Articles

See All

MEDICENNA (MDNA-TSX) THE MOONSHOT TAKES OFF

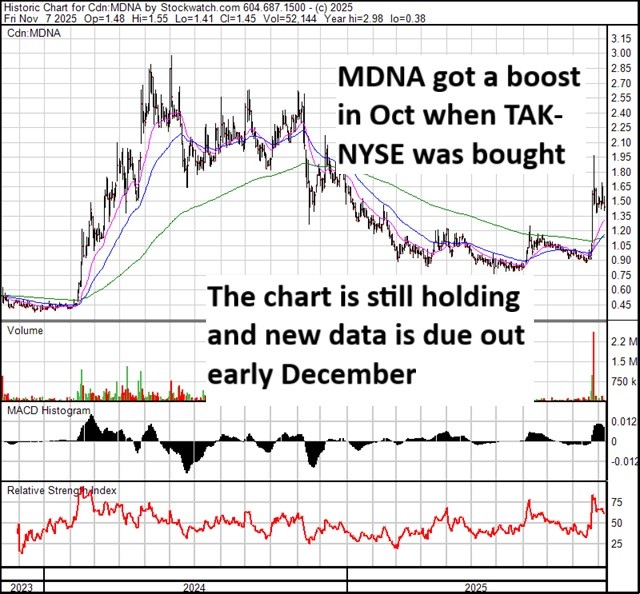

We wrote about Medicenna (MDNA – TSX) in a Free Whisperer last year. In the title we called the stock a “Moonshot”.

That title seems VERY appropriate given the action we saw in the stock last month.

Source: Stockcharts.com

So what the heck drove the stock up 50%+ in a single day?

I think it was a big pharma deal that made investors realize what Medicenna could be worth.

On October 21st, Takeda Pharmaceuticals (TAK – NYSE) announced a partnership with Hong Kong listed Innovent Biologics. The deal will see Takeda paying $1.2 billion up front for the rights to two drugs.

· IBI363: a PD-1/IL-2 bispecific antibody fusion protein

· IBI343: An antibody-drug conjugate (ADC) that targets the Claudin 18.2 protein

Both of these drugs are Phase 3 assets – meaning neither drug is approved for usage just yet. Paying that kind of cash up front for a drug in trials is a big deal. Most biotech pipeline deals have milestone and royalty payments and a relatively small amount of cash up front.

Not this one, though they get that too. In addition to the big lump sum payment, Innovent will still receive both milestones and royalty payments, and a profit or loss split 60/40 (Takeda/Innovent) with respect to one of the assets (IBI-363).

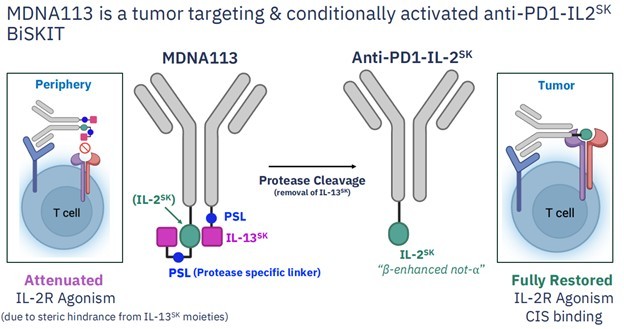

So what does any of this have to do with Medicenna? Well, one of the drugs that is part of the deal (IBI363) is very much like a drug candidate of Medicenna’s.

