Articles

See All

This Business Model for Drug Discovery Is Finally Paying Off

QUICK FACTS

Trading Symbols: ZVRA

Share Price Today: $12.53

Shares Outstanding: 67.9 million

Market Capitalization: $851 million

Cash: $219 million

Debt: $60 million

Enterprise Value: $692 million

Zevra –

Turning Over Stones

Rare disease biotech ideas seem to be my go-to these days. Zevra Therapeutics (ZVRA – NASDAQ) is about the fourth that I have looked at in the past month.

I’ll tell you why. Biotechs have been so hated for so long. With stocks looking more like they are in a bull market, I don’t believe that can continue.

The biotech sector is full of small, commercial companies with growing revenue that are, in a surprising number of cases, profitable. Yet they are ignored by the market.

If this bull market is going to continue, at some point it is going to expand out of just AI stocks and a few meme names. And we’ll see big moves from the biotechs.

That was the case with Zevra. The market was giving them no credit, even though the company was growing revenue and on the cusp of profitability.

That has certainly changed over the last couple weeks.

When this market catches on to a stock it moves fast. While Zevra’s not a meme stock, this has been a meme-like move.

There has been no new news. Instead, there have been several influential Fintwit accounts that have found the stock. I’m finding that Fintwit influencers are maybe the greatest source of momentum in this market.

Adding fuel, in early July HC Wainwright initiated coverage on the stock with a $22 price target.

Still, you must have the goods to drive interest and Zevra has that. It is easy to argue that the market is just playing catch-up here.

Zevra is in the early stages of a new drug launch. Their drug, MIPLYFFA, is approved for the ultra-rare Niemann-Pick disease type C (NPC).

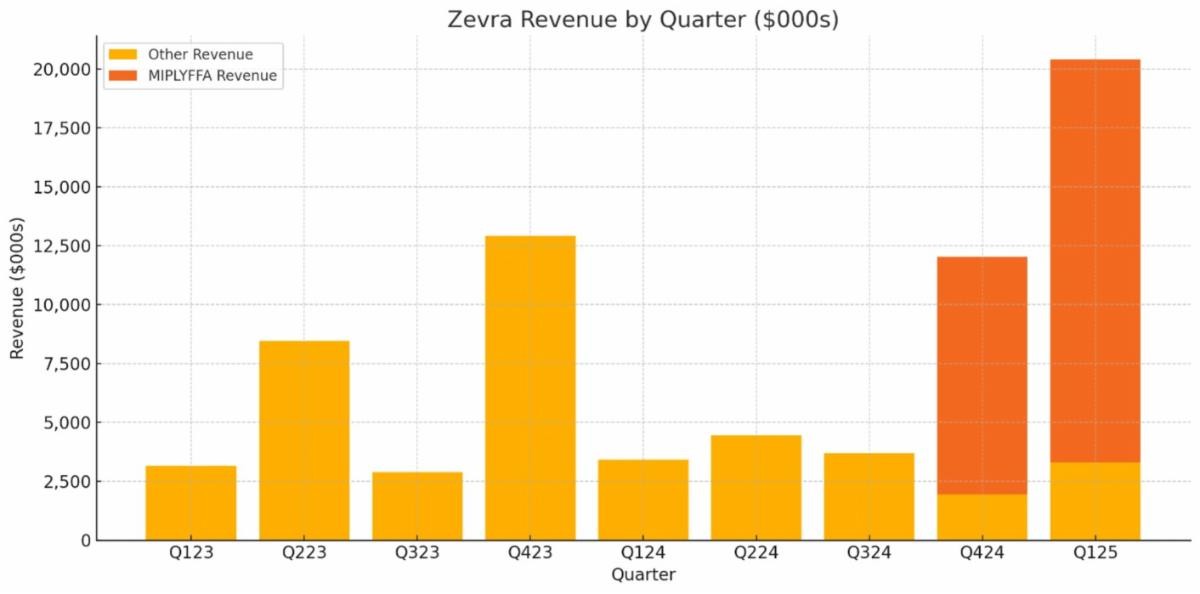

That launch is going very well. MIPLYFFA was approved in September. In Q4 the drug did $10.4M of sales. In Q1 it did $17.1M. 70% sequential growth is nothing to scoff at!

It is entirely possible that MIPLYFFA hits a $100M run rate this year. Zevra should be profitable later this year, maybe even next quarter. There is a second product candidate (called celiprolol) enrolling in a Phase 3 trial and it has all the markings of another winner.

There have been plenty of reasons for the stock to go up. Before this move Zevra traded at just 4x my expected sales run rate. Even now it is just priced at just 7x sales, which is not an unreasonable valuation for a company growing this fast.

