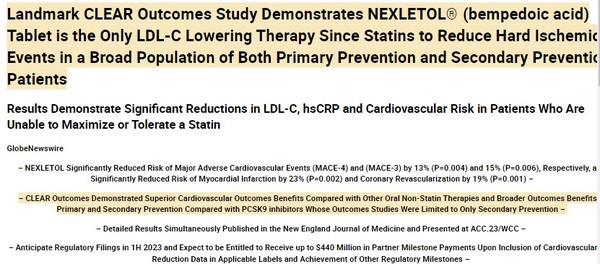

In March, Esperion released the details.

Source: Esperion Press Release

The results were ok. Not bad, not great. Just in line.

The stock sold off, not because the results were bad, but because without a clear win in what was a terrible biotech market (particularly for fund raising) investors focused on whether the FDA would react positively and if not, how Esperion would get by without significant dilution.

But it turned out that the results were good enough. Bempedoic acid alone showed 13% reduction in Major Adverse Cardiovascular Events (MACE-4) vs. 15% for PCSK9I inhibitors. The combination of bempedoic acid and ezetimibe showed a much greater benefit.

The FDA decision on a label change was expected in the first half of next year. But Esperion got a sneak-peak on December 5th when a partial label change was approved:

Source: Experion Press Release

The new label removes the statin limitation, says NEXLETOL and NEXLIZET can be used for primary prevention and removes the statement doubting if the drug works.

NEXLETOL and NEXLIZET have a couple of big advantages over PCSK9I inhibitors.

For one, they are a small tablet, instead of requiring a syringe.

Second, they carry a lower cost.

Third, while PCSK9I’s are very good at lowering LDL-C they do nothing to reduce high-sensitivity C-reactive protein (hs-CRP).

hs-CRP is a measure of inflammation in your body. hs-CRP is used as another indicator of heart disease. Recent research has suggested that hs-CRP reduction is important for achieving better cardiovascular outcomes.

NEXLETOL and NEXLIZET both saw meaningful reductions in hs-CRP.

TURNING A WILD CARD INTO A WIN

When I started to write this stock up there was one other wild card that could drive Esperion’s stock price up as much as 100% overnight.

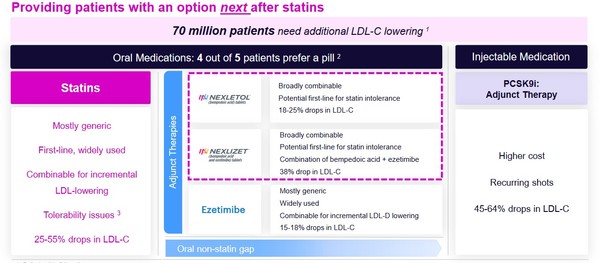

Esperion has a royalty agreement with Daiichi Sankyo for sales in Europe and Japan. This agreement was signed in 2019. It included a 15% royalty plus milestone payments.

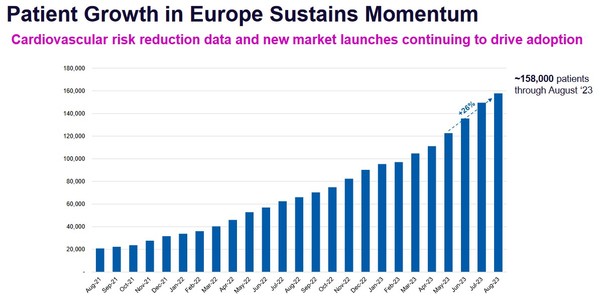

It is good to see Daiichi take on a bigger role. Daiichi’s sales of NEXLETOL and NEXLIZET in the EU and Japan have been going well.

Sales are annualizing at $100 million this year and have recently accelerated.

Source: Esperion Investor Presentation

That Daiichi is willing to take on manufacturing responsibilities suggests they see a future for the drug in their territories.

PAST IS NOT PROLOGUE

Esperion’s stock had a big run, largely because of the news of the label change. The sell-off on the Daiichi news should not be that surprising given how extremely overbought the stock was.