Articles

See All

Another Biotech Trading Below Cash

Sometimes I find a stock that looks worth buying but trying to tell the story is a chore – it is just not interesting!

That is NOT the case with Amylyx (AMLX – NASDAQ). Amylyx has almost too many stories! It is hard to know where to start.

I am going to kick off this dive with what is most fashionable. What could be more fashionable than a GLP-1?

Amylyx just bought itself a Ph3 ready GLP-1 drug.

That’s right. But wait, woah, woah, WOAH! Before you hit the buy button you need to hear the whole story.

Amylyx bought itself a very different GLP-1. In fact, what they bought is quite literally the opposite of what Novo Nordisk (NVO – NYSE) and Eli Lilly (LLY – NYSE) are selling.

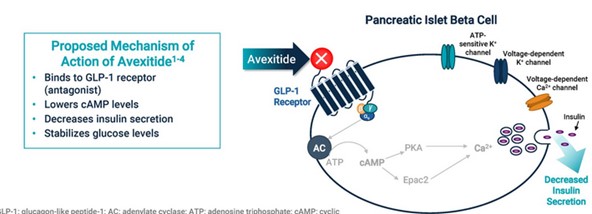

Amylyx’s GLP-1 is called avexitide. Avexitide is a GLP-1 antagonist. Drugs like semaglutide (Ozempic) and tirzepatide (Mounjaro) are GLP-1 agonists.

Agonists increase insulin and reduce blood sugar. Avexitide does the opposite.

Wait a minute, you’re telling me they bought a drug that will promote diabetes and make me fat?

No, not really. In fact, there is no evidence that avexitide causes weight gain at all. But it does raise blood sugar levels, something that can be very beneficial sometimes.

In fact, avexitide could turn out to be a life saver for people that have mis-dosed or overdosed on Ozempic or Mounjaro.

More on that shortly. First, let’s take a closer look at the Amylyx story.

HOW TO TRADE WAY BELOW CASH

The first time I looked at Amylyx I did a double take. The stock was $2, which meant that it had a market cap of $~$140M (it is a little higher today). Yet on the balance sheet, there was more than $370M of cash!

If you could liquidate Amylyx on the spot each shareholder would have gotten somewhere around $5 per share. Crazy!

When you see a company with such a massive negative enterprise value, there must be a story.

The Amylyx story is that a few months ago this was a high flying, revenue generating biotech. Their lead drug, RELYVRIO, was approved for amyotrophic lateral sclerosis, or ALS. They had just finished the year with $381M of revenue.

RELYVRIO had been approved by the FDA the year before. In an unusual twist the approval came before a Ph3 study was conducted on the drug.

This doesn’t happen often. When it does it is because A. The PH2 study results is just that good and B. there is desperate need of treatment options, which is the case for ALS.

The problem came with the Ph3 study, which had to be completed at some point. Those results came in early March and delivered a HUGE surprise.

RELYVRIO failed to meet both its prespecified primary and secondary endpoints!

It was a DISASTER. Amylyx had to voluntarily discontinue the drug.

The stock collapsed overnight. And I mean COLLAPSED!

Source: Stockcharts.com

RELYVRIO was basically the company. Now it was gone.

Amylyx responded by reducing staff by 70%. Cutting expenses. Refocusing on their drug pipeline.

But you can’t replace your one approved drug. Every investor was in the stock for RELYVRIO. Now they wanted out.

All that selling is how you get a stock with a negative $200M enterprise value!

SEARCHING FOR A SAVIOR

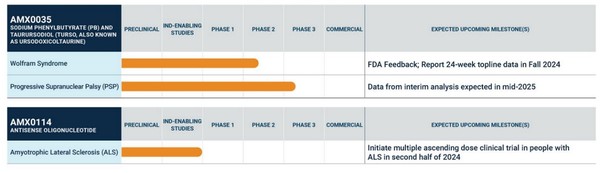

After the failure of RELYVRIO, Amylyx was left with two homegrown drug candidates. One in Ph2, targeting Wolfram Symdrome, and a second pre-clinical drug again targeting ALS.

Source: Amylyx Investor Presentation

Both of these drugs could have legs, but Amylyx didn’t think it was enough and the market didn’t either. So Amylyx went shopping and found a new lead drug via the bankruptcy process.

Amylyx took advantage of an Eiger Pharmaceuticals (EIGRQ – PINK) bankruptcy auction. They picked-off what was Eiger’s lead asset – avexitide.

Eiger had high hopes for avexitide. They were anticipating a Ph3 trial that would springboard the asset to FDA approval.

But Eiger was running out of cash. They had bet the company on a COVID treatment that worked but couldn’t get approved. They also had an extremely adversarial relationship with their primary debtor.

With no access to capital, Eiger couldn’t raise the cash for the Ph3 trial. The company eventually announced bankruptcy in early April.

Bankruptcy auctions can be a good place to find cheap assets. An auction for avexitide was completed in mid-June. There were two main bidders in the auction. The other, Spruce Biosciences (SPRB – NASDAQ), was the stalking horse (starting) bid.

