Articles

See All

FORACO INTERNATIONAL (FAR-TSX)IF WE GET A GOLD BULL MARKET THIS STOCK WILL RUN (EVEN FARTHER)

The Canadian market lists four mineral drilling companies and all of them are cheap, cheap, cheap.

This is not surprising. Up until recently gold has been hated. It is only natural that the drillers, which all trade with the gold price (even though they drill for all the metals), would be dirt-cheap.

What IS surprising is that the cheapest of the bunch is the driller with some of the best operating metrics, some of the best profitability, and is the most diversified.

I’m talking about Foraco International (FAR – TSX).

All this – and a big gold rally – make Foraco worth a look. This won’t take long. Foraco operates a really simple business. Which makes this a simple idea.

QUICK FACTS

Trading Symbols: FAR

Share Price: $2.70 CAD

Shares Outstanding: 99.2 million

Market Cap: C$267 million

Cash: US$25.6 million

Debt: US$98.7 million

Enterprise Value: C$366 million

If we are finally, FINALLY, on our way to a legitimate gold bull market, drillers like Foraco will be along for the ride.

Two reasons. First, investor sentiment. These stocks aren’t cheap because their businesses are suffering. They are cheap because no one cares. These stocks move when interest returns to the sector.

Second, the return of the junior explorer. The #1 thing holding back even better driller profitability are the junior mining exploration businesses that have been struggling to keep the lights on for the last 5 years.

Explorers have been operating on shoestring budgets, spending only enough to keep shareholders from calling it quits and not lose their property rights.

In gold bull market this will change. Juniors will get access to the capital markets again. They will spend that capital on drilling.

What makes Foraco so interesting is that none of this is in the stock. The stock trades at a depressed multiple on depressed earnings. In fact, Foraco is just about as cheap as a stock can get.

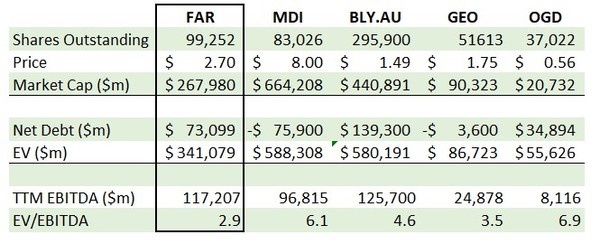

Foraco trades at 3x EV/EBITDA. When a company trades at a 3x turn on EBITDA, it is usually because something isn’t sustainable. Because you are at the top of the cycle and market is looking for a return to earth.

With Foraco, it is the opposite. While drilling is off the bottom, it is a long way from the top. We haven’t had participation from junior explorers for so long that most investors have forgotten that can happen.

Well, it can. Mining exploration CAN boom. We are due for another boom.

Foraco makes for a solid bet if that boom is happening now. At this depressed valuation the stock is a multi-bagger if it is.

NOT OPERATING ON ALL CYLINDERS

Foraco operates a fleet of 302 drilling rigs for minerals and water. They operate in Canada, Australia, Chile, Brazil, and West Africa. This is a diversified business in every way but one.

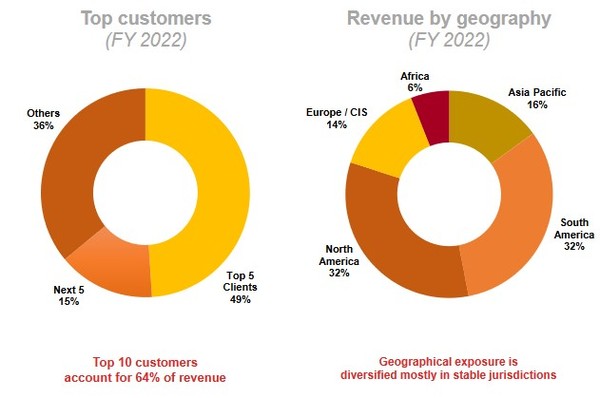

To no fault of their own, Foraco’s contracts are with major mining companies. 85% of revenue comes from the top mining companies.

Source: Foraco Investor Presentation

64% of Foraco’s revenue comes from their top-10 clients.

