Articles

See All

HERE’S THE OPTICS ON DRUCKENMILLER’S NEW AI STOCK

TICKERS MENTIONED:

AAOI-NASD APPLIED ELETRONICS

COHR-NASD COHERENCE

LITE-NASD LUMENTUM

IFN-NASD FABRINET INC.

NVDA-NASD NVIDIA

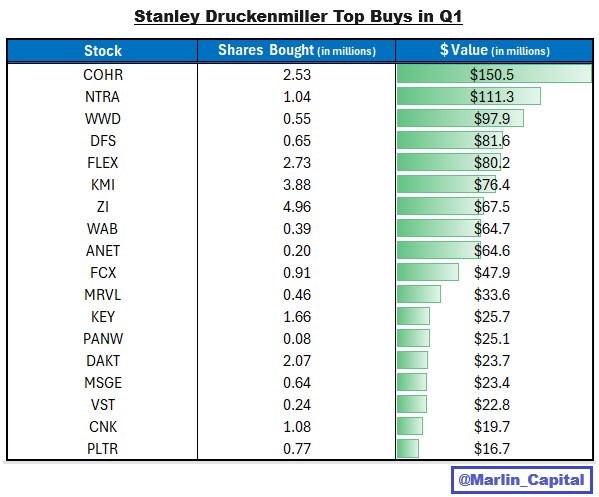

Stanley Druckenmiller is one of the most famous—and successful—investors of the last 40 years. So when he makes a big investment in an AI stock—Artificial Intelligence—it’s worth figuring out WHY.

AI is the one theme—main theme? that works in this market. But all these stocks have had BIG runs—so what is Druckenmiller seeing? Finding new beneficiaries from the AI ramp is getting harder.

It’s a pick-and-shovels play on DATA, and the amount of data that the world is processing every day is going up EXPONENTIALLY right now—see charts and statistics below.

Druckenmiller has purchased a large amount of Coherent Corp (COHR – NASDAQ) to his Duquesne Family Office fund.

Source: X.com

Coherent designs and manufactures optical transceivers. These are devices used to convert data so it can be transferred via fibre cables. This is a HUGE deal, as fibre optics is MANY TIMES FASTER than copper.

Fibre has been used for years by the telecom industry to move data, but is being adopted more and more by datacenters looking for higher speed and more bandwidth.

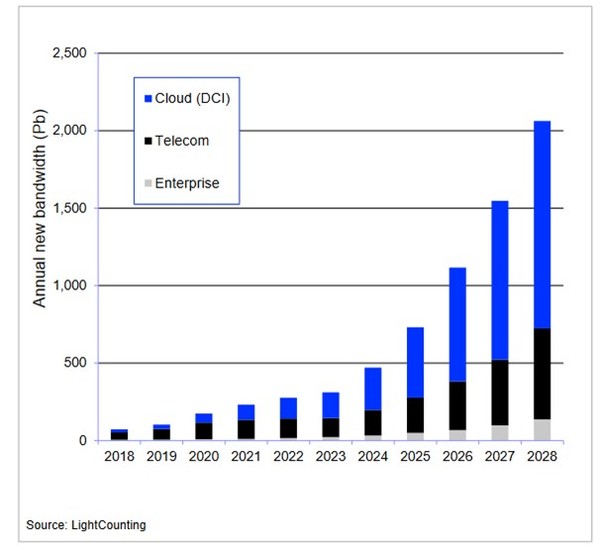

The bullish case for optics is simple. Global annual bandwidth, a measure of how much data is being transferred around the world each year, is increasing exponentially. It is likely to accelerate even more as AI catches on.

