Articles

See All

Will Retail Investors Get To See The Sun Shine On This Solar Glass Play?

One of the most interesting industrial mineral plays I’ve ever seen is getting ready to launch. Canadian Premium Sand (CPS-TSXv)has a super-high quality sand deposit—that can actually be too good for frac sand.

Their sand is good enough to be used to make glass for solar panels—and the Market is keen to have a North American sourced solar supply chain.

The pro-forma economics on this project—in Manitoba—are stellar—over CAD$170 million of annual EBITDA.

But like all juniors who want to be producers—the cost of building their asset is HUGE—almost CAD$900 million. How does an illiquid stock with a $50 million market cap raise that money and keep investor interest up during a 2 year construction period?

CPS plans to build:

- A sand mine

- A sand processing facility

- A glass manufacturing facility

Like I said, this could cost some $900 million. With just a $50 million market cap, and a very illiquid stock, they can’t do that in a simple equity raise. And of course, the cost of debt has skyrocketed.

But they do have offtake already arranged with THREE big groups. For a project this size, everyone does A LOT of due diligence, so that’s a very validating factor—and a big potential source of funding.

Even at $900 million capex, the project will still be very economic. Project economics are:

- $300 to $330 million of annual revenue

- $170 to $190 million of annual EBITDA

- Greater than 18% unlevered before-tax IRR

In May, CPS signed up an EPC consortium (Engineering Procurement Construction) for construction of the project. Well known firms PCL Constructors Canada Inc. and Henry F. Teichmann firmed up the pre-construction design. They agreed to a guaranteed price cap of $880 million.

How they raise the money they need without diluting shareholders too much?

This is one of those stocks with big risk, big reward. Solar glass is a huge growth market and with the move to onshore, a North American source would put CPS in the catbird seat.

But getting from A to B – and doing it without the share count going through the roof – well, I wonder that they can pull it off.

A BOOM FOR…. SAND?

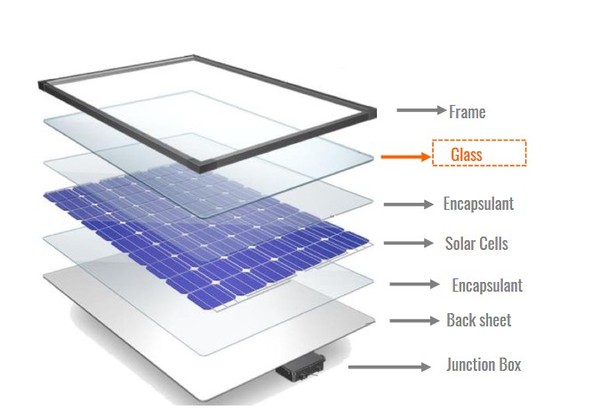

High-grade silica sand that is. This is a very specific type of sand used to make the glass used in solar panels and smartphones.

It is specially designed to transmit a high percentage of sunlight. It is also made to protect the rest of the panel materials against things like dust, moisture and fluctuations in temperature. It has to be strong – being hail resistant is a big concern for solar panels.

Source: CPS Investor Presentation

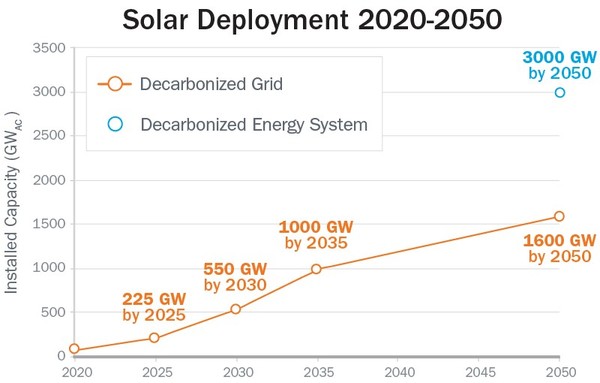

The growth of solar glass follows the growth of solar. And solar demand seems almost certain to grow.

Source: Department of Energy Solar Futures Study

A 2022 report from ReseachandMarkets.com expects the global solar PV glass market to grow at a 28% CAGR until 2027.

