Articles

See All

BYRNA TECHNOLOGIES (BYRN – NASDAQ) CAN WE HIT the BULLSEYE TWICE?

Byrna Technologies (BYRN – NASDAQ) is a good lesson in why it’s not a good idea to focus on how much a stock is up.

When we first wrote up Byrna in the fall of 2023, the stock was already up over 100% – from $2 to $4 – in just over a month.

Source: Stockcharts.com

On price action alone, it would have been easy to conclude that we had missed the move.

But you couldn’t have been further from the truth.

If you had bought Byrna on the day we wrote it up and held it until its recent high, you would have had nearly an 8-bagger (it peaked at $34 per share).

QUICK FACTS

Trading Symbols: BYRN

Share Price Today: $20

Shares Outstanding: 22.7 million*

Market Capitalization: $453 million

Cash: $13 million*

Debt: $0 million

Enterprise Value: $440 million

*Includes latest flow-through financing

It’s a lesson in anchoring bias, and why you don’t want to look too close at how much the price has changed. You want to figure out where it’s going.

Today, Byrna is well off its highs. The stock is down 40% from its late-spring level.

Source: Stockcharts.com

The decline has been almost entirely due to poorer than expected second quarter result. Management delivered a cautious tone. It wasn’t a disaster by any means but with the stock having already doubled (in a short time) from April to June, it was enough to cause a big sell-off.

Is this decline an opportunity to get back into the stock? We have had two months for the market to digest what management said. And Byrna just pre-announced Q3 revenue that is better than everyone feared.

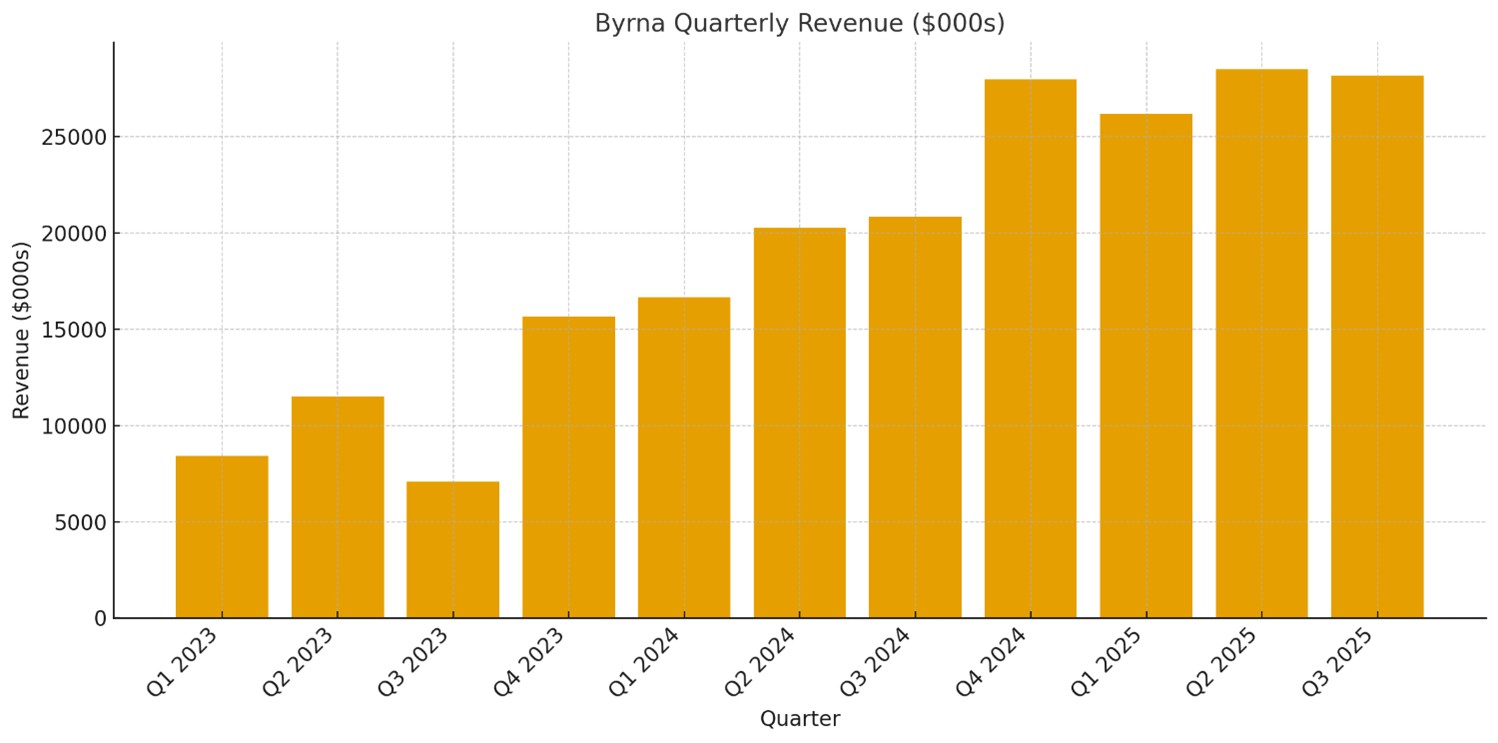

Byrna announced Q3 revenue at $28.2M. This is just a smidge lower than Q2 but still 35% growth year-over-year.

