Articles

See All

IS IT TIME TO LOOK AT THIS CANADIAN HOUSING STOCK

QUICK FACTS

Trading Symbols: AEP

Share Price Today: $0.80

Shares Outstanding: 70.3 million

Market Capitalization: $56 million

Cash: $5 million*

Debt: $19 million

Enterprise Value: $70 million

THE CYCLE TURNS?

Last year, I sold our position in Atlas Engineered Products (AEP – TSXv) for one reason only. The cycle.

Rates were high. The Canadian housing market was clearly slowing down. The scuttle I was hearing is that no one was starting a new build.

It doesn’t matter how well run of a company you have, if you are in a cyclical business and that business is going through a trough, it will be a slog. Which is not going to be good for the stock.

It was the right move. The stock today is 80c, down significantly from where it was a year ago at down 50% from its top in early 2024.

Source: Stockcharts.com

I’m ready to take a second look at the stock here. There are three big reasons to think that the cycle is about to turn back up.

1. Interest rates are coming down

2. The Canadian Government is focused on building more homes

3. We have a shortage of single-family homes in Canada

Notice that none of these catalysts are specific to Atlas. That’s because there was nothing wrong with Atlas in the first place, it was just the wrong point in the cycle for them. And I think that is about to change.

Atlas is good at what they do – making pre-engineered trusses, joints and panels.

They produce the prefabricated building blocks that can be used to build homes faster and cheaper. They don’t produce the entire module of a modular home, what Carney and the Liberal government talked about last week, but the pieces they produce can be used to build those pre-fab homes.

Altas operates across Canada, with the only real notable exception being Alberta (they recently acquired a Saskatchewan company, Penn-Truss MFG Inc, not shown in the map below).

Source: Atlas Engineered Investor Presentation

Their customers are Canadian home builders. They are tied to single family home and multi-family wood frame starts.

Source: Atlas Engineered Investor Presentation

The business is tied to Canadian home starts and with it, to the Canadian rate cycle.

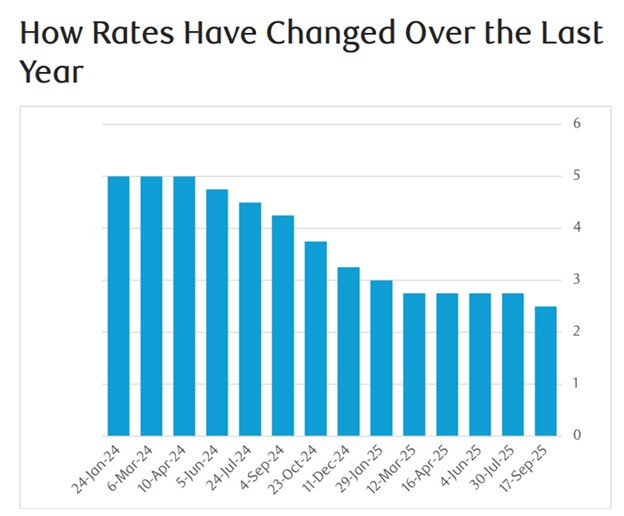

That rate cycle has decisively turned. They were 5% in April of last year. After this week’s cut they are 2.5%.

Source: RBC

In Canada, short term rates are directly tied to housing. There is no 30-year mortgage in Canada. Most people that have a mortgage are taking it out with a 1–5-year term or even at a variable, short-term, rate.

While you can argue that the Federal Reserve interest rate cuts in the US will only have a bit of an impact on housing there because short-term rates don’t necessarily bring down long term rates, the same argument doesn’t apply to Canada. In Canada, its very direct – lower rates from the Bank of Canada lower borrowing costs for mortgages, and are a direct boost to housing demand and with it to home builders.

The obvious argument against this is that the Canadian housing market is in a correction, that is it going to crash, that supply is overwhelming demand.

But a close look at the numbers suggests something a little different.

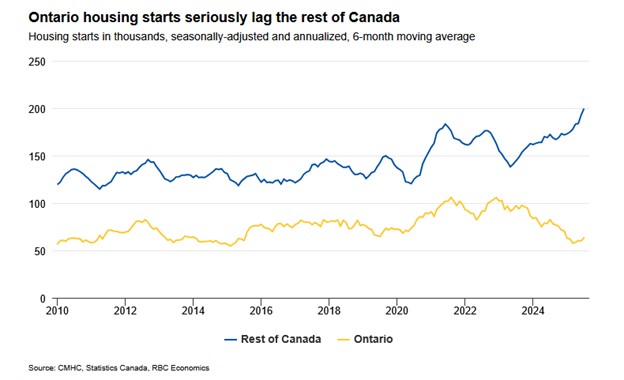

RBC came out with a report in August that made an important distinction between Ontario and the rest of Canada. And while Ontario housing is clearly down in the dumps, the rest of Canada is not.