Source: Coherent OFC 24 Presentation

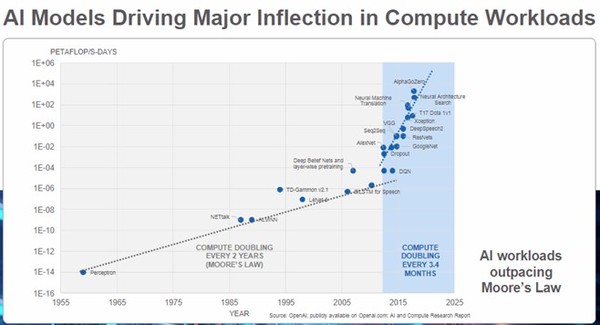

We are moving so fast that even Moore’s law has been repealed. Moore’s Law states that the speed of computation should double every two years. That held true for 60 years, but now it has broken out to the upside. Compute is doubling every 3 to 4 months!

Source: Lumentum Technology Event Presentation

Optics should be a big beneficiary of increasing data usage. Fibre is the most efficient way of moving data. It is way more efficient than the alternative – a copper wire.

Putting that all together, anyone selling optical solutions should be a no-brainer, right? There should be years of growth ahead.

I do believe that’s the case. Yet, the optical players must be the most complicated no-brainer I have ever come across.

Indeed, the market remains skeptical. A big ramp in optical transceiver demand was supposed to happen last year, and investors were burned when that didn’t materialize.

The three biggest publicly traded transceiver suppliers, Coherent, Lumentum (LITE – NASDAQ) and Optoelectronics (AAOI – NASDAQ), are at best back to year ago levels and at worst far below them. Only one, Fabrinet (FN – NASDAQ), which has been the supplier of optical transceivers to Nvidia, has been able to buck the trend.

Yet if you listen to what these companies are saying on recent calls, those big ramps from their datacenter business will begin in the second half of this year.

If that’s the case, then maybe Druckenmiller is early (as usual), and we are about to go on a big run.

HOW LIGHT—OPTICES—

COMPETES WITH COPPER

And the Head Fake that NVIDIA Gave Investors

The main impediment to the growth in optics can be summed up in a word: copper.

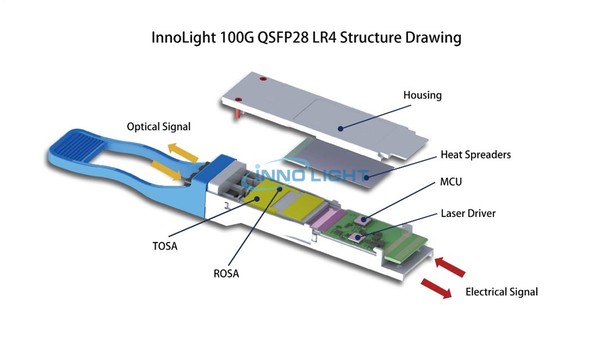

Optical transmission, sending data over fibre cables using light waves, is complicated. You have to convert electrical signals to light signals, come up with complicated algorithms to transmit different wavelengths of light at the same time, and do a bunch of processing to boot.

All of this is done in a small device called a transceiver that plugs into the edge of a circuit board.

Source: FS.com

Inside a transceiver there is a small circuit board, chips like DSPs (digital signal processes) and a laser to create the light pulse.

Source: FS.com

Even though a transceiver looks like a complicated device, there are many optical companies that make transceivers. Competition is fierce.

Tying this back into copper, adding transceivers to your server or rack so that you can transfer data via fibre is always going to be more expensive than adding a simple connector and copper cable.

As hedge fund manager Gavin Baker puts it, “copper when you can, optics when you must”.

Source: X.com

We saw this play out at Nvidia’s (NVDA – NASDAQ) GTC conference in late March. Nvidia sent a shock to the optical world when they said they would use more copper in their newest AI computing systems.

According to IBD, “Nvidia noted that using copper instead of optics saves 20 kilowatts of power per server rack.”

Over the next month the optical stocks sold off on the worry that there would be less demand for transceivers. Fabrinet (FN – NASDAQ), which is Nvidia’s primary supplier of optics, dropped from $226 to $160. Lumentum went from $52 to $41 while Coherent went from $65 to $49.

But Nvidia’s comments were misunderstood. The reality is that optics are actually better for power consumption than copper.

But why did Nvidia say the opposite?