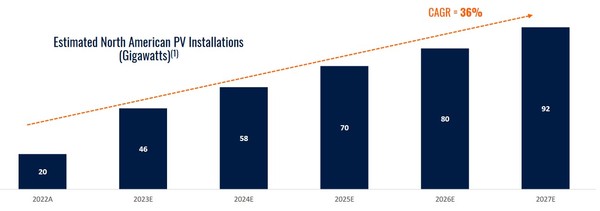

The North American solar installation market is estimated to grow even faster – the Solar Energy Industry Association (SEIA) pegs growth at 36% between 2023 and 2027.

Source: CPS Investor Presentation

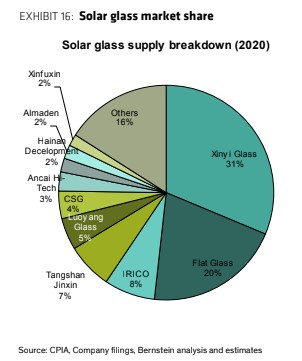

Today almost all solar glass comes out of China. Two companies, Xinyi Glass and Flat Glass make up over 50% of supply. A number of other mostly Chinese companies make up the rest of the market.

Source: Bernstein: Investing Along the Solar PV Value Chain

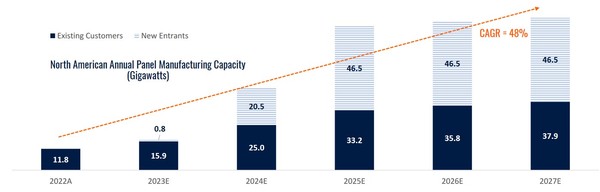

Because of United States reshoring, panel manufacturing capacity in North America will grow even faster than solar demand itself. The Inflation Reduction Act (IRA) incentivized materials sourced in North America.

Source: CPS Investor Presentation

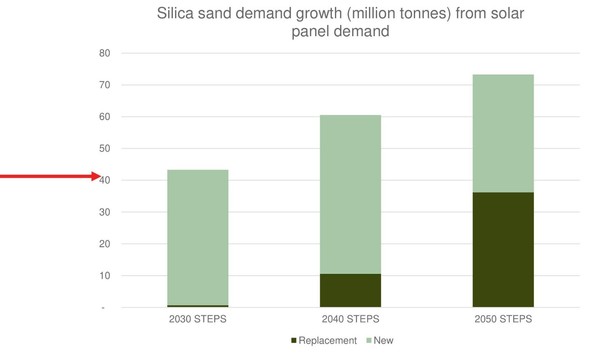

The demand for solar panels is going to drive demand for sand.

Source: Cape Flattery Silica Noosa Mining Investor Conference

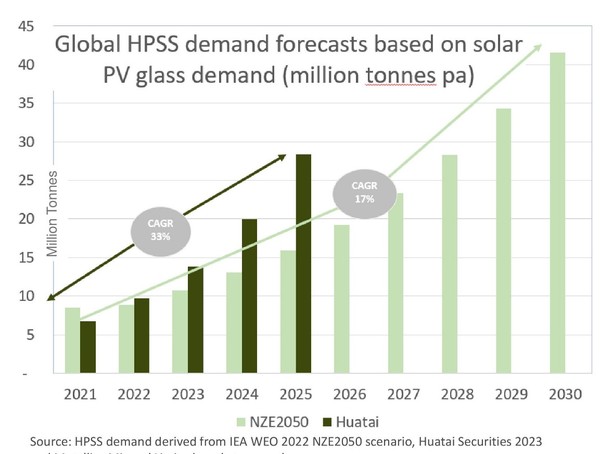

So far, demand for glass for solar is exceeding IEA projections.

Source: Cape Flattery Silica Noosa Mining Investor Conference

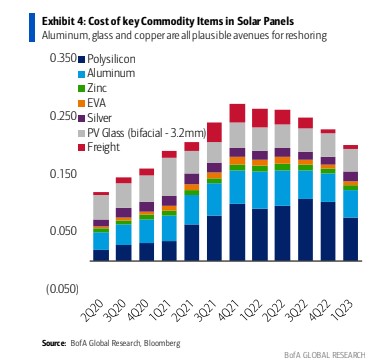

Glass is not the driving factor behind the cost of a solar panel. The cost of the glass on a two-sided panel (called a bifacial panel) averages between 10-20% of overall panel cost.

