Articles

See All

OVID – PHASE 1 TRIAL GOOD ENOUGH, CAPITAL RAISE DOES RAISE SOME QUESTIONS

Ovid Therapeutics (OVID – NASDAQ) came out with their Phase 1 study results in OV329 targeting treatment resistant epilepsy on Friday.

The stock was up – in pre-market the stock went as high as $2. I suspect the initial pop had as much to do with the headline (“positive topline results”) and that they were able to raise some capital. The stock tailed off during the day as investors weighed that the new capital came with a lot of new warrants.

Ovid shored up its cash position by raising $80.8M, which could increase to as much as $175.1M if all warrants are exercised. This market looks favorably when a biotech raises cash.

This raise adds a lot of shares though. In total, Ovid is adding about 125 million shares, more than double its 71 million shares at the end of Q2.

Ovid sold convertible preferred stock at $1,400 per security. The securities are convertible to shares at $1.40. For each convertible security, the buyer also gets 666.6 Series A warrants, and 500 Series B warrants to purchase more stock at $1.40.

It’s a pretty good deal for the subscribers. You get to buy the stock at $1.40 and you effectively get 1.16 warrants to buy another share for free.

But all those warrants going to be an overhang for the stock. They always are.

As for the trial results, if you remember, I viewed it kind of as a non-event, but one that would probably be good for the stock price.

It seemed a foregone conclusion that the results, which looked at safety and biomarkers in healthy volunteers, would be positive.

And they largely were. No big surprises, though some of the biomarker data seemed a little murky.

The drug looks to be safe at the dose levels of the trial (3 mg and 5 mg) and over what was a relatively short period of time (7 days). Of the 51 people that took the drug, one person had a headache, one person got sleepy, and one person thought they tasted metal. Sounds like my Sunday morning!

Source: Ovid Phase 1 Results Presentation

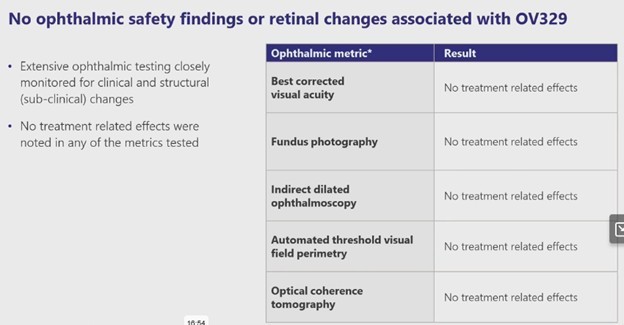

Of course, the really big matza ball is whether the drug causes the same side-effect as its predecessor vigabatrin – peripheral blindness in some patients.

The evidence so far, is no. Ovid said there was no evidence of retinal effects.

Source: Ovid Phase 1 Results Presentation

As I’ve pointed out in past writeups, this is no surprise. Vigabatrin retinal deterioration occurred over months or even years and it didn’t happen to everyone. Dosing OV329 for 7 days to healthy individuals seemed really unlikely to lead to any issues.

That was my bullish case for Ovid going into this read-out. The trial was destined to give good results because it wasn’t going to tell us much at all. And the stock would go up as investors focused on the lack of bad news (that has indeed occurred to a MUCH greater extent than I ever anticipated!).

But the trial also wasn’t going to tell us all that much about whether the drug would work well enough to be a legitimate epilepsy treatment.

I stand by that expectation after reviewing the biomarker results from the trial.

Ovid looked at 3 different methods of measuring the drugs impact on brain activity. And they found that the drug worked much the way they thought it would, at least directionally.

But the data is a little, well, murky. I’m not going to go into all the details here. Suffice to say that:

· One of the biomarker metrics (long-interval intracortical inhibition or LICI) showed very similar behavior to vigabatrin, even a little better.

· Another biomarker test, called magnetic resonance spectroscopy or MRS, showed some trend, though the results weren’t statistically significant

· A third biomarker test, called electroencephalography, or EEG, showed a lot of noise and the data Ovid gave us looks to messy to draw much of a conclusion from.

These weren’t perfect results, but they were probably good-enough results.

But if you were hoping that the biomarker data would show that OV329 blew vigabatrin out of the water, well you would be disappointed.

It’s okay though, because it doesn’t really matter! This is a Phase 1 safety trial and really, all you need to show in a Phase 1 safety trial is that the drug has promise. The results clearly show that the drug has promise. We are also in a bull market, which means the market isn’t going to dissect the results too carefully.

Next step is off to Phase 2, which will (hopefully) give us enough data to make a meaningful evaluation of what this drug can do and whether it has potential for approval.

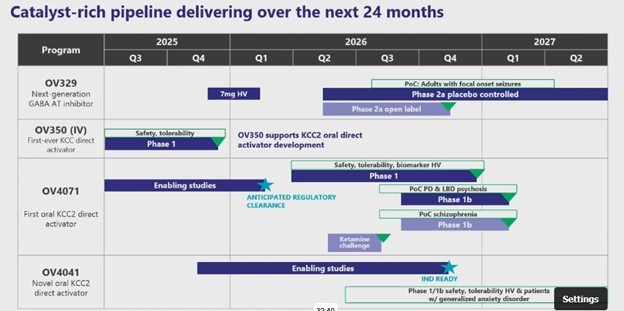

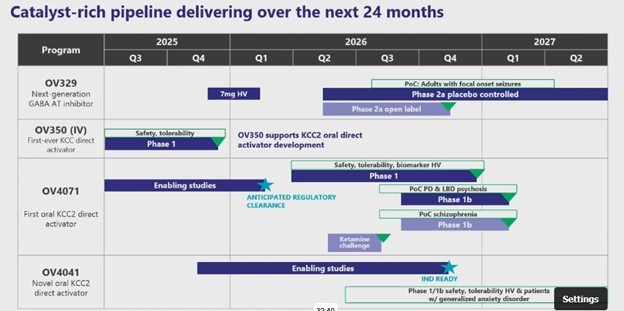

It will be a bit of a wait though. Ovid expects to begin a Phase 2a trial in Q2 2026 and finish it in 2027, though they expect to release some interim results sometime in late 2026. That means it will be over a year before we get any data.

Source: Ovid Phase 1 Results Presentation

In the meantime, investors are going to focus on Ovid’s other drug, OV350, which is going to readout its own Phase 1 in Q4 of this year (I will try to get something out on my expectations there before the results come out).

As for the stock? Well, that is a tough call. Mainly because those are a WHOLE lot of warrants at $1.40. We’ll just have to see if the stock can hold the levels it did Friday (it closed at $1.80), or whether those 67 million warrants begin to weigh on it at some point.