Articles

See All

AN UNCERTAIN PATH INTO AI

Before AI, there was RPA—Robotic Process Automation. That was where businesses were spending their software dollars to get more efficient and use less labour.

RPA takes repetitive, computer-based work, and executes that work through software, or what they call “robots”.

UIPath (PATH-NASD) is an RPA provider, now trying to transition to AI—which has me intrigued, as you will read below. It has been doing…OK…and now sits with no debt and $1.5 billion cash. They’re still growing but more slowly than before.

First, here are some typical examples of what Path’s RPA robots do:

· Copy data between ERP, CRM, and legacy systems

· Invoice processing and accounts payable

· Employee onboarding/offboarding

· Insurance claim processing

· Compliance checks and reporting

· IT service desk tasks like password resets and ticket routing

Until AI, UIPath offered a clear value proposition: if a human was clicking, copying, pasting, reconciling, or collating, a robot could do it faster and cheaper.

The promise of AI – especially for enterprises – is that all this and more, increasingly complicated tasks, can be done by AI and done adaptively.

UIPath is trying to figure out how it fits into this new world.

UIPATH (PATH – NASDAQ)

QUICK FACTS

Trading Symbols: PATH

Share Price Today: $16

Shares Outstanding: 536 million

Market Capitalization: $8,578 million

Cash: $1,523 million

Debt: $0 million

Enterprise Value: $7,056 million

HARD TO IMAGINE

A MORE UNCERTAIN PATH

UIPath (PATH – NASDAQ) is one of the hardest stocks I can remember trying to project.

I can make a case that in the next few years UIPath becomes a massive winner, perhaps becoming the platform enterprises use to manage AI agents as they move from experimentation into real, mission-critical workflows.

But I can just as easily lay out the opposite. That UIPath’s legacy business is steadily eroded by AI agents and robots that no longer need its tooling. That former customers find ways to achieve the same outcomes using open-source frameworks, or vendor-specific automation. And that eventually, AGI makes the whole thing a moot point.

Maybe most uncomfortable is that…I don’t think anyone can say with confidence which of these paths is more likely.

Why? Because forecasting what AI will look like in 2-3 years is VERY difficult.

We know AI will get better. It will be used more widely. It will be trusted with increasingly complex tasks. But how that progress evolves inside real businesses — and which layers of today’s software stack are reinforced or bypassed — that is much harder to pin down.

It is an uncertainty that matters for all software businesses, but much more so for UIPath.

It is easy to connect the dots and arrive at two entirely different outcomes:

· UIPath becomes the go to platform for facilitating ever-growing process automation

· UIPath is bypassed by AI tools that can do the process automation without their tools and the ice cube melts.

I don’t have a good feel for which of these scenarios wins out. I don’t think anybody does.

With that much uncertainty around the “path”, this stock is going to be all about the numbers. With the narrative so uncertain, retention, expansion, and margins are going to drive confidence, or erode it.

A COILED SPRING – BUT TO WHERE?

UIPath went through a difficult stretch through much of 2024 and into 2025. Deal cycles lengthened, renewals hesitated and customers paused.

The market took this as evidence that UIPath was being disrupted by AI. It jumped to the conclusion based on the dearth of deals that the slowdown wasn’t just cyclical, it was existential. The stock dropped. It briefly fell to the single digits during the tariff panic.

Source: Stockwatch.com

Today that response looks like an over reaction, or at least a premature one. The pause wasn’t customers deciding “AI agents will replace RPA” so much as it was a rapidly changing environment that caused pausing and budget freezes while customers figured out, ‘what just happened’?

That period appears to be easing. Customers are gradually differentiating between where embedded agents can replace RPA and where they can’t. We are seeing spend stabilize.

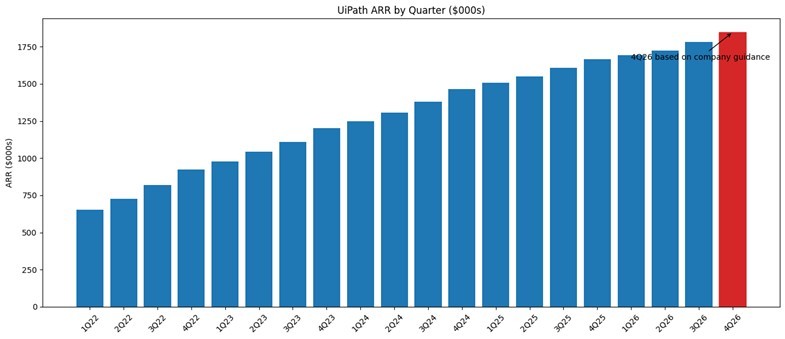

The most relevant metric for the “health” of a SaaS business like UIPath is annualized recurring revenue (ARR). ARR is the value of all active subscription contracts at the end of a reporting period. It doesn’t include the one-time impacts of professional services, implementation fees, or training.