Source: Foraco Investor Day Presentation

Foraco, in fact all the drillers, play up their exposure to the major mining companies. “All the big miners use us”, “we are signed on with long-term contracts”, and so on.

I get it, they have to spin this as a positive: ‘see, the revenue is safe, it won’t go away’.

But the truth is having a large miner weighting is out of necessity. There simply isn’t enough business from the juniors, and there hasn’t been for years.

Foraco has a drill fleet that was ~60% utilized in Q3. This is higher than peers – Geodrill (GEO – TSX) was 55%, Major Drilling (MDI – TSX) 49%. At this level of utilization, Foraco has a profitable business. But it also means there is room to grow, which is what the bet is will happen if the juniors find themselves flush with cash.

This is a paid for performance business. Foraco provides drilling services for mining companies. Revenue comes from the long-term contracts, charging a fee for the meters drilled in combination with an hourly rate. Overtime is extra.

The more hours drilled, the more Foraco gets paid. Which will work in their favor in a gold bull market.

A HIGH CAPEX BUSINESS

The downside is that the business requires a lot of capital. Foraco is continually investing a portion of cash flow into refurbishing and renewing the fleet.

The market value of their 302-drill fleet is about US$150 million. To maintain that fleet, Foraco spends about 8% of revenue on capex.

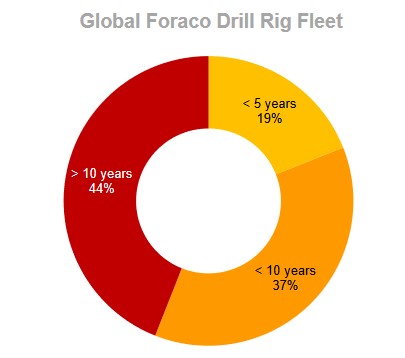

During lean times that is barely adequate. Expect the number to climb as Foraco gets more comfortable with the sustainability of their operating cash flow. Foraco’s fleet of rigs is 44% >10 years. Rig life is 15-20 years.

Source: Foraco Investor Day Presentation

Fortunately, the business generates plenty of cash flow to pay for that expense even today, and will do even better as conditions improve.

Foraco’s funds flow (cash flow before working capital changes) was $58 million in the trailing twelve months!

They spent $26.7 million in capital expenditures. Leaving over $30 million of free cash flow.

WHAT MATTERS IS SENTIMENT

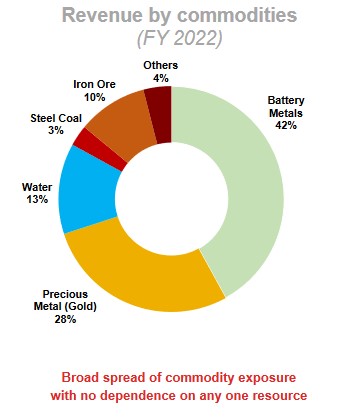

One thing that separates Foraco from other drillers is their exposure to gold.

Source: Foraco Investor Day Presentation

Gold drilling is 28% of total revenue. Compare that to Major Drilling where it makes up 46% of revenue. It is even more for Orbit Garant (66%). For Geodrill it is almost 100%!

Now you might say, wait, don’t I want a driller with BIG exposure to gold if this is a story about a bull market in the precious metal?

The short answer – it won’t matter. Just like it didn’t matter that Foraco had low exposure to gold on the way down and it won’t on the way up. If the juniors get access to capital that is going to drive utilization and it will lift all boats.

Remember, there is nothing unique about drilling for gold. A drill is a drill – it can be used for gold, copper or iron ore. Increased demand can come from any of the above.

WISHING FOR A BUYBACK

If I have a quibble with Foraco it is what they plan to do with their free cash flow.

At the company’s special investor call at the beginning of November management outlined 3 uses for their excess cash.

- Pay down debt

- Raise capital expenditures and pursue acquisitions into new areas

- Dividend

What I wish was that buying back shares topped the list. But I understand why it’s not. Foraco is not a liquid stock. Volume rarely exceeds 100k and often is less than 20,000 per day. The rules around buybacks are strict and low volume leaves little room to buy back significant shares.

