Articles

See All

APRIL 2024 OPTIONS TRADE COVERED CALL MPLX-NYSE

Buy MPLX units, sell May $40.00 calls against the long position

Extended Commentary

We are back to our bread-and-butter philosophy this month, writing/selling a call as opposed to last month’s buying a call–on this same MPLX-NYSE stock.

(That trade has by far been our most lucrative to date–buying the Sept 24 $40 call for $1.82, trading today at $2.35 for a $38,000 gain–25%–in just one month on our 600 contract purchase. We see the stock going higher.

You can read our full company report on the company and why we like it so much here–https://inthemoney.capital/editors-picks/our-march-2024-options-trade-markwest-energy-partners-mplx-nyse/.)

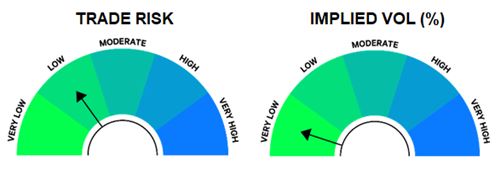

Our March (last Friday) covered call trade involves buying MPLX units at $41.67 and writing May 17th, $40.00 calls for $1.92.

The covered call trade should generate a 2.64% gain (including an anticipated $.85 per unit distribution) if MPLX units trade at $40.00 (or above) at the options expiration – a 23.53% annualized return.

The trade breaks even if MPLX trades down to $38.90 – a full $2.77 per share (6.65%) below the current price.

MarkWest Energy Partners, more commonly known as MPLX, is a diversified, large-cap Master Limited Partnership (MLP) formed by Marathon Petroleum Corporation (MPC) in 2012.

MPLX’s assets include a network approximately 16,000 miles of crude oil and refined product pipelines; an inland marine business; light-product terminals; storage caverns; refinery tanks, docks, loading racks, and associated piping; and crude and light-product marine terminals. MPLX also owns 5.9 BCF/d of natural gas gathering systems as well as natural gas and natural gas liquids (NGL) processing and fractionation facilities.

In 2023, a third of adjusted EBITDA was generated by their gathering and processing segments while two-thirds were generated by their logistics and storage segments

April 30 (est) – First Quarter Earnings

=Consensus estimates call for revenue of $2.91 bln and earnings of $.97 per share

=MPLX has exceeded both revenue and earnings estimates in 11 of the past 12 quarters

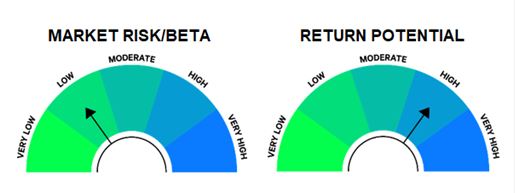

With a beta of .71, we would expect MPLX shares to decline 7.1% if the S&P 500 declined 10.0%, sending the shares to $38.71. (This Market is overdue for some kind of correction!!)

This would result in an anticipated loss of $.19 on the covered call position at expiration – net of the $.85 dividend.

If the S&P 500 rallied 10.0%, MPLX shares would likely rally 7.1% (to $44.63) and the covered call trade would realize the maximum gain of $1.10 per share including the dividend, or 2.64%.

Here are the links to our previous trades:

DECEMBER 2023

JANUARY 2024

https://inthemoney.capital/past-trades/january-2024/

FEBRUARY 2024

March 2024