Articles

See All

SOLAR ENERGY PAYS FOR INVESTORS…..This Junior Solar Developer Just Landed A MEGA SALE $200M++ (all cash!)

Junior solar developers are REALLY cheap–but not because of cash flow multiples. Multiples are much higher than oil & gas. But the take-out value of solar projects–because of their 25-40 year power contracts–is HUGE!

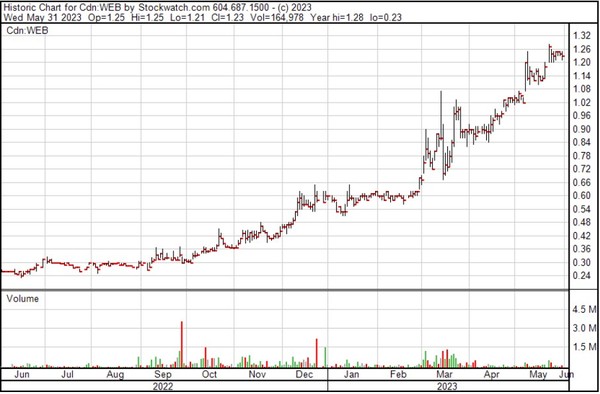

My largest position Westbridge Renewables (WEB-TSXv / WEGYF-OTC) proved that out this week.

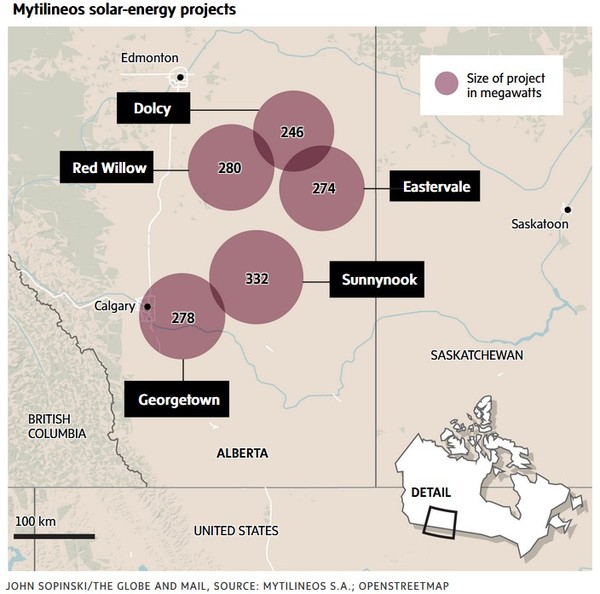

This week management surprised shareholders by monetizing FIVE of its early-stage solar assets in southern Alberta, totalling 1.4 GW or 1400 MW for CAD$217 – $346 million. CASH. At the bottom of that range, it works out to roughly 15.5 cent per watt.

The Market had been expecting a sale of just ONE—its lead Georgetown asset. Alberta is a premium solar market not just for weather but also—it and Ontario are the only Canadian provinces to de-regulate power prices, and they are 3rd highest among the 10 provinces (see chart at bottom).

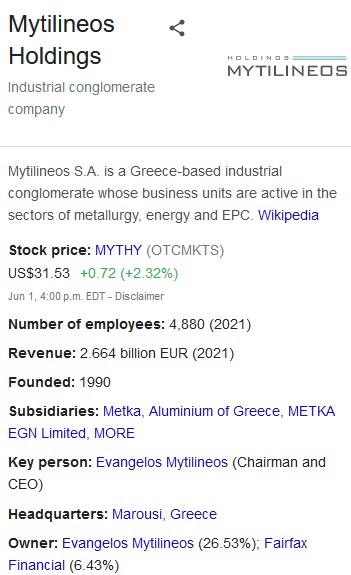

This deal is announced but not closed. The buyer is Greek conglomerate Mytilineos (OTC-MYTHY), a US$4 billion company. One of its main backers is Canadian Prem Watsa via Fairfax Financial (FFH-TSX; CAD$23 Billion market cap), a legendary investor.

I have TWO OTHER JUNIOR SOLAR STOCKS that I am very keen on right now–to get their name and trading symbols for $5, click HERE.

The stock may not come to trade for a few days, as the Canadian exchange people wrap their heads around such a new, small company getting such a big big deal so quickly. Closing of the purchase and sale of each asset is conditional upon

- obtaining approval of the purchase and sale by Westbridge shareholders

- and the TSX Venture Exchange,

- and obtaining regulatory approvals from the Alberta Utilities Commission (AUC).

Understand that the company will not receive much money initially. There was a small downpayment, but Mytilineos won’t be paying for these assets until they hit NTP and get into production.

Georgetown, their lead project has NTP–Notice-To-Proceed, which is a key milestone for production. Once an asset hits NTP–anywhere in North America–it is worth a lot of money.

SunnyNook likely will hit NTP later this year. As rough guidance, given that the first two assets could monetize this year, Westbridge could receive cash of just under $100 million this year and just over $100 million next year.

So there’s no big cash up front (so the stock will open higher but not close to $2 IMHO). But for sure WEB will never have to raise capital again if they don’t want to.

And they will now be able to be a BOOM company–Build Own Operate Maintain–and get all the long term cash flow from their next few solar projects–if that’s what they want to do. They can do so without ever raising capital again.

The final purchase price will be very complicated, as WEB has a trailer on the ITC credits that Canada is offering–which could total over $400 million.

I purchased my 100,000 shares in December at 57 cents. It closed Wednesday at $1.22—already a double, but it has a chance to double again.

This deal was done with no commission to anyone. No M&A fees, no big lawyer bills. This team–Stefano Romanin and Scott Kelly–raised all their own money. There was never any analyst coverage here by the sell side because they were never going to raise any money/make fees.

There is a good story on Mytilineos (and the Westbridge deal) in Canada’s Globe and Mail newspaper today—you can read it here:

The size of this deal I’m sure surprised everyone. But this transaction proves how much the industry is valuing these projects–WAY MORE than investors are. That’s the opportunity on my two other solar stocks–there is little competition for stock.

But this deal shows the Market is coming around. This is the way to play energy–and small caps. These two companies have proven teams who have already monetized solar assets. Both have less than 50 million shares out, and neither need funding this year.

Subscribe now and get these two picks for just $5– Click Here.