Articles

See All

BRANCHOUT FOODS (BOF – NASDAQ)

QUICK FACTS

Trading Symbols: BOF

Share Price Today: $2.25

Shares Outstanding: 9.6 million

Market Capitalization: $21.6 million

Cash: $2.4 million

Debt: $6.3 million

Enterprise Value: $25.5 million

WILL BRANCHOUT’S SNACK TECH DELIVER JUICY RETURNS?

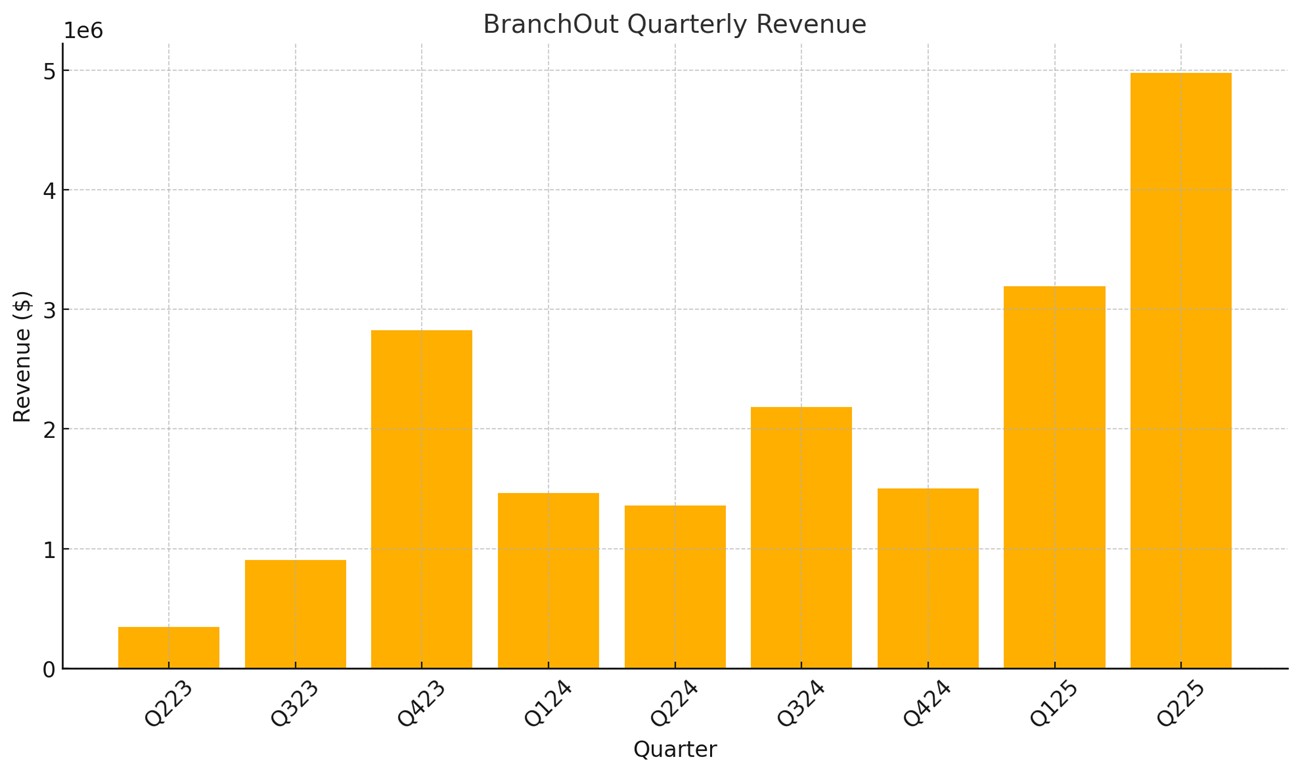

BranchOut Foods (BOF – NASDAQ) is putting together some terrific results.

