Articles

See All

OVID’S EPILEPSY TARGET MAY SOLVE BLINDNESS IN PATIENTS

The stock of Ovid Therapeutics OVID-NYSE took off Thursday, up 23%–at the high up 50%–to 47 cents on WAY above average volume of 24 million shares—all on no news.

HOWEVER—it is a very cheap biotech stock, which before Thursday had a negative EV value (market cap is less than the cash in the treasury) and it has a catalyst in H2 2025 that could warrant a much higher valuation.

And hey, that’s all this market—where greed is running rampant—needs for a stock to go up.

In a nutshell, OVID will present Phase 1 data this year on an epilepsy treatment drug that could:

A) Not have the side effect of making patients go blind (yes that’s part of the problem with some current treatments)

B) Have the same/similar efficacy as existing treatments

That could make OVID a HUGE winner for investors in the next few months. (DISCLOSURE—I’m long a very small 10,000 shares at 42 cents.)

Over 50 million people have epilepsy globally; over 2.5 million in the US. Even getting a small part of that market could make OVID’s drug worth hundreds of millions in revenue. Maybe that will never happen; this is only Phase 1 data. That’s why the stock is just 45 cents now.

My team and I have done a DEEP DIVE into OVID’s technology—a bit deeper than we normally go. But if this Phase 1 data reduces “ocular toxicity” (not have you go blind), that alone could make it a multi-bagger from here.

A respected biomedical blogger (www.encodelp.com) had a small note out yesterday comparing the path for OVID will be taking to the path that XENON (XENO-NASD) has taken—a second generation drug (Xenon is in Phase 3 for a new application on an already FDA approved) that reduced ocular toxicity in a different target application (also seizures). Xenon is now a $2.5 billion company in Phase 3; OVID has a negative EV (maybe not after today!) in Phase 1.

So there is lots of upside here. They will need to raise more capital for sure, but reduced toxicity is likely??? enough to allow them to do that at higher prices.

This is far from a slam-dunk investment, but the real potential for a multi-bagger here makes this worth the read.

OVID (OVID – NASDAQ)

QUICK FACTS

Trading Symbols: OVID

Share Price Today: $0.40

Shares Outstanding: 71.1 million

Market Capitalization: $28 million

Cash: $43 million

Debt: $0 million

Enterprise Value: -$15 million

Now, when I started to look into epilepsy I found it a little overwhelming.

Epilepsy is a catch-all for a bunch of different types of disease and a bunch of different causes.

There are 30+ drugs (My team and I reviewed almost all of them). There are at least a dozen different types of disease (I tried to understand the differences as best I could).

If you boil it down, what all epilepsy patients have in common is that they have seizures, which are behavioral changes caused by electrical discharges in the brain.

That’s what defines the disease. But there is another commonality, one that defines the patient.

What these patients unfortunately have in common is that far too often they fail to respond to treatment.

It is kind of crazy to think that epilepsy has 30+ drugs approved, has been studied for decades, and really even today there are almost half the patients that have it that are considered “refractory”. That means that they have failed multiple treatments and are considered unlikely to respond to other treatments.

When a patient is diagnosed with epilepsy the first drug they take is usually the one that is safest. It is often a drug called levetiracetam or a drug called lamotrigine. Both of these have about a 50/50 chance of working.

If that drug doesn’t work, the second drug tried has only a 10-15% chance of working.

If that second drug doesn’t work, the chance of a 3rd drug working is typically quite small. One doctor said its less than 5%. Most of these patients either figure out how to live with the disease or go on to some type of surgery as their only option.

50-15-5. Those are not great odds.

OVID is targeting refractory epilepsy. You can look at that one of two ways. Either that Ovid has an opportunity, or a battle ahead of it. They are basically trying to beat the odds.