I’m not going to recommend buying the stock just yet – this is a crazy move and a consolidation seems likely. But if the market has finally bottomed on biotech negativity – something that may be happening, the stock should continue to see love.

MIPLYFFA –

ZEVRA’S MODEL OF BUYING LOW TO SELL HIGH

Zevra has an interesting model for drug discovery.

This isn’t a research firm, grinding out proteins or antibodies in the lab. All three of Zevra’s primary molecules were acquired. And each of these drugs has a unique history.

MIPLYFFA is the branded name of ariomoclomol. It was discovered 20 years ago by Hungarian researchers.

Ariomoclomol bounced around to a couple of drug companies that tried to target insulin resistance with no success. It eventually landed in the hands of Danish biotech company Orphazyme A/S in 2011.

Orphazyme put the drug through multiple clinical trials, focusing on rare diseases with misfolded proteins, including NPC.

NPC is a rare and fatal neurodegenerative disorder. It is caused by a mutation in either the NPC1 or NPC2 gene.

The mutation causes the protein created by that gene to be misfolded. The misfolded protein can’t do its job, which is to help metabolize cholesterol and lipids. You end up with the build up of cholesterol and with it a bunch of detrimental effects as a result.

Orphazyme thought they had a winner with their trial results for NPC. But when they tried to submit an NDA for the drug in 2021, it was rejected by the FDA.

Biotech firms rarely get more than one shot on goal. Orphazyme was no exception. They went bankrupt in 2022.

Zevra swooped in. They bought the rights to arimoclomol out of bankruptcy for $12.8M cash and another $5.2M in liabilities and went to work putting together a better data package.

They compiled real world data from Europe, where the drug was already being used under France’s Expanded Access Program (EAP). They also had more open-label data from the Orphazyme study that they were able to include.

It worked. MIPLYFFA was approved by the FDA for NPC in September 2024.

The MIPLYFFA approval was in combination with another drug, miglustat. Miglustat has its own complicated history. It is approved on its own to treat NPC in a bunch of countries, including the EU (where it was approved in 2009). But it is not approved in the US.

I took a look at the miglustat data, and I can see why there is discrepancy. Miglustat worked, but only marginally. It slowed progression of NPC but didn’t stop it.

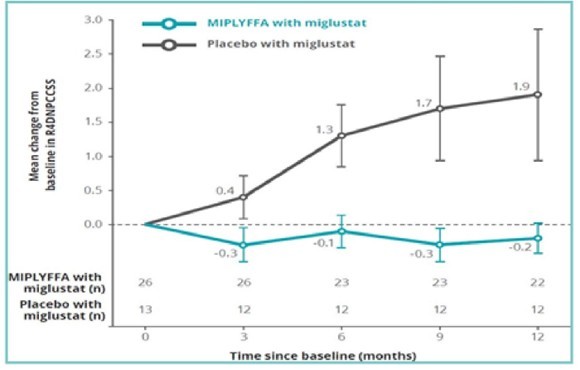

In the trials completed by Orphazyme, MIPLYFFA worked very effectively in combination with miglustat compared to miglustat alone. With both MIPLYFFA and miglustat, NPC progression was stopped.

Source: Zevra Investor Presentation

In fact, the drug combination worked so well, I’m still not sure why the FDA did not approve MIPLYFFA when it was first submitted by Orphazyme.

The other odd thing about the approval is that much of the data that Zevra relied on to get MIPLYFFA approved came from Europe – from the real-world studies under the French EAP.

It’s just a strange turn of events: you got a US approval from EU data for a drug that is used with another drug that is approved in the EU but not in the US. Makes my head hurt!

All that really matters is that the drug is approved and the opportunity for MYPLYFFA is significant.

NPC is not very well diagnosed in US, in part because, at first, the symptoms are a lot like epilepsy and because without an approved treatment there wasn’t a lot of reason to dig into a diagnosis.

Estimates are that there are 500-1,200 patients in the US with NPC, another 1,200 – 2,000 in the EU and 3,000 to 5,000 globally. Zevra’s own estimates are 300 diagnosed in the US, 900 living with it, and another 1,100 diagnosed in the EU.