To get a sense of just how much both these companies wanted avexitide, that starting bid from Spruce was $10M. The final winning bid from Amylyx was $35.1M!

AVEXITIDE – SITTING ON A TEE

Is Avexitide worth the price? That remains to be seen, but it could turn out to be a big, big bargain.

Avexitide is a single drug but there are actually at least two indications to target:

- Post-bariatric Hypoglycemia (PBH)

- Congenital Hyperinsulinism (CH)

Both have already met their endpoints in Ph2 trials. Both are indications where patients have limited options. CH also comes with Rare Pediatric Disease Designation (RPDD), where the FDA throws in a priority review voucher to another drug if avexitide is approved. That voucher has typically been valued at $100M+.

Patents on avexitide are good until at least 2037 and could be extended even further.

Amylyx made it clear at their webcast last Wedensday that their first focus with be PBH, which is closer to being Ph3 ready.

The avexitide Ph2 and Ph2b trials for PBH both had statistically significant results. Both trials showed no safety issues.

There have been 5 trials of avexitide in all, including some run by 3rd party investigators, with positive results across the board.

Because they are getting this drug from Eiger, they benefit from all the work Eiger put into avexitide up until now. Amylyx already has FDA guidance for a Ph3 trial, including the endpoint and size of the trial.

Source: Amylyx Avexitide Investor Presentation

In other words, avexitide is about as close to Ph3 ready as you can get. It has a strong probability of success and with a long runway if it succeeds as you can get.

A DIFFERENT SORT OF GLP-1

Let’s get into the weeds for a minute.

The GLP-1 pathway regulates the blood glucose level in your body through determining how much insulin to produce.

GLP-1 receptors are a way for the body to find out if it needs to produce more or less insulin.

GLP-1 agonists like Ozempic, attach to receptors and tell the body to produce more insulin, which reduces blood sugar levels.

This is the diabetic benefit of these drugs. The weight loss benefit is a side-effect – when the receptor attaches the pathway also sends a signal to your brain telling it not be hungry.

In some cases, the body produces too much insulin. This is where avexitide comes in.

Avexitide attaches to the GLP-1 receptors just like Ozempic, but it sends the opposite signal, telling the body to produce less insulin.

Source: Amylyx Pharmaceuticals Avexitide Call

Most of the time, that would be a BAD thing. But there are some instances where people have low blood sugar levels, and they need to kick-start those levels higher.

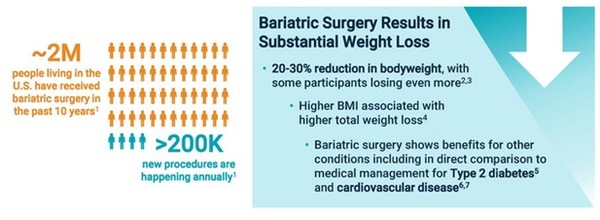

Bariatric surgery is a common approach to treating obesity, reducing the size of the stomach to force weight loss.

But it comes with a side effect. When we eat our intestines are what release GLP-1 receptors naturally. The amount of GLP-1 released is proportional to the size of the meal.

After bariatric surgery your stomach isn’t the same size as it used to be. But your intestine doesn’t know that. Your intestine thinks you just ate a big meal because your stomach is full. It sends off far too many GLP-1 signals, too much insulin is created, and your blood sugar drops too low.

Avexitide regulates this mismatch. It binds to the receptor, blocks the signal, and stabilizes your blood sugar.

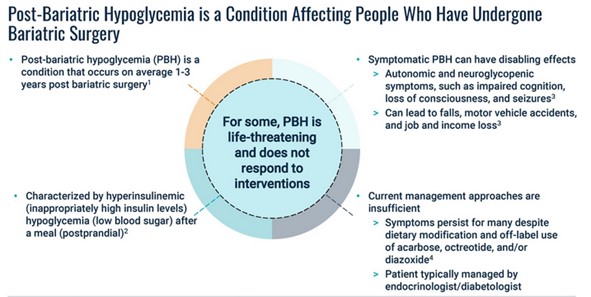

THE OPPORTUNITY IN PBH

PBH can happen from 1-3 years after surgery. When it does, the consequence is a sudden drop in blood sugar (called hypoglycemia) after a meal.

Source: Amylyx Pharmaceuticals Avexitide Call

The sudden lowering of blood sugar wreaks havoc on the body. It messes with brain signaling and causes brain fog, blackouts and seizures.

PBH is an orphan condition. Over 200,000 people get the surgery each year.

Source: Amylyx Pharmaceuticals Avexitide Call

Of those, between 5,000-10,000 end up with PBH.

Amylyx estimates there are 160,000 people with PBH in the US – It has NO approved treatment options today making this is a patient population with no current options.

THE DATA LOOKS GOOD!