Just this week the company announced an update on their Q2 results. They showed blow-out growth. In the first half of 2025 they grew revenue over 129% and in the month of June alone they did $1.7M of revenue, which is more revenue than they did in 3 of the 4 quarters in 2024.

BranchOut has been rolling out product into the Walmart (WMT – NYSE) stores in the US. They also announced multiple expansions with “the nation’s largest warehouse club”, almost assuredly Costco (COST – NYSE).

When I see a company growing at 100%+ on the back of the two largest retailers, I have to stop and take a look.

There is a lot to like here. BranchOut stands to benefit from the general trend of healthy snacks. The healthy snack market is growing 6-8%, more than double the larger snack category.

They also offer a better (tasting?) mousetrap. BranchOut is licensing technology from Canadian company Enwave (ENW – TSXv), called Radiant Energy Vacuum (REV). The technology creates a dry-food product that preserves more nutrients than traditional freeze-dry or air-drying techniques.

Finally, they are in Walmart and Costco. Having these big retailers in your pocket is a vote of confidence and a leg up for getting store-space elsewhere.

With a market cap of a little over $20M, BranchOut has the potential to be a big winner.

A HEALTHY ALTERNATIVE

Here’s the story. BranchOut is a consumer package goods company that makes plant-based, dehydrated fruit and vegetable snacks and ingredients.

Source: Branchoutfoods.com

This is a straightforward business. They buy the raw inputs, fruits and vegetables, they use 3-large scale REV machines and 10 smaller REV R&D machines to turn the raw foods into chips and snacks. They package and ship the product under their own BranchOut brand, or under private label.

Their portfolio of products include:

• Snacks: Avocado Chips, Chewy Banana Bites, Pineapple Chips, Brussels Sprout Crisps, Bell Pepper Crisps, and Sweet Potato Sticks.

• Powders: Avocado, Banana, and Blueberry Powders.

• Industrial Ingredients: Bulk avocado powder, dried avocado pieces, and other fruit powders/pieces.

Their portfolio has been expanding. BranchOut been consistently launched new products over time. In the last 3 years they added:

• 2022: Banana Powder and Blueberry Powder

• 2023: Vegetable snacks such as Brussels Sprout Crisps, and Bell Pepper Crisps

• 2024: Salad Toppers and Kids Snack Packs

They are currently developing Broccoli Bites, Mango Chips, Mandarin Chips, and others.

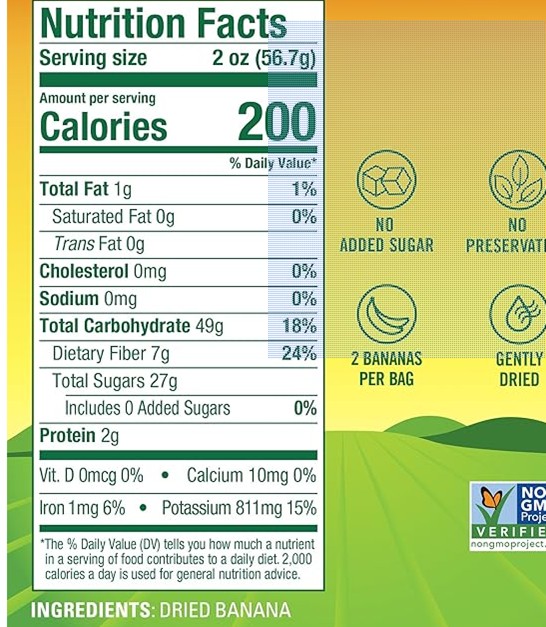

From what I can tell, these products are all extremely simple. Almost all are just one, single ingredient – the fruit or veggie. There is very little else added – no preservatives, no artificial flavor, no coloring.

BranchOut relies on Enwave’s proprietary technology, called GentleDry, for the dehydration process. GentleDry is licensed from Enwave for a minimum of $250K per year plus another $50K for blueberry exclusivity. On top of that they pay an undisclosed royalty on product sold.