OVID’S LEAD DRUG CANDIDATE OV329

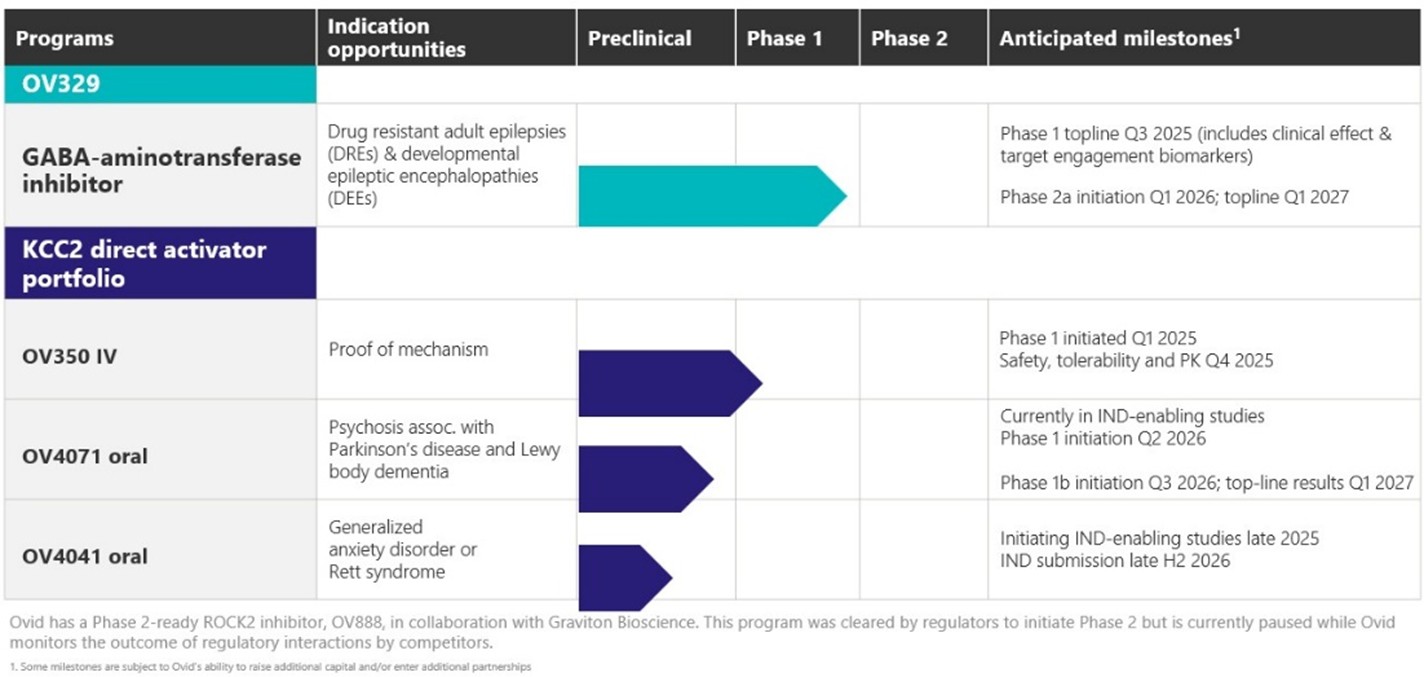

Source: Ovid Therapeutics Investor Presentation

Investors really only need to care about OV329, which is based on previous drugs that all targeted the same pathway, and I’ll explain that below:

THE GABA PATHWAY

(OR, WHAT IS EPILEPSY REALLY?)

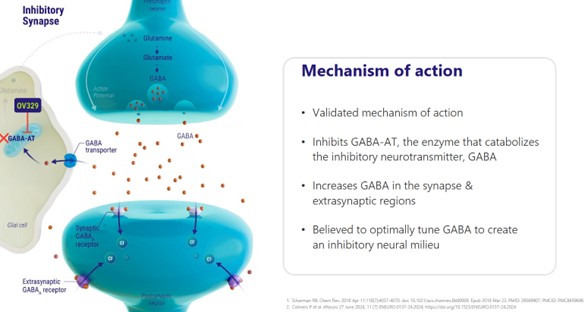

OV329 works by blocking GABA-AT. GABA-AT plays a critical role in the brain, and by blocking it, you can slow or even stop epileptic attacks.