Source: Bank of America

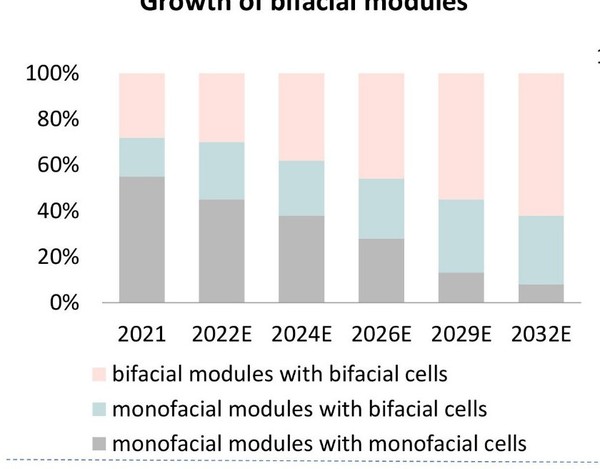

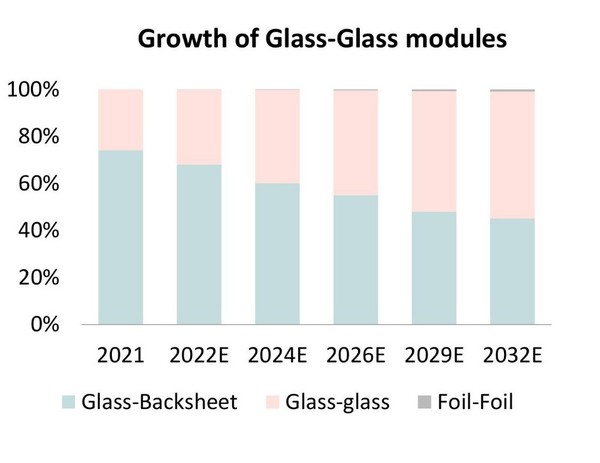

Several factors will influence demand growth – mostly to the upside. The growth of “bifacial cells” (cells that can capture sunlight on both faces) doubles the glass required for each panel.

Source: ITRPV 2022

A second driver is growth of glass-to-glass modules. This involves replacing the backing on a monofacial panel with another pane of glass.

Source: ITRPV 2022

The biggest restraint on demand will come from technology. Engineers are figuring out how to make the glass thinner.

Today over 60% of the glass is 3mm thick. Most of the rest is between 2-3mm. Those percentages are expected to flip by 2030 while newer technologies could reduce glass thickness below 2mm.

NORTH AMERICAN ADVANTAGE

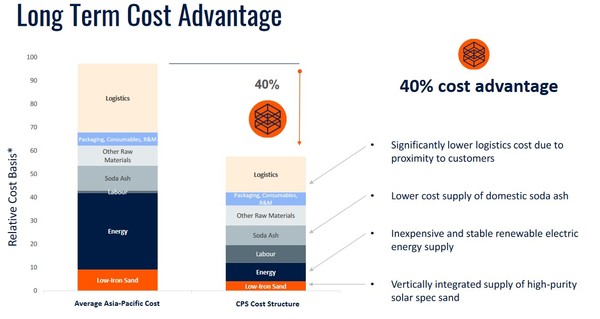

Worldwide, the solar glass market is going to grow. But North American glass production will see an added growth kicker because of important cost advantages.

- Logistics Cost

- Energy Cost

- Vertical Integration

Source: CPS Investor Presentation

Reduced logistics cost is the biggest advantage. Chinese producers bring in sand by boat (from the Middle East) and then, for North American panel producers, will transport finished glass to solar panel manufacturers via another ship ride.

Transportation is expensive because glass weighs a lot. Solar glass is about 70% of the weight of the entire panel.

A Manitoba location simplifies logistics. Rather than costly trips across the ocean CPS will be shipping by rail or truck to panel factories.

Source: CPS Investor Presentation

A second advantage is Manitoba’s hydroelectric power. A main, high voltage line runs just a kilometer away from the facility. The cost of power in Manitoba is typically among the lowest in North America.