The key attribute of the GentleDry tech is that it preserves 95% of the nutrition in the products they sell. Which allows BranchOut to market the products as a healthy alternative.

Conventional dehydration methods like freeze-drying and air drying tend to degrade fruits and vegetables.

The freezing process can lead to loss of some vitamins (like Vitamin C) that are sensitive to heat and temperature.

Elevated temperatures from air drying break down vitamins and enzymes in the food.

The exposure to air in both processes breaks down other food compounds through oxidation.

Some fruits and veggies are more sensitive than others. Bananas and avocados, for example, aren’t offered on dehydrated basis largely because of the degradation in quality.

GentleDry also results in a better flavour, color and texture.

Source: BranchOut Investor Presentation

BranchOut produces their product out of a brand-new facility in Peru. Until recently, product was manufactured by 3rd parties in Peru and Chile, but this year that changed with the build out of a 50,000 square foot production facility in Peru in 2024.

In May BranchOut announced that “Q1 was the first full quarter of operations” at the facility (this was a long-time coming – BranchOut had originally forecast an opening in August of last year).

The site has capacity to produce $40M of product annually.

The new facility is expected to improve gross margins a lot. BranchOut has guided to 40-50% gross margins from it, up from < 20% over the last year.

If they can hit this target, that would be an impressive feat.

When I perused the landscape of smaller CPG companies, they almost all have margins of less than 40%. Only the extremely large, and extremely efficient, producers like Hershey (HSY – NYSE) or Pepsi (PEP – NYSE) have margins at 45%+.

In their most recent press release BranchOut said that in June, with the Peru facility fully operational, gross margins increased to 27%.

MAKING INROADS AT WALMART AND COSTCO

BranchOut has hooked two BIG retail partners: WalMart and Costco. Almost all their revenue comes from thes names.

They struck their first deal with Walmart in 2023. Since then, it has been expanded multiple times. It is worth going through that expansion to get a feel for the progress.

The original contract was announced in June 2023, with shipments beginning in May. BranchOut agreed to “supply multiple dehydrated fruit items to 2,250 of the retailer’s stores or about 50% of their national location”.

The deal was for two private label fruit items, most likely their pineapple chips and banana chips.

In February 2024 this agreement was extended and expanded. The extension was for $5.2M annual product for the two fruit items and an additional $2.6M from two vegetable items (likely Carrot Sticks and Bell Pepper Chips).

The agreement with Walmart was expanded to a 3rd fruit product in April 2024. That third contract had a value of $1M annually. This was likely Brussel Sprout Chips.

On their Q1 2024 earnings press release they said the 3 contracts with Walmart were worth $8M annually. They began shipping the vegetable chip orders in June 2024.

BranchOut didn’t announce anything else with Walmart until July, when they debuted Sweet Potato Sticks Topped with Cinnamon into 1,952 stores and expanded their Brussel Sprout Crisps into 3,945 stores.

Adding it all up, that puts 5 products (2 fruit, 3 veggie) in 3,945 Walmart stores and one product (the Sweet Potatos) in 1,952 stores.

Costco was a BranchOut customer when the company became public (via IPO) in late 2023. Their contract was for Pineapple Chips in Southern California stores.

This contract was expanded in January 2024 to Bay area stores and then to northern California and 7 other states in February 2024, which include $1.1M of orders that were fulfilled in the first half of 2024. I believe it was just for Pineapple chips.

In the second half of 2024 Costco reordered $1.7M “after strong per-store sales”. BranchOut also said they sold $1.1M of Pineapple Chips through Costco in the second half of 2024. Their per store performance “exceeded retailer expectations by more than 200%”.

The success led to an expansion in SKUs to include Organic Chewy Bananas, and Bell Pepper Crisps in October 2024.

Costco expanded their purchase agreement again in January 2025 across 4 major markets. BranchOut expected sales of $4M from Costco in the first half of 2025, a big increase from the $1.1M they sold in H2 2024.