It turns out that Nvidia is in a unique situation where they can tweak their server board design to use more copper for the moment. But it doesn’t change the need for optics in the long run and it doesn’t even mean Nvidia will be using any less optics in their new servers.

To make more copper work, Nvidia used more liquid cooling technology on their GPUs. Using liquid cooling allowed them to put their GPUs closer together. If you can put your components close enough together, it makes sense to use copper to connect them.

As Evercore ISI analyst Amit Daryanani said, “A key enabler of using more copper is liquid cooling, which allows more GPUs (graphics processing units) to be packed into a single rack”.

But this only works for so long. Copper is eventually going to run into trouble. The gotchas of copper are:

- Distances getting further apart

- Data rates increasing

- A combination of A and B

The entire history of optics is one of fibre replacing copper cables at the longest distances and highest speeds and then working its way in.

The original market for fibre was telecom, where companies like AT&T (T – NYSE) and Verizon (VZ – NYSE) needed the fastest way to get large amounts of data across cities, countries and oceans.

But as datacenters get bigger and the volume of data increases, speed becomes more important even at short distances. Today fibre is used to connect datacenters to one another, to connect racks within a datacenter, and to connect servers within a rack.

That Nvidia is using more copper because they have figured out a clever way of putting their GPUs closer together comes as no surprise. Nvidia is going to do everything they can to use copper “when they can” because copper is cheap.

But its a fight against time. Higher data rates and demand for higher power GPUs will continue to favor more fibre, less copper over time.

In the meantime, other factors are at play that could make optical demand grow even as companies like Nvidia try to squeeze a bit more out of the legacy metal.

THE REFRESH CYCLE

While Nvidia talks up their use of copper, the reality is that copper went up, but optics did not go down.

In fact, Coherent pointed out shortly after GFC24 that the new Nvidia products would actually be using more optical bandwidth.

Data is increasing too fast, which demands more fibre! On top of that, the sheer number of datacenters looks like it will drive optical transceiver demand higher beginning in the second half of this year.

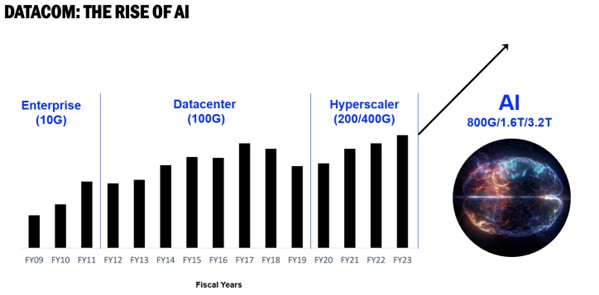

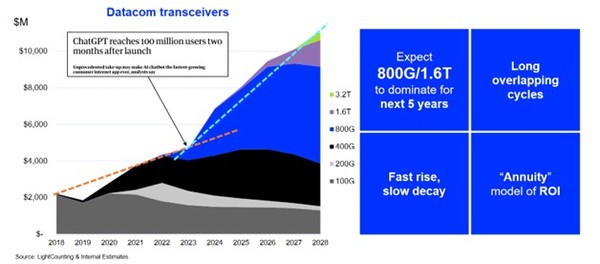

Optical transceivers go through product cycles. Every subsequent generation of optical transceiver provides faster transmission, which is measured in Gb/s (G).

15 years ago, transceivers transferred data at 10G. That increased to 100G beginning in 2012. The last cycle was 200G/400G speeds. These are now on the verge of being replaced by 800G/1.6T transceivers (the Nvidia products on display at GFC24 used a combination of 800G and 1.6T optics).

As the product cycle to 800G and 1.6T transceivers takes hold, the overall $ value of the optical transceiver market will more than double over the next few years.

Source: Coherent OFC 24 Presentation

While for the last year Nvidia has been shipping products that use 800G and will begin shipping 1.6T products later this year, the inflection for the rest of the datacenter industry has yet to happen.

Many analysts thought that it would happen last year, and they were wrong. But there is growing evidence it is on the verge.