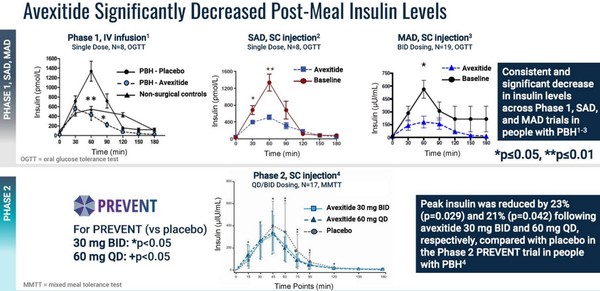

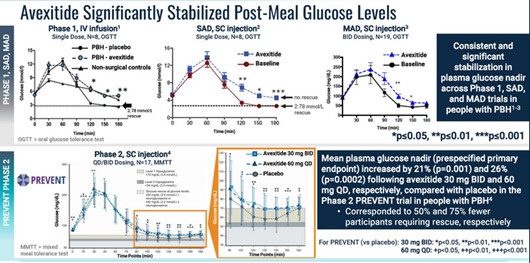

Eiger showed that avexitide can regulate insulin release and blood sugar levels in patients with PBH in a number of trials.

It’s a consistent outcome: insulin levels come down and higher doses of avexitide means less insulin.

Source: Amylyx Avexitide Investor Presentation

With less insulin released, blood sugar levels do not dip nearly as low.

Source: Amylyx Avexitide Investor Presentation

Eiger first Ph2 study was the PREVENT study. Patients took a placebo and then two doses of avexitide (30 mg and 60 mg) for 14 days each. The results showed lower insulin, higher glucose and lower rates of hypoglycemic events (events caused by critically low blood sugar).

Source: Amylyx Avexitide Investor Presentation

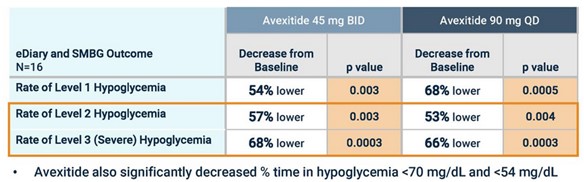

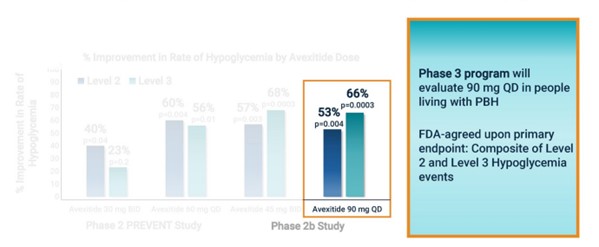

Eiger’s next study, a Ph2b, used higher doses of avexitide (45 mg and 90 mg). This study looked primarily at hypoglycemic events, which again came down significantly after taking avexitide.

Source: Amylyx Avexitide Investor Presentation

Importantly, Amylyx plans to use hypoglycemic events as their end point (a composite of Level 2 and 3). This has already been agreed to by the FDA in a meeting they had with Eiger.

None of the studies showed any significant safety concerns. That lets Amylyx go with the highest dose (90 mg) of any of the Ph2 trials.

Source: Amylyx Avexitide Investor Presentation

A GLP-1 ANTIDOTE?

There is one other interesting twist to this story.

According to HC Wainwright, the misuse of GLP-1s is coming with a negative consequence. Mistakes.

The rates of serious medical outcomes mostly attributed to therapeutic errors have jumped to nearly 81% from 2017 to 2021, with rates of serious medical outcomes increasing up to 96% in 2022. Hypoglycemic events form a major part of these events.

With use of Ozempic and Mounjaro growing rapidly, the risk of even more hypoglycemic events occurring is likely.

Also, remember that we don’t know the impact of long-term use of GLP-1 drugs. What if there is the need for an “antidote” further down the road.

The wild card is that in such a scenario, avexitide would have a LARGE role to play.

At the very least, it could be used to offset GLP-1 “poisoning”, cases where patients mis-dose their injection and take more than their body can handle.

WORTH THE WAIT?

Even if such worrisome scenarios are avoided, and avexitide is limited to PBH and CH, the opportunity is quite large.

In a recent note, Bank of America noted that peak sales of avexitide could exceed $1B.

Source: Bank of America Research

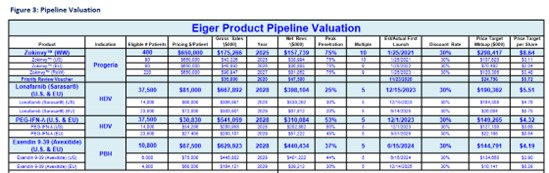

In a 2021 report on Eiger, Wedbush estimated net annual revenues of avexitide would peak at $440M.

Source: Wedbush Research

If either of these estimates are in the ballpark, Amylyx will have itself a big winner if approved.

The risk is, of course, that avexitide doesn’t meet its Ph3 endpoint.

Even if it does, approval is still 2+ years away.

Amylyx won’t start the avexitide trial until next year. They will announce data in 2026.

Source: Amylyx Investor Presentation

That means we are in for a long wait.

On the other hand, you are buying a stock with a negative $200M EV. A valid question is how much lower could it possibly go?

Of course, Amylyx is a biotech. Which means most rules don’t apply.

The only rule of biotech is to expect the unexpected. Which means that you if buy Amylyx you do it with the expectation of a wild ride. One where the sky is the limit, but there is no guaranteed floor either.