In March, BranchOut announced $600K+ orders from Costco Midwest region as they expanded to include the Bell Pepper Crisp product.

In May BranchOut said that Costco had expanded to 5 regions (that would mean one more than before) and there were $3M in sales in the first half of 2025.

Finally, at the end of July BranchOut announced another $2.8M of orders from Costco, which included adding SKUs to each region and adding new products like Crunchy Strawberry Halves.

OVER PROMISE, UNDER DELIVER?

In that same July press release BranchOut said they now see “a $20–30 million opportunity within the grocery channel alone”

Which sounds great, right?

But there is one pretty BIG caveat. Management has been, to put it bluntly, horrible at giving guidance.

You may not have noticed, but in the timeline I gave of the Costco rollout, BranchOut went from expecting $4M in sales in H124 to $3M in sales in H124 between January and May.

This sort of forecasting miss is not unusual. I went through the last 2 years of new releases, and they are absolutely littered with projections that were never met.

To take a few:

• BranchOut guided for current commitments of $9M in sales in 2024, which turned out to be quite high. Total sales in 2024 were $6.5M.

• Guidance was reduced to “$8M in annualized revenue” in their Q1 update.

• In their second quarter update, BranchOut estimated $5M of revenue in the second half of 2024. Revenue in H224 was $3.7M.

• In October 2024 they provided their first look at guidance – $15M run rate and positive cash flow for Q1 2025. They were far off of those estimates.

• In January they projected “$9 million in H1 2025 revenue”. While revenue in H125 was very good, it came in below that at $8.1M

WORRYING ABOUT CONCENTRATION AND DEMAND

There are a few other things to think about before you run out and buy BranchOut.

First, having the two top retailers in the US is great. But it also means concentration. I suppose you could say this with many small retailers, but BranchOut simply can’t afford to lose either of their big customers.

According to the 10-K, these “top two retailers of our products for the years ended December 31, 2024 and 2023, accounted for 99% and 90% of our net sales.”

Another consideration is that this is an expensive snack. 4-packs on Amazon are $25, or $6 per pouch.

Source: Amazon.com

Even the larger 8-pack is over $4 per pouch.

This is a snack that isn’t going to be for everyone. Not everyone likes dried fruit. And while the healthy, keeping-in-the-nutrient angle is a positive for health-conscious buyers, the snacks still have a lot of sugar. The drying process concentrates sugar, which is 27g for the banana snack, and 32g for the cinnamon churro banana and pineapple snack.

Source: Amazon.com

The Bell Pepper Crisps is less sugar – only about 6g. But I wonder about how popular veggie snacks can be?

Which is my third point. This is just my opinion, but I have some doubts about whether these sorts of healthy snack food items could really catch on and “go viral”. This seems like the sort of product where a steady climb in revenue, nothing spectacular, is really the best-case scenario.

Walmart and Costco are likely to be their biggest addressable market. Yet, as I mentioned above, BranchOut said they see a $20-$30M opportunity in grocery.

While that’s good, its not exactly huge.

WHAT DOES THE UPSIDE LOOK LIKE?