In fact, Canada ex-Ontario appears to be in a bit of a home building boom!

Source: RBC

Into this already strong home building market now comes a second tailwind from the Canadian government.

Last week, Mark Carney’s Liberal government announced the Build Canada Homes (BCH) initiative. They are going to put C$13B of capital towards getting more home built.

That will translate into around 50,000 units, including a starter-pack of 4,000 factory-built homes on federally owned land in Dartmouth, Longueuil, Ottawa, Toronto, Winnipeg, and Edmonton.

I’m not going to pretend that BCH is going to buoy the homebuilding business on its own. It is a drop in the bucket. The CMHC estimates we need 500,000 more homes built each year to get rid of the existing home deficit.

But it is a signal, one that I suspect will be the first of many housing initiatives. Look, Canada is in some trouble here – the US is clearly not interested in free trade and with USMCA negotiation likely to end in some materially negative way for Canadian exports, the Canadian economy is in for a rough time.

I am confident that Carney, who if he knows anything he knows economics, is aware of just how bad things could get. He is going to be looking for levers to pull to drive growth in other areas to get us through the transition away from the US.

Building more homes is a no-brainer.

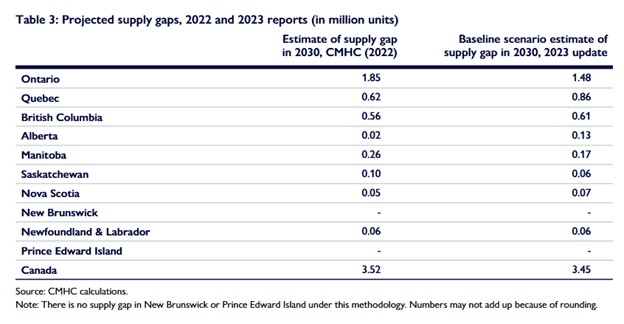

In their report “Housing shortages in Canada” the CMHC estimates Canada needing to build 3.5M homes by 2030. Even in their “low-economic-growth” scenario, the CMHC report estimates Canada is 3M units short.

The biggest supply gaps will be in Ontario, Quebec and British Columbia, all areas of focus for Atlas.

Source: CMHC

I think BCH is just the starting salvo of what’s likely to be a series of moves that drive more development across the country.

THE VIRTUOUS CIRCLE OF MARGINS AND GROWTH

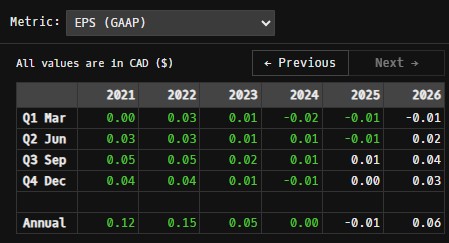

Atlas doesn’t look all that cheap if you just go on estimates. The average analyst estimate for Atlas earnings per share are 1c EPS loss for this year and 6c EPS for next year.

Source: Bloomberg

That puts the stock at 14x PE on next years earnings. Which is not exactly dirt cheap.

But these estimates are lagging. They tell you more about where we have been then we are going.

The best way to see where Atlas could go is to look even further back, at what their earnings power was the last time the housing market was strong.