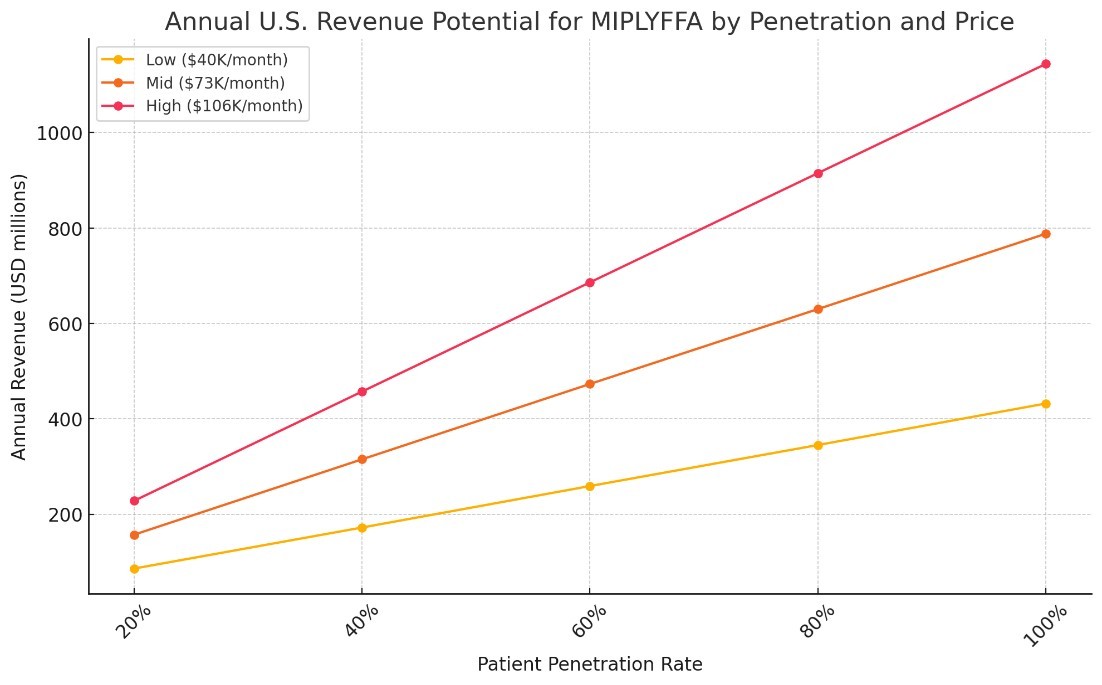

Zevra gave the following guidance on MIPLYFFA pricing on a September 2024 call. They have since reiterated that guidance.

We expect MIPLYFFA to be priced at $9.50 per milligram with the wholesale acquisition cost ranging from $40,000 per month for the lowest dose to $106,000 per month for the highest dose. The exact dosage for an individual will be determined by his or her body weight. And the average price based on dosing seen in our expanded access program is expected to be approximately $85,000 per month

That makes the opportunity significant – well over $1 billion addressable market. You can easily model out what revenue might be depending on how successful Zevra is at penetrating that population:

Source: Company Estimates

One thing that Zevra has going for it is that a large number of diagnosed patients in the US were part of the clinical trial. That has led to quick uptake as those patients converted from trial to prescription.

As of Q1, Zevra had 122 prescription enrollment forms, meaning that roughly 1/3 of the estimated individuals diagnosed with NPC are already enrolled to get MIPLYFFA.

If those 122 enrollment forms all go through to prescription, that would be $125M of annual revenue.

Zevra is planning to file a Marketing Authorization Application (MAA) with the EMA in H2 2025.

OLPRUVA –

NOT EVERY SHOT ON GOAL GOES IN THE NET

OLPRUVA is Zevra’s second commercial product.

Zevra acquired the rights to the drug through the acquisition of Acer Therapeutics in August 2023. They paid $15M (all stock), paid off $28M of Acer’s debt, and have additional payments of up to $76M if certain sales targets are met.

OLPRUVA is also targeting an ultra-rare disease. It is approved for chronic management of urea cycle disorders (UCDs).

Patients with UCD can’t eliminate ammonia from their body. It accumulates in their bloodstream and creates a condition called hyperammonemia, which can have bad effects on the nervous system.

There are 2,000-3,000 patients in the US suffering from UCD. Which gives Zevra a large enough addressable market to give OLPRUVA a $100M+ revenue potential.

But so far, OLPRUVA has been a disappointment.

To understand why, you must look at what OLPRUVA is.

OLPRUVA is a reformulated version of a decades-old active ingredient (sodium phenylbutyrate). It was approved based on bioequivalence – that means it didn’t go through any clinical trials with patients. Acer simply showed that the drug is functionally equivalent to another approved drug.

That similar drug is called RAVICTI, which is marketed by Amgen.

RAVICTI is glycerol phenylbutyrate. You’ll notice the name. The two drugs start off different, but once in the body both drugs break down into the same compound – phenylacetate, which is the molecule that combats the disease.

Marketing OLPRUVA has proven to be trickier than Zevra expected. Because the molecules are so similar, there are pros and cons of both OLPRUVA and RAVICTI.

The biggest advantage OLPRUVA has it that is cheaper. Which has been Zevra’s strategy. They have tried to convince insurers to go with OLPRUVA and drop RAVICTI based on pricing.

According to StatNews, RAVICTI can cost up to $850,000 per year.