GABA (the full name is gamma-aminobutyric acid) is THE primary inhibitory neurotransmitter in the human brain. It is a protein. It floats around in the brain and plays the role in calming down brain activity when you get too excited.

GABA binds to GABA receptors on neurons and reduces the chance that the neuron will fire.

This keeps brain networks stable, supports sleep, reduces anxiety, and helps control muscle tone and seizures.

GABA-AT is an enzyme that breaks down GABA. If you produce too much GABA-AT you break down too much GABA and your brain doesn’t settle down as fast when stimulated.

Epilepsy linked to too little GABA activity, leading to runaway neuron firing. Low levels of GABA can also cause anxiety, panic and insomnia.

By blocking GABA-AT, OV329 should allow more GABA to stay active in the brain longer. Which should mean less crazy neuron firing and with it, less seizures.

Source: Ovid Investor Presentation

A SHORT HISTORY OF TARGETING GABA

OV329 isn’t the first drug to target GABA in some way.

In fact, some of the oldest epilepsy drugs – benzodiazepines and barbiturates – work by regulating GABA.

But these drugs are no longer recommended for long-term use.

Barbiturates are highly sedative, they are easy to overdose on, and you develop a tolerance to them fairly quickly. Benzodiazepines (like valium) are used in some acute settings, where you need to stop cluster seizures that just won’t stop on their own. But they have lots of problems when used over the long run.

Neverthless, despite the limitations it was recognized that going after GABA was effective against epilepsy. Better alternatives began to be investigated.

Out of that came a drug called vigabatrin (the product name was SABIL), which was designed in the lab to still target GABA but without the side-effects of benzodiazepines and barbiturates.

Vigabatrin worked. But…..

The problem is that vigabatrin introduced another, in a way worse, side effect. It had what they called retinal toxicity. Which was a fancy name for blindness, which it caused when it was used chronically.

This was NOT predicted (obviously). It’s just another example of the how unpredictable developing a drug can be.

So vigabatrin is now only used in very short-term situations. And even then, changes to the eye are closely monitored.

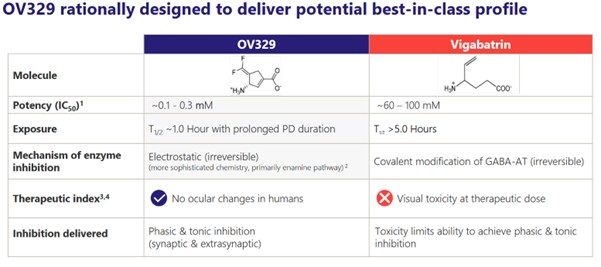

OV329 is a small molecule that is based on vigabatrin. It is basically Ovid trying to recreate the effect of vigabatrin but without the side effects on the eye.

Both OV329 and vigabatrin irreversibly inhibit GABA-AT. That means more GABA is in the brain, which in turn reduces neuronal excitement and seizure activity.

But OV329 is expected to NOT cause blindness. (It better not or Ovid is done for.) Ovid thinks they have overcome the retinal effects in a few ways.

First, OV329 is more potent. This might seem counter-intuitive (it does to me) but the higher potency means that less of the drug needs to be administered, which Ovid says less accumulates.

They say that the dosage of OV329 is 1000-fold less drug than was in vigabatrin.

Second, it has a half-life of 1.5 hours, meaning the body gets rid of it very fast. Vigabatrin had a half-life of 5-8 hours. So that makes sense, if the drug disappears faster, it can’t accumulate as much.

Third, the drug acts irreversibly. This means that once its been administered, it keeps inhibiting the GABA-AT enzyme even after the drug is totally out of the body. So presumably that should mean less dosing, though we won’t know what that means practically until we see some trial results.

Source: Ovid Investor Presentation

But after reviewing all of Ovid’s literature, the biggest reason to think OV329 isn’t going to cause blindness is simply—that so far there is no evidence that it does—so far.