That power is also clean. Existing glass supply from China comes from pickling, which is costly and has environmental issues. Being able to produce power with a low-carbon footprint is important to CPS’s panel customers.

MANITOBA SAND

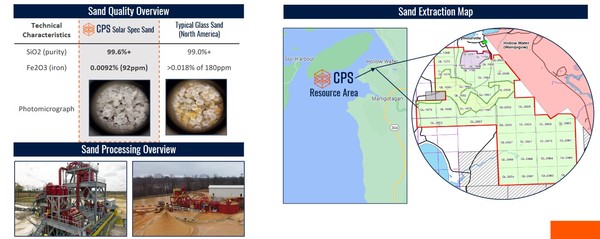

The third CPS advantage is the deposit. CPS is planning a vertically integrated operation pairing its high quality sand deposit with solar glass manufacturing.

The sand resource is off the east shores of Lake Winnipeg. The deposit contains an extremely high purity silica dioxide sand.

Source: CPS Investor Presentation

The deposit grade compares favorably to other deposits being pushed ahead (mostly by Australian companies).

The CPS sand has higher SiO2 purity and lower iron oxide impurities than accepted global specs of >99.5% SiO2 and <100 ppm of iron oxide.

PROJECT ECONOMICS

CPS expects to produce 800 tonnes of solar glass each day—enough to supply the glass needed for 6 GW per year of panel production.

Building the project is expected to cost $880 million. It will be financed with a combination of debt and equity. CPS management is ballparking a 50/50 debt/equity split.

Some cost relief could come from the recent introduction of the Clean Technology Manufacturing Tax Credit. This credit covers 30% of machinery and equipment cost. Management estimates this could reduce another $100 million from the total.

Other subsidies and credits could offset more costs. Low-interest loan programs and provincial grants could amount to as much as $200 million if they all go through.

The project is forecast to generate between $300-$330 million of revenue and $170-$190 million of EBITDA. The unlevered IRR is 18%. Future phase expansions will see better capital efficiency with unlevered returns of 25-30%.

PROGRESS AT SELKIRK

In September 2022, CPS contracted HFT and PCL as joint EPC contractors to conduct pre-construction design and engineering on the project.

Source: CPS Investor Presentation

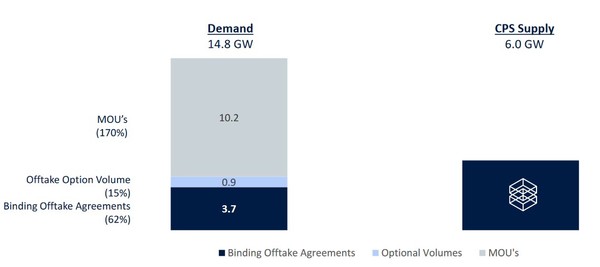

By May, CPS had reached commercial off-take agreements with 3 companies:

- Hanwha Solutions (the largest solar panel manufacturer in NA)

- Heliene (a Canada-based company with a panel assembly facility in Minnesota)

- Meyer Burger Technology AG (which is building a 2 GW panel facility in Arizona).

Together this represents offtake for 62% of the output capacity. There is an option for these customers to take another 15%.

Including MOUs, CPS has demand interest for more than double their output.

Source: CPS Investor Presentation

AHEAD OF LOCAL COMPETITION

Also in May, CPS announced that the Manitoba government had issued an Environmental Act license to construct and operate the facility.

This puts CPS ahead of other projects proposed in Manitoba.

The Winnipeg Free Press reported in July that a German company, RCT Solutions, was proposing a plant of their own. The plant would make both the glass and the panel, and churn out 10,000 MW of solar panels a year, or 20% of the current North American market.

But this project is waiting on approvals from the Manitoba government and no timeline was given in the article. Another article from the Winnipeg Free Press said that this project is facing opposition from residents that worry it could “permanently damage the region’s primary water supply”, while Manitoba’s Clean Environment Commissions “is urging caution”.

It just shows that building these kind of projects – especially in North America – is not necessarily going to be easy. All this gives a leg up to CPS.