IF IT WALKS LIKE A DUCK…

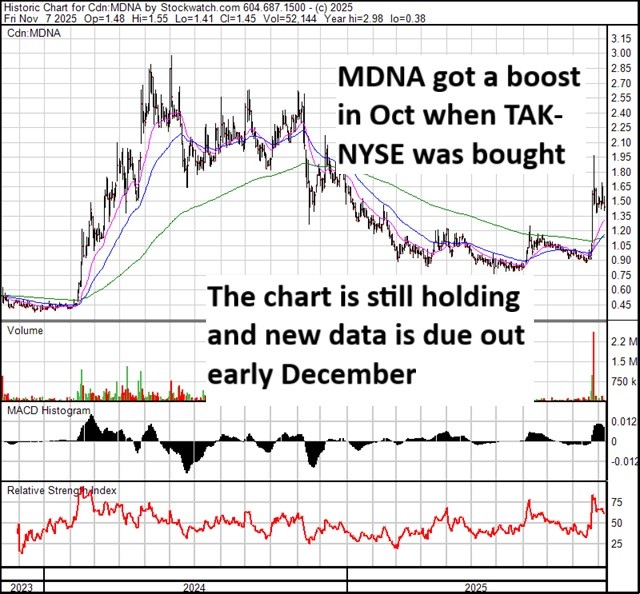

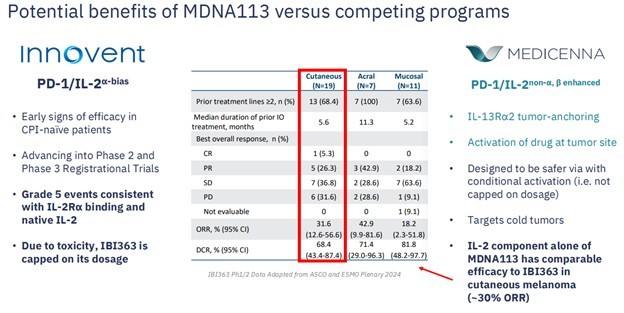

Medicenna has its own PD1/IL-2 α-bias bispecific antibody, which they call MDNA113. They also have another IL-2 α-bias bispecific antibody (no PD1 here) called MDNA11.

Source: Medicenna Investor Presentation

It’s a small leap to realize if these two Innovent drugs are worth $1.2B+, then maybe Medicenna has something quite meaningful on its hands.

MDNA113 is a very similar molecule to the IBI-363 molecule that Takeda just paid big bucks for. A fact that is not lost on Medicenna management. They devoted not one but two slides of their investor presentation to comparisons to the Innovent drug.

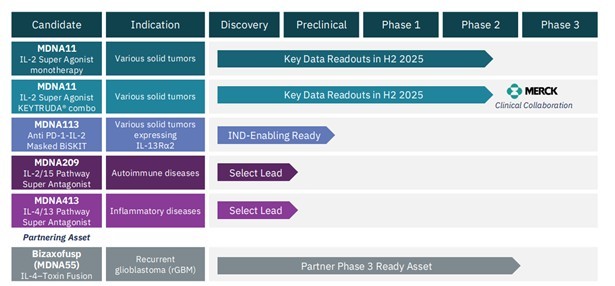

Source: Medicenna Investor Presentation

Source: Medicenna Investor Presentation

The easiest way to think about both the Innovent molecule and MDNA113 is that these are like two-armed messengers.

One of the arms, called an anti-PD-1, binds to a PD-1 receptors of a T-cells, which are blood cells that your body uses to mount an immune response.

The other arm, called an IL-2 cytokine, gives that T-cell instructions about what to do.

Why do this? Well, tumor cells can be sneaky. One of the ways they have learned to be sneaky is that they have learned how to “turn off” T-cells that attach and try to kill them.

Different tumors have different methods of doing this. One way to turn off a T-cell is by binding to its PD-1 receptor. Once the PD-1 receptor is annulled, the T-cell effectively shuts down.

MDNA113 works by binding to that PD-1 receptor before the tumor can. By doing so, the T-cell doesn’t turn off, and instead goes about its job of killing the tumor cell.

The second arm of MDNA113 is the IL-2 cytokine. The job of an IL-2 is to tell a T-cell to activate and reproduce itself. It’s basically saying – you found your target, now go get it!

If the T-cell is the body’s soldier, MDNA113 is helping that soldier fight. The anti-PD-1 arm is freeing the captured soldier. The IL-2 arm is telling the soldier to attack and make more of itself.

The key thing here is that both MDNA-113 and Takeda’s IBI-363 perform these tasks.

On top of that, MDNA113 has one additional attribute that IBI-363 does not have—called masking. Think of this as being like a disguise that allows MDNA113 to stay inactive while circulating in the bloodstream, and “turn on” only when it reaches the tumor.

So that is MDNA113. It is a preclinical drug right now, so its much earlier stage than the Innovent drug. But lot’s of potential nevertheless.

YOU DON’T AIR YOUR DIRTY LAUNDRY

The other drug that Medicenna has in development, which is further along in trials, is MDNA11.

MDNA11 isn’t quite the same as the Takeda drug, or MDNA113, because it is just the IL-2, or cytokine, arm of the structure.

You can sort of think of MDNA11 as the first prototype, whereas MDNA113 is the fully built end product.

But that isn’t to say that MDNA11 isn’t going to work. If you read the Free Whisperer we put out last year, that was all about MDNA11 (MDNA113 was but a dream at that point!). The data just published at the time was showing positive signs that MDNA11 DID work.

MDNA11 was the moonshot.

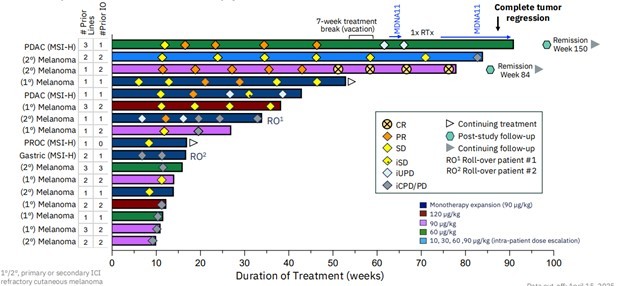

This moonshot potential comes from a Phase 2 study called ABILITY-1.