Of course, the caveat here is that the evidence is primarily limited to rats and to a single dose study result where we really don’t have any data to dissect just yet. So that’s one reason the stock may not take off on Phase 1—there just isn’t a long enough timeline of no side effects yet.

Which means that we have to kind of take Ovid’s word for it. Otherwise we are just flying blind, pardon the pun.

HOW WELL DID VIGABATRIN WORK?

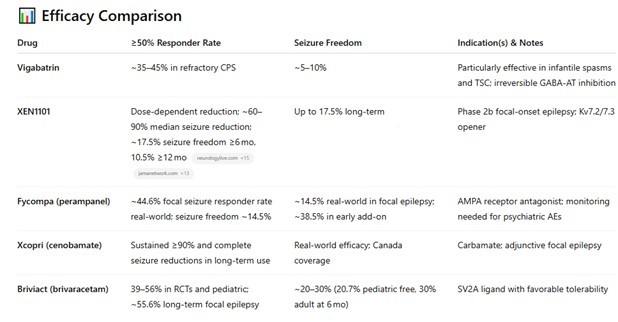

Vigabatrin did work at what it was intended to do – it reduced epileptic seizures.

But how did vigabatrin work just generally, particularly if you compare it to the drugs that are available for epilepsy today. This is a piece I am less sure of.

I used ChatGPT to make a comparison of vigabatrin against other newer agents:

While vigabatrin worked, it didn’t necessarily work any better than other drugs. That is especially true today, where new epilepsy drugs (even the ones that are 30 years old are newer than vigabatrin) have better efficacy.

If you compare Vigabatrin to NEW drugs targeting epilepsy, its not as good:

Source: ChatGPT

That gives me some pause. It makes the hurdle for OV329 a little bit higher. Because for OV329 to get approval, it probably needs to work better than the options that are out there. And it is based on a drug that doesn’t.

EPILEPSY IS A BIG MARKET

A big part of Ovid’s story can simply be boiled down to this: epilepsy is a big market and if they can get even a piece of it, that will be worth billions.

It’s not wrong. 50 million people have epilepsy across the world. There are 2.4 million people with epilepsy in the US.

Ovid realizes that they aren’t going to be a first line treatment no matter how good the drug is. There are plenty of cheap, generic drugs that are used as first and second line and they will continue to be used as such.

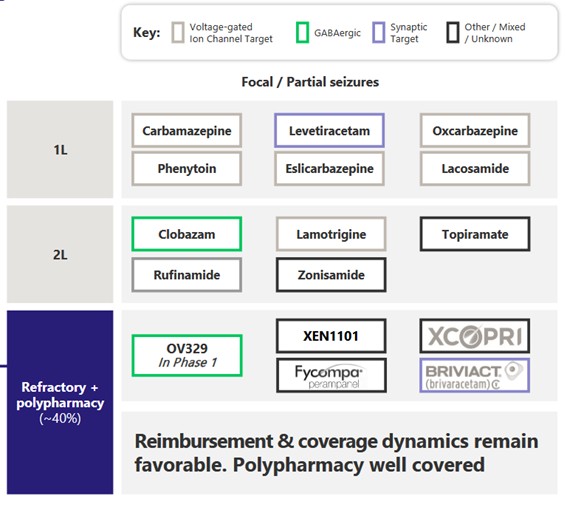

Here is their own map of first, second line treatments.

Source: Ovid Investor Presentation

All six of the first line treatments are generics.

But those drugs don’t work in everyone. 30%-40% of people with epilepsy are treatment resistant.

Source: Ovid Investor Presentation

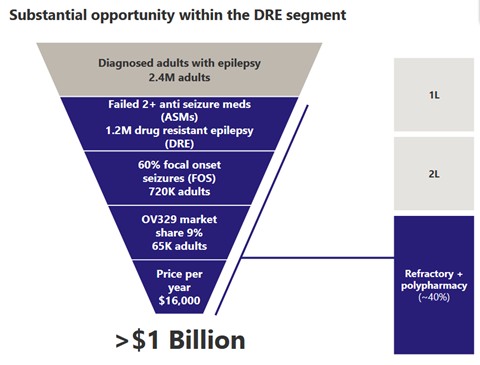

OVID is focusing on adults that are drug resistant to start. They estimate 720K adults as target, 9% market share at $16K per year drug price for $1B+ opportunity.