Last quarter, Coherent said that over 50% of their fiscal ’24 revenue will be from AI datacenters and demand for 800G products. Coherent expects their 800G shipments to double quarter-over-quarter in Q2. From H1 to H2, Coherent expects 800G revenue to increase by roughly 3x.

Lumentum said on their last quarterly call (in May) that they expected “initial volume shipments of 200G/lane components and related 800G/1.6T transceivers to begin in H2 CY24” and that they would be “disappointed” if they didn’t “more than double datacom business” in FY2025 from their Q3 run rate.

Applied Optoelectronics disappointed investors with their Q1 results (not the first time) when they pushed out the datacenter ramp from Microsoft (MSFT – NYSE) – their primary customer – until Q3.

But Applied Opto CEO Chih-Hsiang Lin gave a shockingly upbeat forecast of a $500-$600M annual run rate for their 800G products over the next couple years – which is a HUGE number if you consider that Applied Opto’s entire business did $217M of revenue in 2023.

Finally, Fabrinet, which is a bit different beast than these other names for a couple reasons. Fabrinet is a contract electronics manufacturer (CEM), meaning they do not design and manufacture their own transceiver brands. In addition to transceivers, Fabrinet is an CEM for auto components and medical devices.

Second, up until recently Fabrinet was the single source CEM for Nvidia’s transceiver components. They are already benefiting from Nvidia’s amazing ramp. In Q1, Fabrinet said their datacom revenue was up 150% year-on-year and up 6% quarter-on-quarter, presumably on the shoulders of Nvidia.

But Fabrinet is the outlier. The rest of the sector is only starting to see demand ramp up.

THE LONG GAME: FIBRE FOR THE WIN

Fibre transfers data at the speed of light. Nothing is faster. While copper cables max out at around 10G, the current optics are 80x that speed, and that is soon going to increase to 160x.

For now, slower copper cables and traces are fine for the shortest distances, which Nvidia told us in March. But a time will come where even those very, very short distances are better suited for optics.

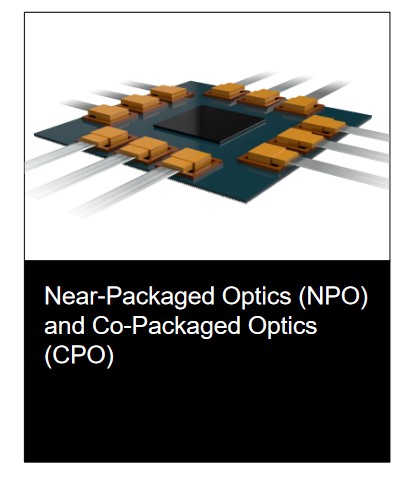

Coherent and Lumentum are already talking about the next-gen of optics. This is truly revolutionary, as optics will begin to replace copper right on the chip.

Source: Coherent OFC24 Presentation

Near-package optics and co-packaged optics would put optics right next to the device, essentially removing the use of copper entirely from the board design.

Producing these products at scale may still be a few years away but the trend is clear.

AI has made the switch inevitable. The bottleneck of GPUs is data transfer – from the GPU to memory and from GPU to GPU. All that parallel processing consumes time. That time is dramatically reduced when you start using optical interconnect.

The second driving force for optics will be attenuation. Copper is an electrical signal and over distance that signal degrades. As data volume increases, this becomes more problematic for copper. In fibre this doesn’t happen. The signal remains up and running for the entire process.

Third, optical interconnects require far less power than electrical connections, especially over long distances. Yes, Nvidia says their copper usage is going to reduce power consumption. But that is really slight of hand and clever design using liquid cooling.

In other words: it’s the PHYSICS! Fibre wins because the physics of optics is simply superior. For now, because copper is cheap companies will use it when they can, but over time the speed and power benefits of fibre will win out.

WHAT HAVE YOU DONE FOR ME LATELY?

While the long run makes a great story, it is the short run that makes money.

In the short run the optical transceiver companies are telling us we are in for a replacement cycle. Yet the market is completely discounting what these companies are saying.