THE COMPETITION IS CHINA

There is limited solar glass manufactured in North American today. The only producer is a Japan based company called Noppon Sheet Glass (NSG). NSG manufactures a specific type of glass in Ohio for First Solar, US producer of solar panels that uses a unique technology called Thin Film. Thin Film technology is used in approximately 10% of all solar panel projects, whereas 90% utilize silicon based solar cells which is CPS’s target market..

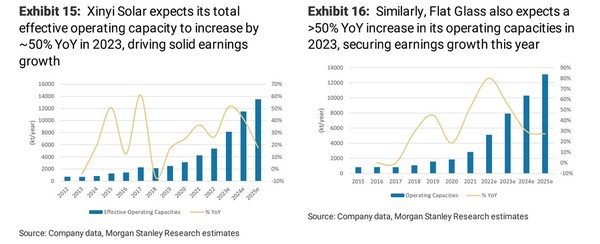

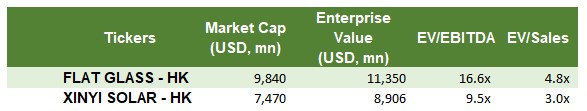

By far, the majority of solar glass comes out of China. This is a business of scale and two companies, Xinyi Solar (0968 – HK) and Flat Glass (6865 – HK) together have over 50% of the market.

Each has been growing their own production of solar glass significantly.

Source: Morgan Stanley Research

Flat Glass boasts a $77 billion market cap while Xinyi has a $59 billion market cap.

While Chinese equities make for tricky comps, I’d say that these companies trade at reasonable valuations given their expected growth.

Source: Sentieo

WHAT ABOUT THE STOCK?

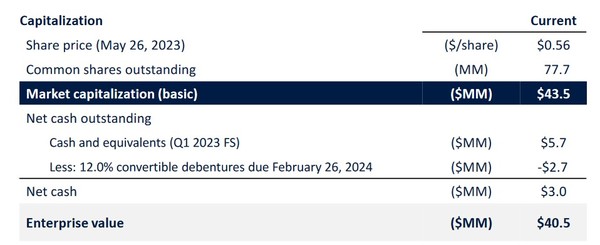

CPS trades a 50c. That gives it a market cap of under $50 million.

Source: CPS Investor Presentation

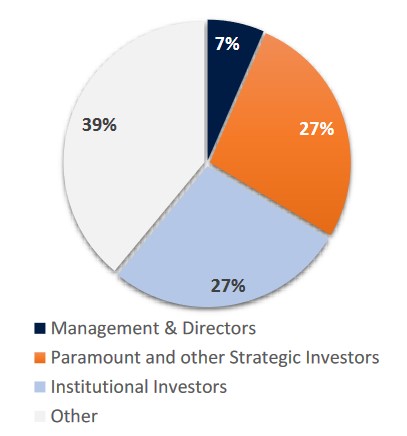

The stock is tightly held by insiders and large strategic investors.

Source: CPS Investor Presentation

Key investors include Mackenzie Investments, Paramount Resources POU-TSX, and Equinox Partners. Kelt Exploration founder David Wilson is also here.

I really wonder whether this project gets built in a publicly traded vehicle. It seems that this project, which is going to require large debt and/or large dilution, may be better off in the hands of big players with long time horizons.

The Venture exchange is the opposite.

CPS will have to raise $880 million to complete construction. While tax credits will bring that number down, working capital requirements will bring it back up again.

CPS is targeting a 50/50 debt to equity. At 50c that would mean significant dilution compared to what is outstanding. $400 million of equity would be 800 million shares – or about 10x the current outstanding shares!

CPS believes they can make the transaction accretive to existing shareholders. Maybe they can. But it is a risk until its done.

Participants in financing could be big names like Blackstone, their offtake partners or other solar glass manufacturers looking for a wedge in the North American market.

I asked management point-blank about the go-private option. They wouldn’t rule out the possibility.

It would make sense to me.

It could get done at a nice premium to the current price, making it a win for shareholders. In the grand scheme of project costs, spending a few extra bucks on a premium to the stock price is not all that significant.

That could be reason enough to hold the stock. But beware: this is a stock firmly in the “be patient” box. Not a lot is likely to happen until one day something big does.