Which sounds good. $1B is great. But it’s good or bad, and it depends how you look at it.

IT REALLY DEPENDS ON

HOW YOU LOOK AT IT

Going after the drug-resistant patients is a bit of a half glass full/glass half empty kind of story.

First let’s look at the glass half full. The reason that Ovid has a chance with these patients at all is because OV329 has a differentiated mechanism of action.

What that means is—it is doing something different then the other drugs out there. I went through that history of GABA in part to explain how the other drugs that targeted GABA had big problems and because of that they aren’t used much today.

That is important because there are a lot of epilepsy drugs. There are over 40 drugs out there. But a lot of patients do not respond to any of these drugs. And coming up with a drug that works similarly to one of these drugs isn’t likely going to solve that.

So you have to assume that benzodiazepines and barbiturates aren’t used today simple because of their side effects, even though they might actually work in some patients.

Which is maybe the case? I don’t know. But I think that has to be the assumption.

If you stand a chance of helping these patients, you want a drug that works different. Which OV329 does.

LOOKING AT SAFETY AND BIOMARKERS

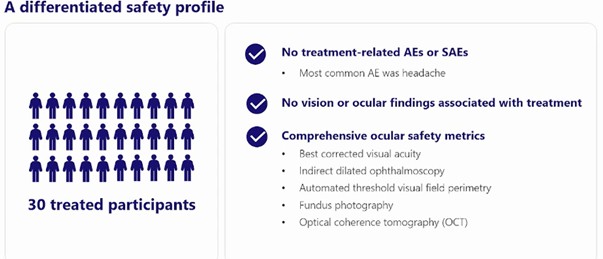

In August 2023 Ovid released Phase 1 single ascending dose (SAD) results. Those results seemed to be ok, though the company doesn’t appear to have released a lot of the details for them. They did there were no adverse events (AEs).

Source: Ovid Therapeutics

But we don’t know much else. In particular, they never told us what the dose was. Which would seem pretty important, given all the safety concerns of its predecessor drug.

I see that as a yellow flag. I looked everywhere for those dose results, and I couldn’t find it.

Also, no AEs in the SAD portion of the trial isn’t really telling us much. It is a single dose. Even vigabatrin didn’t cause blindness right away.

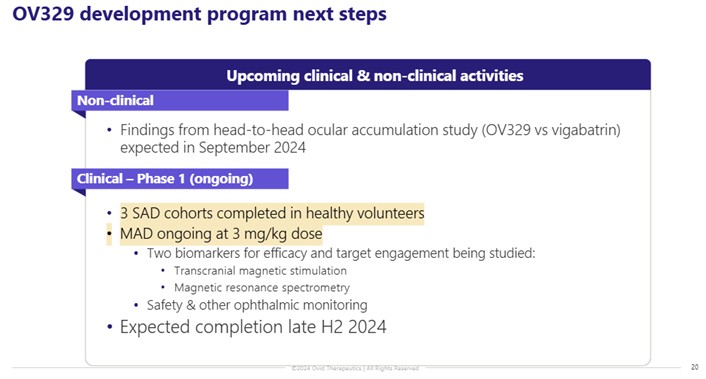

The next step for Ovid will be their Phase 1 multiple ascending dose (MAD) results. Just to clarify – the SAD results are a single dose. The “ascending” means that some patients received a single lower dose and some a single higher dose. Again we don’t know the dose any of them received.

For MAD patients get more than one dose. Which should give us a bit better idea of safety.

Ovid has told us one of the MAD doses in this presentation in August 2024.

Source: Ovid Therapeutics

The 3 mg/kg dose seems to be on the low-end of the doses they used in mice trials. They looked at safety in mice at 3 mg/kg but when they were comparing how much drug was getting into the brain, they looked at two higher dose levels: 5 mg/kg and 30 mg/kg. And in the one poster presentation, they said it was at 30 mg/kg that they actually saw efficacy in the mice.