Source: UIPath 10-Qs

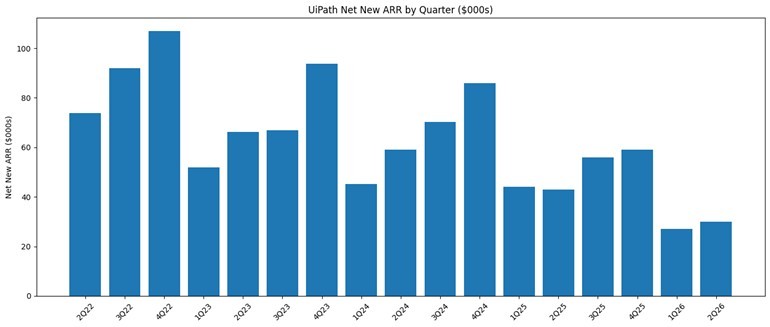

UIPath saw ARR growth slow through 2024 and into 2025 (their fiscal year ends January, so that shows up as 2025 and 2026 in the chart). While this trend isn’t super obvious by looking at the above chart, if we isolate net new ARR, or how much ARR changed each quarter, the trend is pretty clear.

Source: UIPath 10-Qs

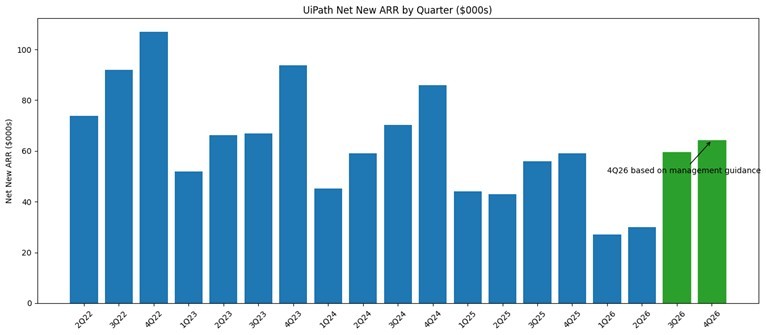

But this downward march of net new ARR has changed recently. The above chart only goes up to UIPath’s 2026 Q2 quarter. Extending the results to include Q3 and their guidance for Q4, we see that for the first time in a long time, UIPath had better year-over-year net new ARR.

Source: UIPath 10-Qs

While its early days, this gives us some hope that UIPath is turning its business around and that it is maybe going to be a winner, not a loser, from AI.

DIGGING INTO THE DISRUPTION

UIPath is a difficult business to summarize.

I’ve already labeled what they do as RPA. RPA takes repetitive, rules-based computer work and automates it. If a task is being done by a human through typing, copying, pasting, or clicking, there is a good chance UiPath can offer to do it faster and more consistently with software.

Whether the work ultimately gets done by a robot comes down to things like rules, exceptions, and safeguards. If those can be overcome and built into the model, and especially if it’s a high-volume task, it will be worthwhile to automate.

Embedded in this explanation is the basic duality that is tearing the stock between the bear case and the bull case. UIPath is both a winner and a loser:

1. Some tasks, which previously could not have been automated at all, can now be targets of automation for UIPath

2. AI makes other tasks much easier to automate without using UIPath

What separates (1) and (2) has to do with complexity.

There are two layers of disruption here: embedded agents and open-source bots.

The first, embedded agents, comes from tasks that live entirely inside a single modern application and are thus ripe to be disrupted. Consider just a few of the promoted embedded agents out there:

· Salesforce (CRM – NASDAQ) has launched their AgentForce AI tool.

· Microsoft (MSFT – NASDAQ) has had Co-Pilot for over a year now.

· Workday (WDAY – NASDAQ) has Build which allows users to create agents within their product.

· Numerous AI native tools that have built their own coding agents.

This trend is only accelerating. In relatively short order — perhaps a year or two — every major enterprise application will ship with embedded agents.

UIPath has said as much on their conference calls. They admit that they are losing the simple RPA business. A lot of the slippage in ARR the last couple of years is because customers saw what tools like AgentForce could do (for very little cost) and started retooling simple automation tasks to use those tools.

But these native agents all share the same limitation: they are confined to their own application.

This is where UIPath has its moat, and where it can win new business. The moment a workflow touches multiple apps:

· SAP + Excel + email

· ERP + CRM + bank portal

· Legacy UI + web portal + API

Agents like AgentForce and Copilot are no bueno.

The second layer of disruption comes from open-source agents.

