Articles

See All

The Sweet Spot for Gold Investors

Gold hit US$2500/oz last week—a new all-time high. The cheapest part of the gold market is junior developers, which are trading at 0.45x price to net asset value. The average historical ratio is twice that. It’s been a long bear market for gold stocks, which means the upside potential in junior – the more leveraged of the lot – in a real gold bull market is BIG.

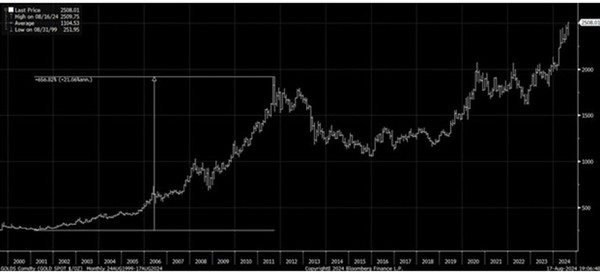

Gold is clearly in a bull market. The yellow metal is up 90% in 5 years, including 23% already in 2024, and there are lots of reasons to think it will jump again this fall. Here’s a 25-year gold chart from VIII Capital that shows when gold moves, it moves BIG:

And while the price of gold is now rising, cost inflation is finally coming down—so profit margins across the board are stabilizing and/or increasing.

So if a rising tide will finally start to lift all boats now, where is the Sweet Spot for gold investors?

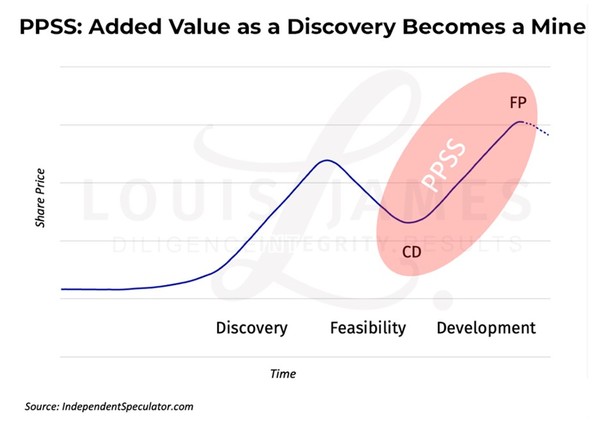

My colleague Lobo Tigre of the Independent Speculator www.independentspeculator.com, @duediligenceguy) did some original research that shows there is a Pre-Production Sweet Spot (PPSS) for investors, backed up by some real numbers.

What he dubbed the Pre Production Sweet Spot is the last, upward slope of the famous “Lassonde Curve” right before production.

And the numbers back him up: after assessing 124 first-mine-building companies stretching back to the 1980s, Lobo Tigre found that 95% of Construction Decisions successfully reached First Gold.

His study found that the average gain from construction decision to first gold was 111%.

That’s a risk-return setup I can get behind! And those cases occurred across a range of gold markets. The average PPSS gain during gold bull markets was 132%.

That’s one big reason why I like West Red Lake Gold (WRLG-TSX / WRLGF-OTC) right now. They’re going into production within a year. They have raised over $100 million in the last 18 months to ready their 60,000-oz-per-year Madsen Mine in Ontario, in a time when few juniors could raise money. (That’s my estimate at annual production; as I’ll explain, WRLG is about to issue an official mine plan with that number.)

This is a past producer—that ran 9 g/t gold! That was 30 years ago. Then this past cycle, a company called Pure Gold tried to get it back in production, spending over $350 million on a new mill and a lot of infrastructure.

But a combination of COVID, being constantly under-capitalized, and a couple management decisions forced it back into care & maintenance in late 2022. As a result, CEO Shane Williams and financier Frank Giustra were able to buy Madsen & surrounding deposits for only $6.5 M cash upfront, a 1% NSR, and some stock.

(Shane was COO of Skeena Minerals (SKE-TSX) as it went from $3 – $10 and before that VP Operations for Eldorado Gold (ELD-TSX) leading the build of 3 major gold mines.)

Madsen is an asset that has now had $500 M spent on it, with almost all infrastructure still brand new and production permits in place. All Williams and his team have had to do is put the finishing touches on what others spent big capital on.

The main reason Pure Gold fell down was that the rock they mined didn’t have the gold grade they expected—from a lack of infill drilling to really know where the gold was.

Williams and VP Exploration Will Robinson have made infill drilling Job 1, to get everyone’s confidence up in the mine plan at Madsen. In the last year they have hammered the parts of the deposit they plan to mine first with tightly spaced drilling.

Huge amounts of infill drilling core from Madsen Mine

The mine engineering team have taken all that data and planned out over a year’s worth of mining areas – stope defined mineable inventory, in shop talk.

Investors have not yet recognized WRLG as a Pre Production Sweet Spot opportunity. I think a lot of people still think of Pure Gold here, and WRLG has pushed Madsen towards production so quickly that investors haven’t kept up.

Another reason for this: the company hasn’t yet issued an official mine plan. It takes a long time for external consultants to produce those detailed studies. Lacking that study, the market hasn’t understood how quick this mine will turn on again.

But I understand. And I think the market will catch on soon, because a pre-feasibility study is imminent. It should be a strong plan, with very modest capex left to spend (because the company has been funding restart work for a year already) that should lead to a high rate of return.

I think this study will highlight West Red Lake Gold Mines as a rare Pre Production Sweet Spot story just as investors are scrambling for exposure to gold.

So there will be a steady stream of catalysts for investors to get excited about here.

I follow this story really close (yes I’m long), and they were a client of mine a couple years ago. I haven’t touched on the high grade drill results previously pulled from the 8-Zone at depth at Madsen, which could put a new look on both profitability and Life-Of-Mine (LOM) here—or the crazy high grade results (296.8 g/t gold over 1 metre, 42.4 g/t gold over 3 metre, 118.3 g/t gold over 1 metre, and 56 g/t gold over 1 metre are some of the best) at the Rowan deposit several miles away.

LAST POINT—always remember, the most precious commodity is PEOPLE. Williams heading the ops team and Giustra on the finance team have great success behind them. The stock is very liquid, but still close to the same price it was when they took over WRLG. It has yet to have its First Big Run. I think the new PFS—Pre-Feasibility Study—will be the catalyst that starts its move.

Jill Christmann, chief mine site geologist of West Red Lake Gold

Keith Schaefer