Articles

See All

Inside: 1 of my Top 3 Picks for 2024

It’s not 2024 yet–but I’ve been thinking where do I put my time, attention and MONEY next year. After two years of a bear market in small & micro-cap stocks, I think 2024 will be a GREAT year–lower interest rates, more “risk-on” sentiment and low valuations will all work in investor’s favour.

My Top 3 picks for 2024 include two small-cap NASD stocks, and one TSX-listed stock up in Canada. None are commodity plays; all are companies that I expect to have HUGE jumps in EBITDA throughout the year, with all three of them reaching positive cash flow in the first half of the year.

I outline one of them for you right here–MYOMO Inc. This stock has jumped from my original purchase of 83 cents to $4.50 recently–after they received approval in the US to be covered by Medicare (CMS) for their myo-electric arm brace. This brace is a huge improvement in the quality of life for stroke victims, people injured in accidents, and others with prosthetics, Parkinson and other nerve disorders.

I think there’s another 5-bagger in it from here. They have built up a $20 million a year business BEFORE they got CMS approval in November (which takes effect in 2024).

It’s a very empowering device for people injured in accidents, who have strokes or develop conditions affecting nerve endings.

Here’s my original subscriber notice on Myomo.

This gives you an idea of the type of small-cap research we offer. After reading this, reach out with any questions to keith@investingwhisperer.com.

If you want our full updated report on MYOMO–just being completed now after an in-depth talk with CEO Paul Gudonis–please email jenn@investingwhisperer.com with the Subject line: Please Send me the updated Myomo report!

PORTFOLIO PURCHASE:

MYOMO MYO-NASD

I have purchased 30,000 shares of MYOMO MYO-NASD at 83 cents per share.

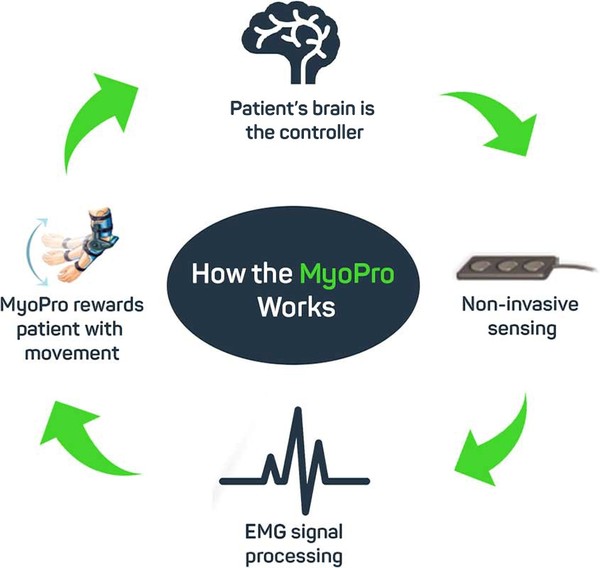

Myomo makes and sells an electromagnetic arm brace, (picture below) that picks up brain signals and allows people to have some controlled movement in their paralyzed arms.

This is leading edge tech! And it’s FDA-cleared in the US and CE Mark (Europe) approved. They cost US$43,000, which isn’t cheap, but revenue was US$15 million in 2022 and is expected to be US$18 million in 2023 — 20% growth. Backlog is growing more.

They have US$9 M cash, no debt and net cash burn is about US$1.5 million per quarter. The Big Catalyst — every junior stock needs a catalyst to go up; just having a good story and being cheap is not enough—is that it could receive US health insurance coverage in late Q4.

MyoPro is working with CMS—Center for Medicaid and Medicare Services — to get this covered not as a DME — Durable Medical Equipment — but under a new designation. If this works, the stock will quickly rerate much higher. Though it’s possible CMS only gives them partial payment. There is a small chance this doesn’t happen until early 2024 as well.

There are several insurers in Europe — especially Germany — who now cover their Myopro product.

So this is a working product, a real business that serves a real need like nothing else — and it’s cheap. And in health care stocks, it’s all about US insurance. The Street rarely cares about junior biotech or medical device stocks unless they are covered by US insurance.

With 20 M shares out, the market cap is $16 million at 80 cents and $9 M cash = EV of $7 million.

The fundamentals support my purchase price here, and the US insurance catalyst gives me a 3 to 5 to 10x upside.

Only one broker covers the story and you can find that in the Members Forum under Keith Musings. It’s a detailed initiation report and if you like this story as much as I do, please go read it. Other than me getting us a call with management (I’m working on it!), I can’t tell you the story any better than that report does.

Source: Company website

Source: Company website

The technology was developed at MIT and Harvard Medical School. It picks up weak nerve impulses from the brain and allows the patient to move elbow and wrist. It gives a much more precise movement than spring loaded braces. MyoPro does a cast of each patient and it’s a custom fit.

They were selling through orthotics distribution channels, but since 2019 have been selling direct and working with patients directly to get insurance coverage — with some success, as revenue numbers show.

It’s estimated that just over 1.5% of people in the US-more than 5 million people live with some form of paralysis. It could be stroke, spinal cord, cerebral palsy or multiple sclerosis or an accident of some kind that causes this.

A pediatric version of their product is expected to get approved by the US FDA in early 2024.

MYO is also going international now, with an initial license fee in China received and China’s FDA is expected to approve it late 2023. Australia’s National Disability Insurance Scheme or NDIS, recently started paying for MyoPro.

Source: Stockwatch.com

You will see the stock got CRUSHED in the last 18 months-$13 to 35 cents. The explanation I got was:

- 2022 a horrible year for anything small cap or health care related

- Moving forward on CMS approval (US insurance) stalled

Sales growth stalled as they switched business models to more direct selling and not so much via distributors.

Now, both product sales and backlog are increasing, and international expansion looks a bit stronger, and two small cap funds have given them enough money to make it through to the promised land of US insurance coverage.

The stock did nothing for a couple months, then moved up to $1 in September and as the company press released that their MyoPro product had been re-imbursed by smaller, regional, baby-CMS companies, the stock took off as investors quickly priced in full CMS, nationwide approval before the actual CMS date on Nov. 29, 2023.

Myomo is now gearing up for a huge growth year in 2024. They have a long list–going back years–of many many patients who will now be covered for a MyoPro arm brace. I see a great year ahead for Myomo–and the two other Top Picks I have for 2024.

In fact, one of these two top portfolio plays has a very near-term catalyst happening on January 18. If it goes the way I think it will, the stock could run – and run FAST.

The second of these two plays is one of the most exciting plays I’ve ever seen — a “SaaS in Space” company that’s enjoying LOTS of good news and should be cash-flow positive very soon.

To learn how you can access my full research on these 2 Top Picks for 2024, follow this link.

Keith Schaefer

P.S. Shares of Myomo have been on a terrific run the last 30 days, and I still see potential for 5X returns from here as news flow ramps up. I’ll share more research on the company in upcoming Whisperer stories. But to really get your 2024 off to a flying start, I strongly recommend you learn all about my other top two small cap plays, which you can do — risk-free — right here. Click here for access.