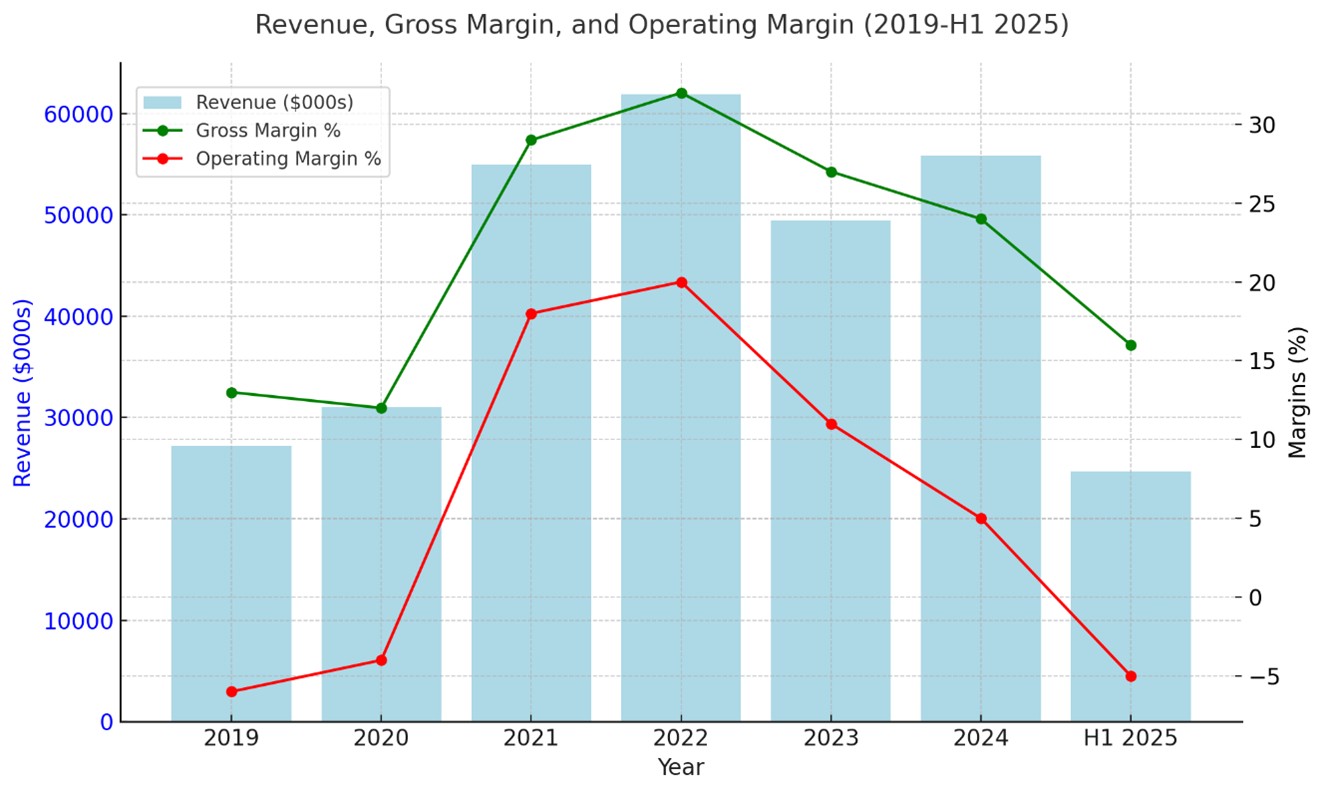

We don’t have to go back that far. In 2021-22, Atlas had much higher revenue and margins than it does today.

Source: Atlas Financial Statements

In 2021 and 2022, Atlas did $12.6M and $15.7M of EBITDA and earned 12c and 15c per share of EPS respectively.

Since that peak in 2022, Atlas has made a number of acquisitions that should boost earnings even more this time around.

• Leon Chouinard et Fils Co – New Brunswick based

• Truss Worthy Construction – Ontario based

• Penn-Truss MFG – Saskatchewan based

We know from Atlas disclosures that Leon Chouinard generated $25.7M of revenue, $9.47M of EBITDA and $6.3M of net income in 2022, that the average EBITDA of Truss Worthy from 2022-2023 was $917K, and that Penn-Truss had average EBITDA of $1.2M in 2022 and 2023.

If I do a bit of back-of-the-napkin math to come up with a pro-forma 2022 that includes these acquisitions, I get about $27M of EBITDA.

Making some conservative estimates of depreciation, interest expense and taxes, it’s pretty easy for me to come up with EPS of 20c+.

Which suddenly makes Atlas look very cheap – when the cycle turns.

TRYING TO TIME THE TURN

Look, it’s really hard to pick a turn. And I might be too early.

I’m certainly not blind to the fact that where the housing market is right now, is not a good place. Recent headlines like this one (from the Friday Globe and Mail) don’t paint a pretty picture.

Source: Globe and Mail

It’s always possible that Canadian housing goes into some sort of death spiral. But it is just hard for me to see that happening when the key levers of its health – interest rates and access to capital – are both going in the right direction and when the Canadian government will so desperately not want that to happen (it truly would be a disaster for the Canadian economy if US tariffs and a housing crash happened at the same time).

So yes, the housing market is not great, but investing isn’t about going to where the puck is.

I’d also point out that I am not calling for another boom in house prices. All Atlas needs for success is a moderately healthy market where prices are largely stable, and builders feel comfortable to build more homes.

If I can turn the narrative on its head, imagine a Canada in 12 months with short term interest rates of 1%, a number of federal government initiatives on affordable housing and, on the backs of both of these, an ebullient housing construction market.

I’m not guaranteeing that happens. But I think its possible.

What I will guarantee is that if it does happen, Atlas Engineered Products isn’t going to be trading under a buck a share. It will be double that, maybe more.