Interim results, published in April 2024, were IMPRESSIVE. In particular, Medicenna announced a patient with full and sustained remission of pancreatic cancer. Incredible!!

A long-term pancreatic cancer remission is impressive. This is an extremely tough disease. Yes, it was just one patient. But that’s what made it a “moonshot” (low probability but high, HIGH leverage to success).

In June of this year Medicenna announced a second update on ABILITY-1.

“We are delighted to announce that the first MDNA11 monotherapy responder, a pancreatic cancer patient who had failed multiple lines of therapy including a checkpoint inhibitor, continues to be in remission for at least 18 months without any further treatment. Complete and partial responses in nine other patients in mono- and combination arms demonstrates best-in-class potential of MDNA11 amongst competing IL-2 programs,”

The responders from the mono-arm portion of the study are shown in the chart below. There are 3 partial responders and 1 complete response (in the figure, CR is complete response, PR partial response, and SD is stable disease). Two of those went into remission post-study follow-up.

Source: Medicenna Investor Presentation

That’s 40% overall response rate (ORR). Which is a good response for a patient population that has had between 1-3 prior lines of treatment.

The ABILITY-1 study has two arms: the monotherapy, in which patients just take MDNA11, and the combination therapy, where patients take both MDNA11 and Merck’s Pembrolizumab. In the combination dose, we saw 4 partial responders, which is a 31% ORR, or a 36% ORR if you include all participants in that arm.

Source: Medicenna Investor Presentation

So that was in July. Last week we found out that Medicenna will be reporting the final results of ABILITY-1 at the European Society for Medical Oncology (ESMO) Immuno-Oncology Conference in early December.

Source: Medicenna Press Release

The market assumed that if Medicenna is “presenting” data the data is probably positive. Which isn’t a bad assumption. When there is bad news, you bury it in an 8-K filing. When there is good news, you present it.

If the results do continue the positive trend we’ve seen, well we could be off to the races.

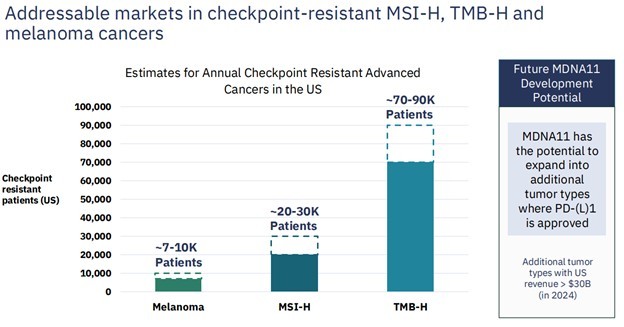

The patient population here is 100K+. It’s a big market and the patients here are truly without many options.

Source: Medicenna Investor Presentation

The “moonshot” potential still exists. Nothing we’ve seen so far has derailed that.

PRICE DISCOVERY AND

A KNOWN EVENT –

BUT IT’S NOT THE SAME DRUG

If you put together the upcoming (positive?) event with the $1.2B price tag from Takeda, add onto that a roaring bull market in biotech stocks, and you end up with the rally we saw in October.

The only wrinkle – the two big catalysts are not for the same drug.

The analog to the drug that Takeda bought is MDNA113, while the drug with trial results on tap is MDNA11.

Which makes the biggest question here be—

1. what you are buying the stock for versus

2. what is going to move the price.

It’s tricky to know how this plays out. I mean, clearly if MDNA11 results are great, then there is no issue. We have two drugs with a bright future.

But if there are any questions about the ABILITY-1 results – either safety or efficacy – well, does the stock sell off on those? Or does everyone just move onto MDNA113 as the main event?

Honestly, I don’t know.

A couple of things mitigate the downside. First, even with that big pop in the share price, the market capitalization of the company is still just $168 million fully diluted.

That is not an expensive stock in this market. Companies with legitimate potential are getting bid to reflect that, something that you couldn’t have said a couple years ago.

Second, because biotech is in a bull market, the market is forgiving.

A few years ago, I would have been worried about holding through an event, like what we have coming up for MDNA11.

Today, I think the market will look past even disappointing results.

Which makes me think I can own the stock here, even after this 50%+ one-day move. Because regardless of what happens with MDNA11, the price that Takeda just paid isn’t going away. That could be enough to support the stock–it is so far, 3 weeks later–while I collect the upside if things go right.

DISCLOSURE—I’m long (a small amount of) Medicenna

To access my full independent research, SUBSCRIBE HERE