In the press release Byrna called out an “expanding retail footprint, international growth, and increasing brand visibility”, especially from the dealer and chain store partners.

That, along with a new product launch that opens up a whole new demographic (women!) there are a few BIG reasons to think the worst is behind Byrna.

BYRNA LAUNCHES A NEW COMPACT LAUNCHER

As background, Byrna is in the business of selling guns—but not the kind of gun that will kill you. Byrna sells guns that will just incapacitate you. It will hurt (a lot), but you will survive.

Byrna doesn’t call their products guns. They call them “launchers”. They are part of a product category known as “less-than-lethal weapons”.

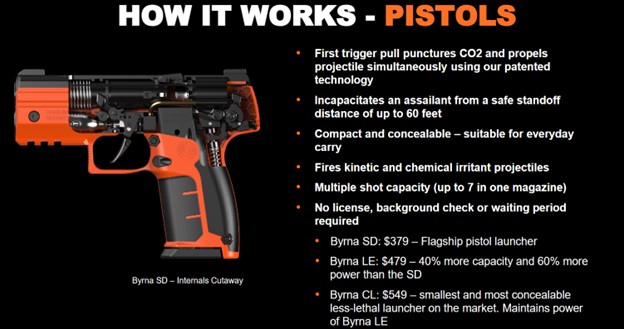

Source: Bryna Investor Presentation

Byrna launchers are powered by pressurized CO2. They shoot projectile balls that break upon impact. The plastic projectiles can be filled with a powder to create a dust cloud, with pepper spray, or with tear gas (for police officers).

Byrna has an assortment of products in the less-than-lethal category: pistols, rifles and even a grenade!

Source: Byrna Investor Presentation

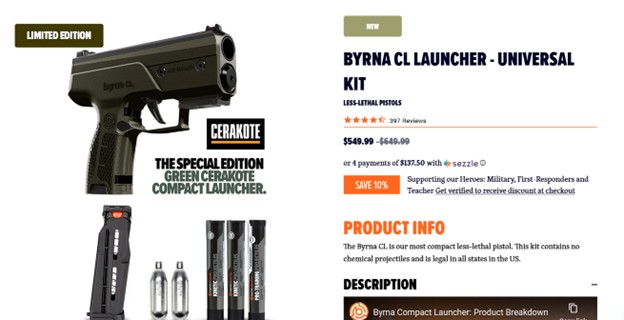

Big reason #1 to take another look at Byrna is their newest product offering. Byrna just launched the Compact Launcher, or CL.

Source: Byrna.com

The CL will be Byrna’s smallest launcher – it is 38% smaller than Byrna’s best-selling SD and 44% smaller than their most powerful launcher, the law-enforcement targeted LE. But it still packs the same punch as these existing, larger products.

In addition to just smaller, the CL is 27% narrower than other pistol launchers, making it ideal for concealed carry.

The big selling point here is that because it is smaller it will be easier to operate for women or anyone with smaller hands to operate. From the back of the grip to the middle of the trigger, the new CL is only 2.5 inches compared with 3.25 inches for the SD and LE launchers.

That should help Byrna crack a whole new demographic.

Two weeks ago, Byrna CEO Bryan Ganz joined ex-Fox News host / now independent Megyn Kelly to drum up interest from her listeners, who are largely conservative women. Byrna has also put out press releases and advertisements addressed especially to women. Women are an underserved demographic for Byrna, and the belief is that the CL will help fix that.

THE BIG ROLL-OUT

IN SPORTSMAN WAREHOUSE

Reason #2 for taking a second look at Byrna is that they are gaining traction with in-store sales.

When we bought into Byrna the first time around, the growth story revolved around the online business.

At the time, online sales had just taken it on the chin as Meta (META – NASDAQ) and Google (GOOGL – NASDAQ) succumbed to political pressure from the Democratic government and changed their advertising rules around allowing firearms ads. Even though they technically didn’t sell firearms, Byrna found itself a victim.