Let’s go through what the three large stand-alone optical transceiver companies are telling us.

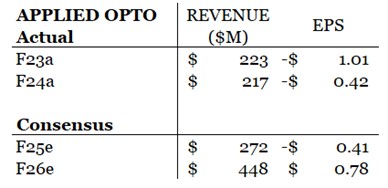

APPLIED OPTO-ELECTRONICS

Applied Opto-electronics CEO Chih-Hsiang Lin said on their first quarter call that their 800G business alone should do annual revenue of “more than $500 million or even $600 million in AIO” based on their current outlook.

Applied Opto is the smallest of the publicly traded companies in the space. It has been hit the hardest by the slump in telecom demand and the slower than expected uptake of 800G last year.

No surprise that analysts are skeptical of Applied Opto but the disparity is huge. While the CEO of Applied Opto is giving $500M to $600M guidance, analysts are barely above $400M in their F26e estimates.

Source: Alphasense

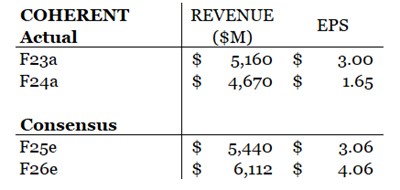

COHERENT

As part of their OFC 2024 presentation, Coherent said that they expect 800G to ramp to half of their revenue over the next couple years. Coherent was recently named a second source supplier on Nvidia’s AI compute systems, which had previously been sole sourced by Fabrinet.

Source: Coherent OFC24 Presentation

Lee Xu, VP of Datacom Transceivers at Coherent, said that they expect to double their datacom revenue in the next few years.

Today, Datacom is about $400M per quarter for Coherent. Doubling that would add $1.6B of new revenue from their Datacom segment alone.

Analyst estimates are again much more sanguine.

Analysts are projecting 16% growth for fiscal 2025 (ends June) and 12% for 2026. 2025 estimates are marginally above Coherent’s 2023 results.

Source: Alphasense

If Coherent adds $1.6B to their Datacom segment, that would be more revenue from Datacom alone than analysts are estimating – and that is before taking into account any return to growth from Coherent’s telecom business, growth from their instrumentation business, any contribution of 1.6T transceivers, or growth from any of their other businesses (Coherent is launching their own DSP chips which should add to revenue in the coming years).

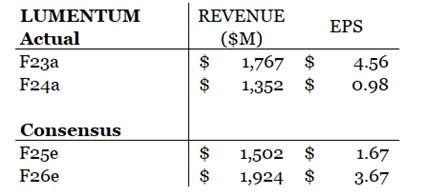

Lumentum is the other big player in the transceiver space. They are projecting a similarly rosy forecast for their transceiver business.

CEO Alan Lowe said just last week that Lumentum “should exit calendar ’25 at $500 million” per quarter and that they forecast revenue “longer term getting to, say, $600 million a quarter”

Yet analysts aren’t baking these numbers into their estimates. Analyst estimates peg Lumentum well below a $500M run rate for F26.

Source: Alphasense

SOMEBODY IS GOING TO BE WRONG

One of two things is going to happen.

- These companies are going to be wrong (again), and their anticipated ramp is not going happen

- The ramp they are expecting is going to happen, analysts will have to raise estimates, and the stocks are going to go up

I’m not going to weigh in on which is going to be true. On the one hand, these companies should know their business. On the other, they have been wrong before.

There are other considerations. The telecom sector, which is the other big source of transceiver demand, is mired in a slump and is unlikely to recover until 2025 at the earliest.

Nevertheless, telecom is riding along the bottom and unlikely to eat into growth any more than it already has.

The optical transceiver business is a cyclical business. It certainly sounds like we are on the upswing of the next round of datacenter demand.

We also have a secular tailwind from MORE DATA. Which is like having a strong wind at your back.

Finally, there is Druckenmiller. Who has a habit of getting in early on these sorts of plays. It is never a bad bet to be on his side.