Does it make sense to pay down debt #1? Maybe, maybe not. Foraco’s gross debt sits at just under US$100 million today. That seems like a lot. It is the most among its peers. It looks like a lot compared to the market cap of C$180 million.

But really that is more about a lack of respect from the market than an indication of their indebtedness. $100 million of debt compares to trailing EBITDA of $86 million. With cash of $25 million, Foraco’s leverage ratio is only about 0.9x.

This is hardly excessive.

If I had a choice, Foraco would raise the value of the equity and not worry about the debt.

A BLUE LIGHT SPECIAL

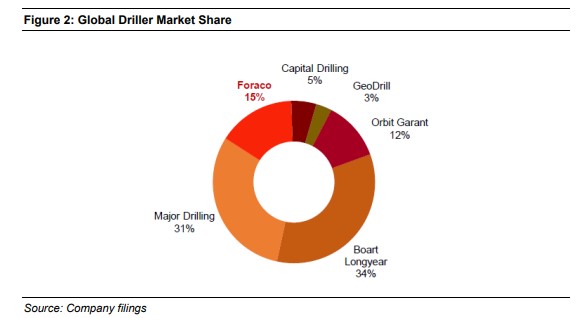

The mining driller universe is surprisingly consolidated.

Source: Paradigm Capital

There are 4 big names on the North American market (Foraco, Major Drilling, GeoDrill and Orbit Garant), one in Australia (Boart Longyear) and one in London (Capital Drilling).

These 6 drillers are essentially the market.

You would think that this sort of oligopoly would mean pricing power. It doesn’t. This is a commodity business.

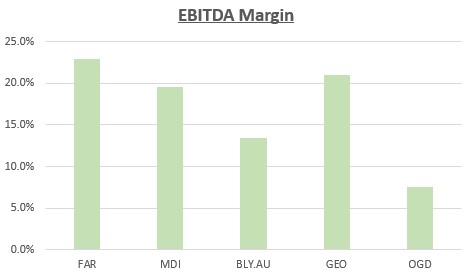

Of these 6 players Foraco has the best margins of the bunch. Gross margins of just under 30% and EBITDA margins are 23-25%.

Source: Company Documents

Yet Foraco trades at a discount to peers. Even though that group includes one perennial underperformer (Orbit Garant) and one company that operates exclusively in West Africa, which has extremely high political risk (Geodrill).

Source: Company Documents

THE BIGGEST RISK IS A FALSE START

The biggest risk with Foraco is that this gold rally fizzles out.

This isn’t a turnaround, it isn’t some sort of hidden value play, this is really a story about an undervalued play that will turn when sentiment in gold stocks turn.

There have been so many false starts with gold. On Sunday night gold popped above $2,100 per oz only to quickly reverse. Now you see a lot of technicians calling that the top.

If it is, then this is the rally that ended before it even got started.

What is more likely is that gold is going to consolidate here. Do nothing for a while. Then (hopefully) make another leg up.

I haven’t seen any significant money flow into the sector yet. Juniors are anything but flush with cash.

That means you are in no rush to buy Foraco. You can set your bid and wait for another long-term holder to get fed up and hit it.

If you start to see that money IS flowing into the junior explorers, that will be the time to hit the ask because you know that some of that cash is going straight into Foraco’s bank account as juniors expand drilling budgets.

At 2x EBITDA on mid-cycle earnings I can tell you with 100% confidence that in the next gold bull market this stock will double – at least. I have zero doubt about that.

What I can’t tell you is whether that bull market is happening now, or whether we have to wait another 5 years. I’ve been disappointed by gold too many times to count on that.

But I also know that when no one believes a bull market will ever happen again is just when the next bull market begins.

EDITORS NOTE–My Top Pick for 2024 just announced stellar financials–and hinted at even FASTER growth in the coming 12 months. Subscribe TODAY to get on board with this stock–AND be ready for a coming micro-cap with a unique product and huge distribution that’s about to drive huge cash flow! Click HERE!!