So that makes me wonder whether this dose will actually be high enough to show efficacy.

Importantly, Ovid is also going to be measuring a number of biomarkers and the results of those will be released with the Phase 1 results.

Ovid is really focused on the biomarkers. They spent a whole event talking about the biomarkers they are looking at. They believe the biomarker data is important because they already know the mechanism of action of the drug and where it should and should not move the needle.

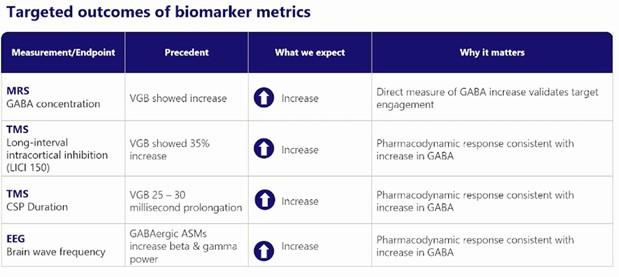

First gen GABA-AT inhibitors increased each of the following metrics and they expect OV-329 to do the same

Source: Ovid Therapeutics

MRS is a direct measure of an increase of GABA. This will validate target engagement. The other 3 measures will show what that increase in GABA does. If TMS levels increase, it tells them that the GABA in the brain is doing what they want it to do – that it is inhibiting excess activity. Same for EEG, which should increase as brain activity is dampened.

Looking at these biomarkers is going to be important for evaluating the results. Ovid needs the biomarkers to hit in order to show that the drug has a good chance of working in these hard-to-treat epilepsy cases.

But I am of mixed mind with the biomarkers. It seems like a bit of a layup. I mean, they have a drug that is designed to mimic a drug that hits these biomarkers. I just don’t know if it is really telling us something that will be a useful signal for whether the drug actually is approvable.

They plan to follow this up with a Phase 2a trial. But that won’t be for a while. Results on a Phase 2a trial aren’t expected until 2027.

CONCLUSION

Ovid has $43M of cash which they say is enough to get them into the second half of 2026.

There are 71.1M shares outstanding. At 40c that is $28M market cap. There is also preferred stock convertible into 1.25M shares.

OV329 is going to be a show-me story. It just has to be that way. While Ovid has highlighted the drugs improved potency compared to vigabatrin as being a positive, potency is a double edged sword. Yes, it means less drug is required, but it also means that drug that is delivered is more potent. How does that impact the eye?

The data so far, which is almost entirely in rats, is that it isn’t impacting the eye at low doses. So that’s good. But doctors that know this is a close relative to vigabatrin are going to want a lot of evidence before they will accept that as fact.

There is also the fact that one of their poster presentations seems to suggest that there is drug in the eye of rats at higher doses. I wasn’t sure what to make of that.

The other thing to consider is that OV329 needs to work better than vigabatrin and it needs to work on patients that have already failed a couple of other epilepsy treatments that probably worked better than vigabatrin themselves. And these patients are often taking other drugs, multiple medications, so how will the interactions work, especially given that we know that the eye can be an issue. Its tricky.

That is a tall order I think.

In the short run this is a $30M market cap stock with more than that in cash. If the Phase 1 results show good safety and positive biomarker results the stock could pop significantly for the simple reason that the market here is $1B+ and any probability of success is worth something.

You could buy the stock on that bet. Its a reasonable bet. The hurdle for safety and biomarkers in a small trial is actually not that large.

But over the long-run, betting that

1. this drug can go through multiple trials

2. and not run into any safety issues

3. and prove itself to be efficacious

4. in a patient population that is extremely hard to treat,

…well, that seems like a VERY low probability outcome. So it will be interesting to see what the Phase 1 data is, in both toxicity and efficacy, and how the Market reacts to it.

I have another biotech pick coming for subscribers–it’s under $1/share and this team sold their last junior biotech for $9/share. SUBSCRIBE HERE