When Byrna found a new advertising angle, through the likes of right-wing influencers like Glenn Beck and others, and realized it worked even better than Facebook ever did, well the stock was off to the races.

Today, that story is flipped. The Byrna is gaining traction in stores, as they roll out their product in large department chains.

In March 2025, Sportsman’s Warehouse announced an exclusive “omni-channel” partnership with Byrna. This included dedicated shop-in-shop sections in some Sportsman Warehouse stores, with live in-store demos and shooting pods, with other stores having 4-sided point-of-sale display towers that are located in high-traffic aisles.

The first store opened in March 2025 at Sportsman’s flagship store in Saratoga Springs, Utah. 12 stores were opened by early May. During the Q2 quarter, Byrna and Sportsman launched another 21 store-within-a-store locations, 14 of which had a shooting pod and another 34 stores with the POS tower.

The total number of Sportsman’s locations that currently stock Byrna products is 59 stores.

They are looking to add 9 more shooting pods in Sportsman’s best locations over the next several months, at the same time, Byrna and Sportsman’s are working on outfitting an additional 72 stores with Byrna’s POS displays, which would bring the total number of Sportsman’s stores that carry Byrna to approximately 140 locations by year-end.

That is a lot of growth in store-count.

MORE BRANDS

ADDING BYRNA PRODUCTS

The success of Sportman’s Warehouse is leading to other stores following suit by engaging with Byrna or giving them more shelf space.

Big 5 Sporting Goods (BGFV – NASDAQ), a chain with over 400 locations and SCHEELS who are already carrying Byrna products are growing the number of stores stocking Byrna products.

Also in Q2 Byrna made inroads with two other potential partners. Rural King, with 123 stores and Family Farm & Home with 73 stores will be putting Byrna in several of their stores as they test the market.

What I learned when I invested in Byrna last time was that the key to this product was getting it in front of the right eyes.

When Byrna can successfully find new addressable markets, the sales seem to take care of themselves.

That is what investors are hoping for here. These are all well-established stores with existing foot traffic. And Byrna could get another boost from advertising, where it has leaned into AI to create better advertising content, which is showing signs of working.

In the first 8 months of 2025 Byrna averaged approximately 33,400 daily web sessions. Byrna’s “We Don’t Sell Bananas” advertising campaign (you can view it on YouTube here) debuted in early August, and drove an increase in average daily sessions on Byrna.com of 50% to more than 50,000 web sessions per day – the highest level in the Company’s history.

Amazon web sessions also strong growth, rising 75% compared to their 2025 average during the first 21 days of August.

IT’S GARP BABY

I don’t talk a lot about growth at a reasonable price (GARP) but I am always on the lookout for companies that are growing revenue and not too expensive.

After the sell of in the stock, Byrna is trading with a market capitalization of ~$450M. Which admittedly, is a lot higher than it was a few years ago (it was less than $100M at that time).

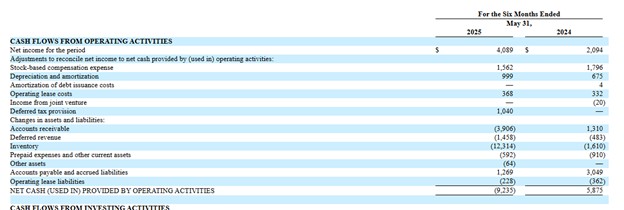

On the surface, Byrna looks like a money-loser. The company has also been free-cash-flow negative for the last couple of quarters, which doesn’t sound very GARP-Y.

But this is misleading. Byrna has been using cash to build inventory in front of the launch of the CL launcher.

Source: Byrna 10-Q

If you look at free-cash-flow before working capital changes, so ignoring the inventory build, the trailing-twelve-month FCF is $10.2M.

That puts Byrna at 40x FCF, which admittedly isn’t cheap, but it looks a lot cheaper when you consider that Byrna grew revenue at 36% YoY in Q3 after growing 40% in Q2.

The problem, and at least part of the reason the stock is down 40% from its highs, is that growth has leveled over the last few quarters.

Source: Byrna Financials

I’m betting that is at least in part due to customers waiting on the rollout of the CL. And in part due the Sportsman roll-out not seeing its impact yet.

If Byrna is just in a lull and revenue has not plateaued, the stock could move back up to $30+ in the next couple of quarters.

And then there is the idea of Byrna turning into a right-wing meme stock. Guns yes but less than lethal guns. How does a horrible event like the shooting of Charlie Kirk impact gun stocks? Does it help or hinder adoption and/or sentiment?

The playbook – a new product, a new vertical to sell into, and improving advertising metrics – is close enough to what made Byrna successful last time. Time will tell if investors are willing to make that bet.