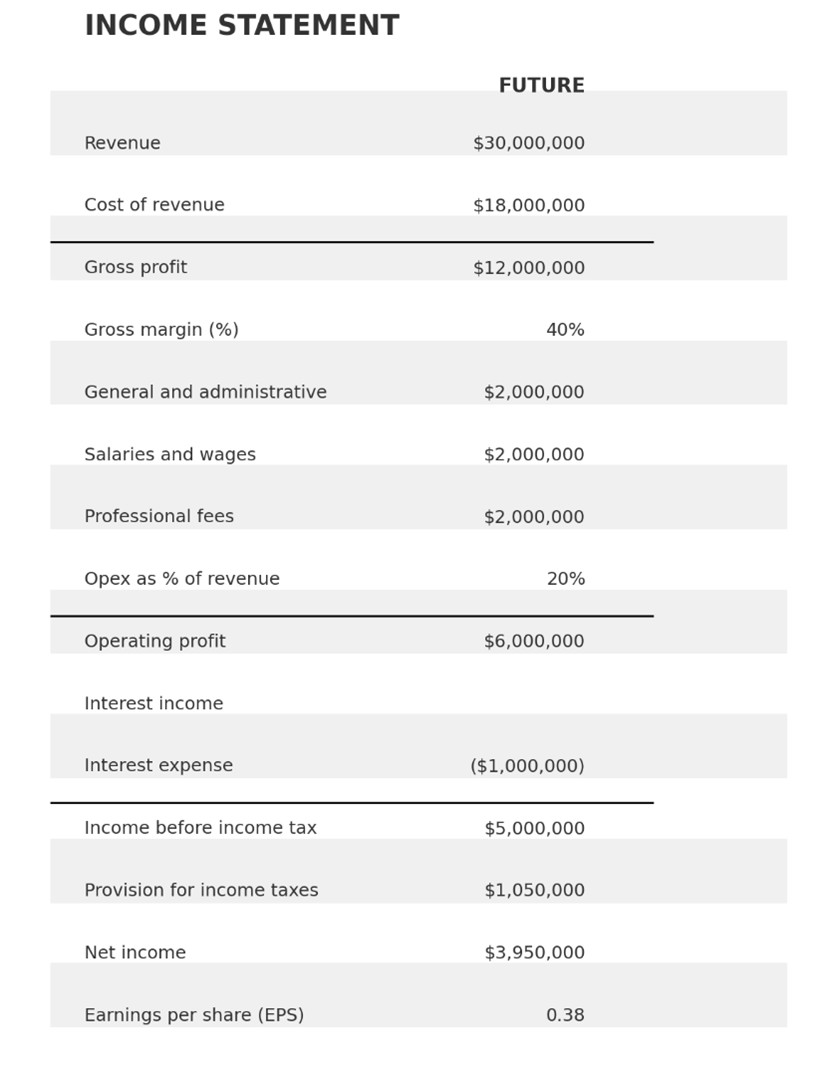

Maybe the best way to look at the stock is how things might be if everything goes well for BranchOut.

I estimate that at $30M of annual revenue, and assuming that with the new Peru plant they can get to 40% gross margins on that revenue, the company could do about $4M in after-tax earnings.

Assuming some dilution from the recently announced at-the-market offering of $3M, that would be EPS of 35c-40c per share.

Source: My Own Estimates

This all seems quite positive. But to get to those numbers I am using some fairly optimistic assumptions.

First is the Peru gross margin target, which as I already went over, is a fairly high bar.

Second, I am assuming operating expenses, so G&A, Selling, and R&D, can drop to 20% of revenue. That would put those expenses on average with larger snack-based food companies like The Simply Good Food (SMPL – NASDAQ) and Hain Celestial Group (HAIN – NASDAQ).

Achieving that sort of leverage to the expense base is not a guarantee. Laird SuperFoods (LSF – NASDAQ), which has been touted on X.com as another up-and-coming healthy eating-esque food producer, has seen its revenue grow from $8M in 2018 to $43M in 2024, yet its operating expenses remain a rather lofty 49% of revenue.

There are a lot of ways this could not work out. But if it goes right, there is quite a bit of upside. And it certainly looks like revenue has inflected up the last couple of quarters.

Source: BranchOut Financials

Unfortunately, it doesn’t appear that the Street has fully bought into the story just yet. The stock is hanging out in the sort of chart pattern that is saying there are buyers of every dip, but no one is ready just yet to bid it up to another level.

Source: Stockcharts.com

I might say the same. I can see lots of potential with BranchOut, but I may need a few more quarters of reassuring results before I am ready to pull the trigger.