OLPRUVA pricing is hard to get, but when it was launched Acer said they were going to price it at 50% of RAVICTI. It’s probably less than that today.

Even still, getting patients to move from RAVICTI has been hard. The patients are stable. While OLPRUVA has some advantages, like being easier to store, it tastes worse and you have to take it more times a day.

The sell could get even more difficult. RAVICTI is a generic compound.

You might be wondering how a generic could cost that much as RAVICTI. The answer is that Amgen has done a good job fighting off generics in court.

That could change. Par Pharmaceuticals is rumored to be close to getting a generic version out, but because Par is private, the information is sparse.

The bottom line is that even with the high price tag, challenging RIVICTI through price hasn’t been an effective strategy.

Zevra admitted as much on their last call. CEO Josh Schafer said “we have moderated our expectations for the pace of the launch given the unique dynamics of the UCD commercial landscape.”

The potential is there. In 2024, RAVICTI did nearly $400M in sales. OLPRUVA did a mere $100K sales last quarter. Until we see that gap close a little, this is a wait-and-see story.

CELIPROLOL –

MAYBE THE NEXT WIN?

Zevra got the rights for Celiprolol from the Acer acquisition. That included contingent value rights if Celiprolol is approved amounting to $20M.

Celiprolol is a beta blocker. This is another drug with quirky approvals. It is already approved to treat hypertension – but only in the EU, not the US.

Because celiprolol is approved in the EU, it can be used off-label for other diseases. And it is! Celiprolol is the primary treatment option in the EU for the treatment of Vascular Ehlers-Danlos Syndrome, or VEDs.

Here is where Zevra can work some magic. Celiprolol is not approved for any indication in the US. If Zevra can prove it works for VEDs (which we already kinda know it does) they can market it for that rare disease without worrying that there will be a cheaper alternative available.

VEDs is an ultra-rare disease. It is an inherited connective tissue disorder caused by a gene mutation. Patients that suffer from VEDs are prone to sudden aneurysms and organ ruptures.

There are currently no treatments approved in the U.S., where there are approximately 7,500 people living with this disease and the prevailing treatment paradigm is only reactive surgical interventions.

Celiprolol is in a Phase III investigational clinical trial called DiSCOVER.

Zevra isn’t going into this study blindly. In total there have been 3 EU studies looking at Celiprolol in VEDs and all showed the drug worked.

Source: Zevra Investor Presentation

The largest of the 3 studies was the BBEST trial (Beta-Blockers in Ehlers-Danlos Syndrome Treatment). This was a landmark clinical study conducted in France and Belgium to evaluate the efficacy of celiprolol in VEDs.

The study showed a 76% reduction in risk of arterial events. A second observational study in France showed a better survival outcome for treated patients.

It seems like the drug works. Which makes celiprolol a good bet for eventual FDA approval.

That makes Zevra’s strategy looks like a clever plan, one that reaches into a similar playbook as arimoclomol.

Take an older, repurposed molecule with promising data in a rare disease, run it through the FDA approval process, and then commercialize it as a premium-priced orphan drug.

But approval isn’t coming tomorrow. Because VEDs is an ultra-rare disease, it is taking a while to get to full enrollment.

At the end of Q1 there were 32 patients enrolled with the goal being 150 patients for the complete trial. It may be 2027 before we see results and an FDA submission for the drug.

REVENUE BREAKOUT –

ARE WE JUST GETTING STARTED?

The commercial story, and really the story that matters most for the stock, is all about MIPLYFFA.

Since the launch in Q4, US MIPLYFFA revenue has dwarfed both the French EUA and OLPRUVA. And the trend is up.

Source: Zevra Filings

Longer-term, getting Celiprolol approved and seeing meaningful revenue from a second molecule could be a big boost.

OLPRUVA is a wildcard. The market is there, but with the struggles so far, I’m just not sure if they can tap it. If they can figure out how, the upside would be massive.

Even without OLPRUVA, the stock looks reasonable here.

Zevra received a Rare Pediatric Disease Priority Review Voucher (PRV) when MIPLYFFA was approved. They sold that voucher recently for $150M.

Adding that to existing cash on hand and Zevra has $218M of cash versus $60M of debt. The enterprise value of the stock at $13 is $690M.

MIPLYFFA sales were $17M last quarter and should reach an annual run rate of over $100M in the next couple quarters. That puts the stock at under 7x sales, which is more than it was a few weeks ago but still not expensive for a commercial stage biotech with room to grow.

Zevra is borderline profitable already. At $100M they should have positive EPS.

You add it up and after we consolidate this move, you can make the argument there’s room for the stock to go higher.

Especially in a better biotech tape. In a better tape, stocks like Zevra get priced optimistically, which is the oppositive of what is happening today.

Which may be closer to that then you think!