Developers are rapidly building open-source products that let you build your own agents. Tools like LangChain, LangGraph and LlamaIndex, are open-source frameworks (developed by private companies), that allow you to stitch together multi-step workflows using AI.

These are technically competition to UIPath. They let you build robots, and at its most stripped-down level, UIPath deploys robots.

But these tools also represent an opportunity. UIPath has been pretty candid on their calls: they want to embrace the open-source agent eco-system and build a platform that enables a “build-your-own-agent” world.

It’s a strategic move. UIPath is betting that agent building is going to be commoditized regardless. What they don’t think will be commoditized will be control and orchestration. These layers are something UIPath already owns.

UIPath already owns the platform that would thrive in a world full of agents. They have tools like Maestro, which is essentially a platform for managing many agents, and Data Fabric, which is a layer of guard rails, rules and controls that manage and watch what data agents can see and access. They also provide identity and credential management for agents, and they have a tool called Process Mining and Discovery, which can find bottlenecks and help determine processes that are ripe for automation.

So there are lots of ways UIPath can win even if customers aren’t using their own bot.

It’s also worth pointing out that most UIPath customers won’t necessarily want to build their own bot. While the open-source option may be right in the wheelhouse of an Amazon (AMZN – NASDAQ) or a Shopify (SHOP – NASDAQ), they will require developers, coding and maintenance on the part of the corporation, which means resources that non-tech outfits don’t have.

UIPath customers typically aren’t the high-tech firms. Their biggest customers are:

1. Global Professional Services and Consulting firms, eg. Ernst & Yound (EY – NYSE)

2. Major banks and insurers, eg Allstate, Western Union, BNP Paribas

3. Healthcare Operators and insurers

4. Logistics firms like DHL

5. Government agencies

These are largely clients that would be less likely to come up with their own solution. Not to say UIPath customers won’t build it themselves if AI makes it easy enough to do, but on average, they are less likely to.

Which is another reason that UIPath may be more comfortable opening up their platform for open-source bots. They may just be saying, look, we already have the biggest firms, if we can consolidate as the platform of choice for all your RPA needs, and whatever way we can accelerate that, the better.

TIME TO SHOW ‘EM THE MONEY

Perhaps the BIG reason UIPath is encouraging open-source bots is simply because their biggest challenge right now is adoption.

Forget about the risks of competition for a second, the most immediate concern is getting customers to adopt AI and drive more growth for the business.

These are still early days, and every quarter analysts ask the same questions about whether the tools are gaining traction, how many pilots there are, how many are converting to production?

But most of UIPath customers are not at the frontlines of AI adoption. They are trying to figure it out themselves. Selling them on these new tools is taking time.

UIPath agentic solutions aren’t material to revenue yet. On the last call they said it wouldn’t be until at least later this year (maybe longer?).

So instead, we are left with less concrete methods. They have 900 companies that are using UiPath to build agents. Some of these companies are doing experiments. Some of them have moved on to pilots. A few have converted those pilots into orders.

It gives a broad sense of progress, but without much in the way of firm numbers.

Which is why the stock is where its at. UIPath is not an expensive software stock because the market is saying we don’t know how this plays out and we want to see evidence that it’s going well.

UIPath trades at just under 5x price-to-sales. It trades at ~20x EV to cash flow. Neither are expensive for a SaaS based business if you know that revenue is recurring and will continue to recur.

But no one is really sure about that. Even in the next 12-months – average estimates are pegging revenue growth at 10%, If you told me it turned out to be 5% or 20% I wouldn’t be all that surprised.

And that is just the short term. The longer-term picture is even harder to pin down. And with the speed that AI is moving, I’m not sure how “long” long-term is?

The risk here is that AI just takes over more of these tasks.

As AI gets better, it could simply watch a human do a task once or twice and generalize that into an RPA workflow that it builds itself. Or a developer could just get AI to build out a python script to generate automation. Given that AI is very good at code, it may be able to do all this while bypassing UIPath.

Albeit it’s hard to imagine how that looks. But a few years ago, it would have been hard to imagine asking a computer to write a book or create a movie based only on a prompt. Yet here we are.

An even longer-term risk comes from artificial general intelligence (AGI). Definitions vary, but one reasonable assumption is that even a rudimentary form of AGI would be exceptionally good at making simple tasks faster and cheaper.

I honestly don’t know how to handicap that. And to balance it against the same thing that trips up open-source solutions today: you still need orchestration and control by a human being. Does UIPath win? Or lose?

For now, all this uncertainty is far enough down the road that the market doesn’t care. But it does put even more pressure on each data point, i.e. each quarter results.

Which makes the near-term story less about disruption and more about adoption. If UIPath can begin to convert early interest in AI-driven automation into deals and growth, the stock could become the next AI winner.

Just keep an eye on the future, because it could quickly turn that story on its head.